ETH’s liquidity supply is gradually decreasing

With an impressive start to 2024, up about 57% year-to-date, and the prospect of a spot ETF on the horizon, ETH could be one of the hottest entities in the crypto market right now.

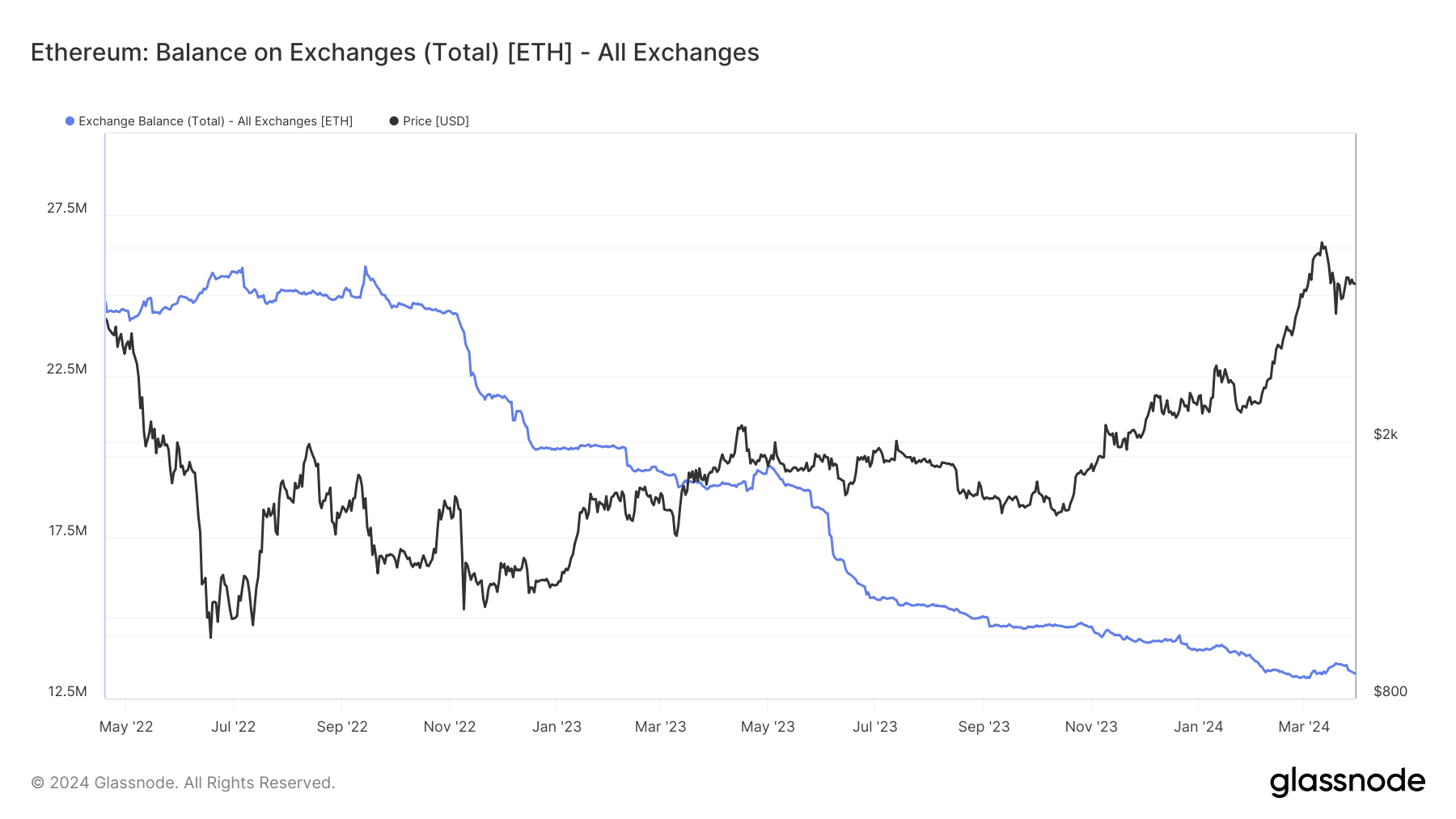

According to data analysis from Glassnode, ETH reserves on exchanges have dropped to a new low as of the time of this writing.

In fact, only about 11% of total supply was available for trading, down from 15.8% at the same time last year.

Source: Glassnode

This trend continues in 2024, even though ETH value has increased 57% year-to-date (YTD). If the downtrend continues, the supply crisis could become more severe.

Such a shortage will typically push prices up over the long term, as long as demand remains strong.

It’s clear that supply has plummeted throughout 2022 and 2023, but ETH is still struggling due to market uncertainties.

However, with improving crypto sentiment, coupled with potential bullish factors such as spot ETFs, the pursuit of the second-largest digital asset could become stronger.

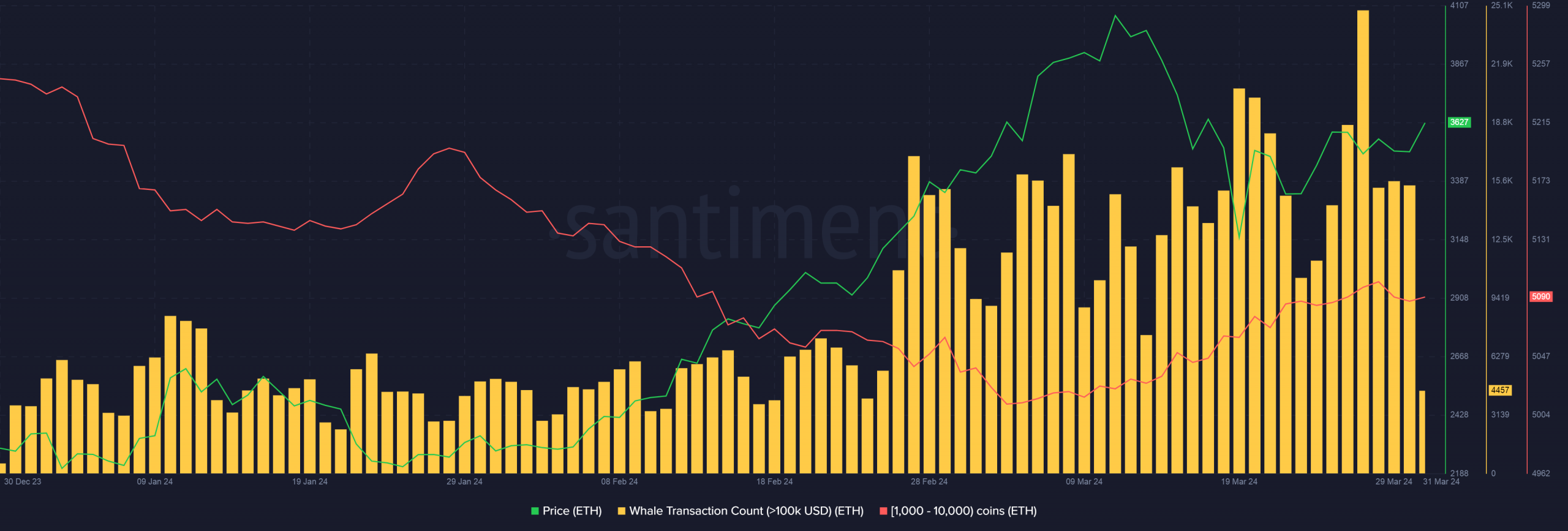

Source: Santiment

ETH whales are busy hoarding

Whales, investors who own large amounts of ETH, also seem to be bullish on ETH.

According to data analysis from Santiment, whale transactions worth more than $100k have recently increased despite the price correction. These transactions have led to an increase in the number of wallets containing between 1,000 and 10,000 coins.

Related: Vitalik Buterin Shares Views on Memecoins

What can you expect from ETH?

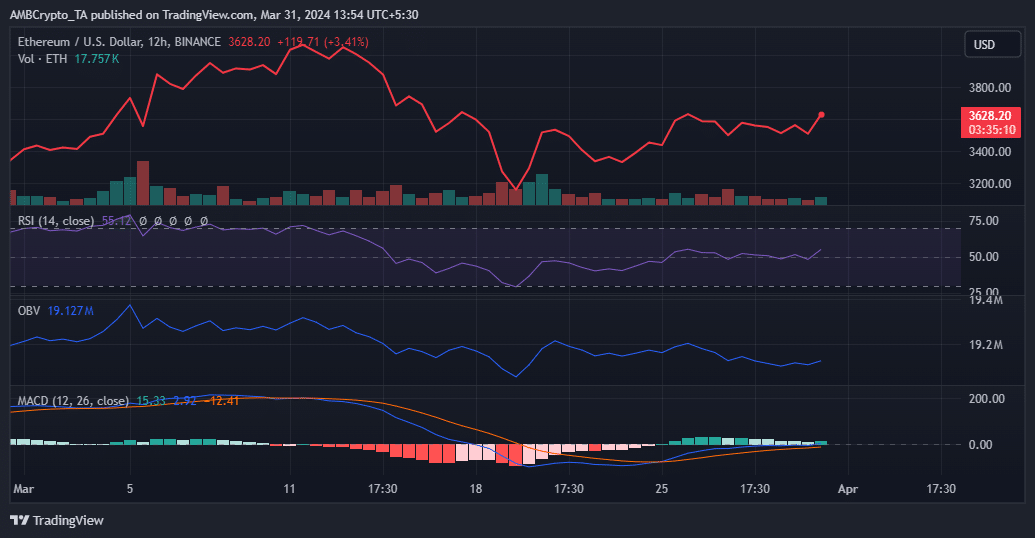

Source: Trading View

The relative strength index (RSI) broke above its 50 neutral line for the first time since mid-March. A move above 60 could strengthen bullish sentiment and pave the way for a rise to $4,000.

However, On-Balance Volume (OBV) has been unable to make higher highs as price has, moving sideways over the past 10 days. This shows that the uptrend may be stopped.

Additionally, the Moving Average Convergence Divergence (MACD) is at risk of falling below the signal line in the next few days. Such an event would strengthen the bearish narrative. Conversely, a move above zero could support further upside.

Great