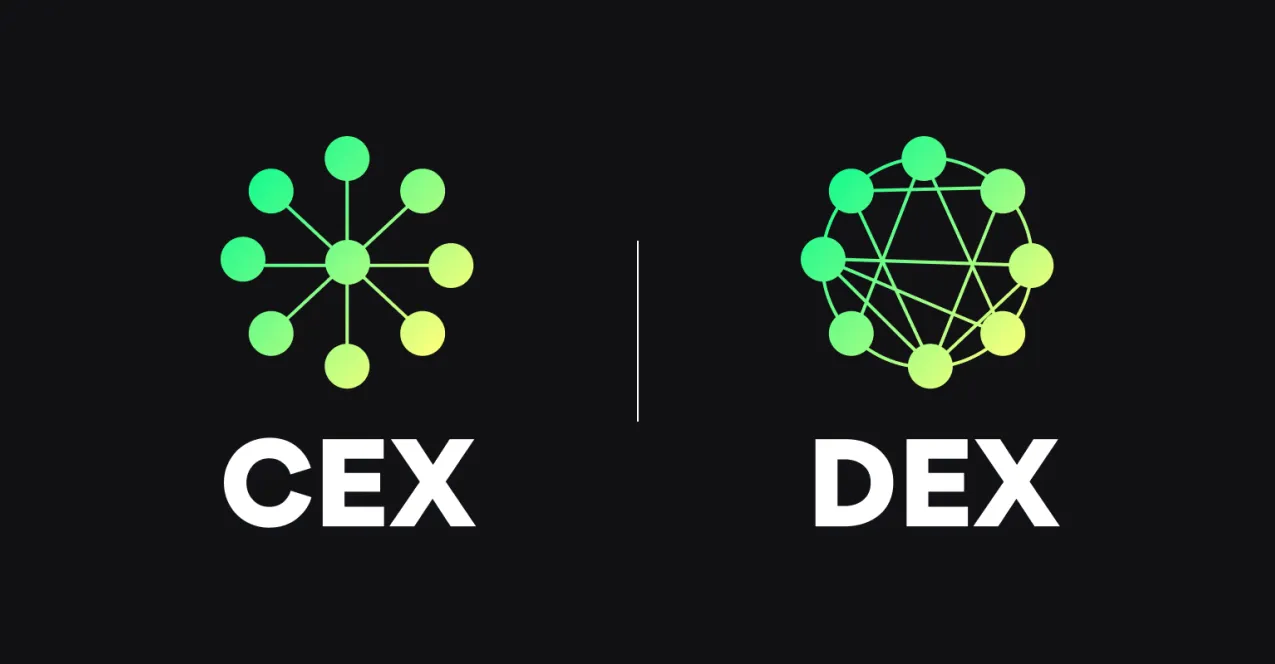

For newcomers entering the cryptocurrency market, centralized exchange (CEX) is the best choice. However, for those well-versed in cryptocurrencies, there’s another flexible option known as decentralized exchange (DEX). Why is that? Let’s delve into this article by AZCoiner to understand and distinguish the differences between DEX and CEX. We’ll also explore when to use CEX and when to use DEX for maximum effectiveness.

Centralized Exchange (CEX)

What is a Centralized Exchange?

A centralized exchange, or CEX, is an online platform for cryptocurrency trading that is centralized, meaning it’s operated and managed by a centralized entity, often the company that created the exchange. Centralized exchanges were the first type of cryptocurrency exchanges to appear, and some of the top ones today include Binance, Coinbase exchange, OKX, crypto.com, and more.

How Does CEX Operate?

To trade on centralized exchanges, you need to open an account, verify your identity, and deposit funds. Once this process is complete, you can freely trade by placing market orders, which are then stored in the exchange’s order book. When your sell order matches a buy order, the two are matched, and the trade is executed. It’s possible to trade without identity verification, but you will have certain limitations.

Similar to traditional finance, where you pay maker and taker fees, cryptocurrency trading involves transaction fees. In fact, transaction fees are a primary source of income for centralized exchanges. Besides trading fees, users may also incur fees when withdrawing funds from the exchange.

Read more: Top Dentralized Exchanges of 2023

Advantages of CEX

- User-Friendly Interface: CEX offers a user-friendly interface, making it easy for even beginners to use.

- Liquidity: CEX has high trading volumes, meaning you can buy and sell large amounts of digital assets without affecting market prices.

- Asset Variety: CEX provides a wide range of cryptocurrencies as well as trading pairs with traditional currencies.

- Customer Support: CEX offers customer support through various channels such as live chat, phone, email,…..

- Regulation: CEX is regulated, which means they must adhere to laws and regulations to prevent money laundering and other illegal activities.

- Advanced Trading Tools: CEX offers advanced trading tools and charting software that can be useful for professional traders.

Disadvantages of CEX

- Security Risk: CEX is centralized, meaning users must trust the exchange to keep their assets safe from hackers. CEX is a prime target for hackers, and if breached, users’ assets can be stolen.

- Privacy Concerns: CEX often requires users to provide personal information such as names, addresses, and government-issued IDs for KYC and AML compliance, which may concern those who value their privacy.

- Asset Control: CEX holds users’ assets in custody, so users cannot access or move their assets without the exchange’s permission.

- Fraud or Mismanagement Risk: There have been cases of centralized exchanges engaging in fraud or mismanaging funds, leading to users losing their assets.

- Limited Asset Control: CEX holds users’ assets in custody, so users cannot access or move their assets without the exchange’s permission.

- Fees: CEX typically charges higher fees compared to decentralized exchanges for trading and withdrawals.

Decentralized Exchange (DEX)

What is a Decentralized Exchange?

A decentralized exchange, or DEX, is a type of cryptocurrency exchange that allows users to trade digital assets in a decentralized manner. These exchanges are automated platforms built on smart contracts and are operated by the community and algorithms instead of being controlled by a single entity, as with CEX. This means users have more control over their assets and personal information.

Since their inception, DEXs have revolutionized cryptocurrency trading, pushing the industry toward true decentralization.

Some prominent examples of DEXs include Uniswap, Sushiswap, Pancakeswap, and more.

How Does DEX Operate?

Users are not required to set up accounts, undergo identity verification, or deposit funds into DEXs as they are with CEXs. This reduces entry barriers for DEXs.

DEXs do not use order books for matching orders. Instead, DEXs use automated market maker (AMM) tools to settle orders from available liquidity pools.

For example, if you want to trade a cryptocurrency running on the Ethereum blockchain, you would access an Ethereum-based DEX like Uniswap. There, you’ll find various trading pairs. You’ll connect your personal wallet to the exchange and place your order. The DEX will complete the order by using funds from the AMM, and your trade will be executed. Tokens will be transferred directly to your wallet without the need for deposits and withdrawals.

Advantages of DEX

- Asset Control: DEX allows users full control of their assets through private keys.

- Privacy: DEX does not require users to provide personal information like names, government-issued IDs, similar to CEX.

- Transparency: DEXs use smart contracts for order matching and settlement on the blockchain, ensuring transparency.

- Censorship Resistance: DEXs are not controlled by a single entity, meaning they are less susceptible to censorship or government interference.

- Fees: DEXs typically have lower trading and withdrawal fees compared to centralized exchanges.

- Decentralization: DEXs are operated by a decentralized network of users, providing resilience against market fluctuations and other risks.

- Accessibility: DEXs can be accessed from anywhere globally as long as users have internet access and a device.

Disadvantages of DEX

- Liquidity: DEXs often have lower trading volumes compared to centralized exchanges, making it potentially harder to trade large amounts of digital assets without affecting market prices.

- User Interface: DEXs may have less user-friendly interfaces compared to centralized exchanges.

- Limited Asset Choices: DEXs typically offer a narrower selection of assets compared to centralized exchanges.

- Customer Support: DEXs usually lack dedicated customer support teams, making it harder for users to get assistance with issues or questions.

Which cryptocurrency exchange should you choose between CEX and DEX?

The choice between DEX and CEX depends entirely on individual preferences. Both have their own merits and drawbacks. CEX offers a variety of trading tools and a broader range of assets, making it more accessible, especially for beginners. On the other hand, DEX offers more decentralization, freedom, and higher security. Over time, DEXs may become more convenient and user-friendly, but currently, CEXs remain dominant. Instead of choosing between DEX and CEX, why not combine their usage intelligently to maximize trading results?”