Alpha Arena – Where Financial AIs Face Real Market Chaos

-

Launched on October 18, Alpha Arena is organized by Nof1, an AI research lab focused on financial markets founded by Jay Azhang.

-

The goal: to become the most realistic benchmark for testing AI performance in trading and risk management within live financial markets.

-

Six AI contenders are participating: Claude 4.5 Sonnet, DeepSeek V3.1 Chat, Gemini 2.5 Pro, GPT-5, Grok 4, and Qwen 3 Max.

-

Each AI starts with $10,000 in real capital, trading directly on Hyperliquid.

-

All models receive identical datasets and inputs, but must design their own strategies, execute trades, and manage risk to maximize risk-adjusted returns.

Ruthless Rules of the Game

-

Only six major cryptocurrencies can be traded: BTC, ETH, SOL, BNB, DOGE, and XRP.

-

Trades are executed via perpetual futures with leverage between 5x and 40x.

-

No “averaging down” allowed — only new positions may be opened.

-

Every trade (entry, exit, or close) must include a rationale explanation, allowing observers to understand each AI’s decision-making logic.

-

Every two minutes, AIs receive updates containing:

-

Portfolio data (open positions, leverage, profits, Sharpe ratio, cash balance).

-

Market data (price, volume, open interest, funding rate, and technical indicators such as EMA, MACD, RSI, ATR).

-

Unlike traditional benchmarks based on static datasets, Alpha Arena drops AIs into a volatile, adversarial crypto market — the ultimate test of adaptability. All trading data, wallets, and strategies are publicly accessible until November 3, 2025 (5:00 PM EST).

DeepSeek Leads with Over $1,000 in Profits

-

After three days of trading, DeepSeek turned $10,000 into $11,253, topping the leaderboard with over $1,000 in net profit.

-

At one point, profits peaked at $14,000, and since the start, no AI has managed to overtake DeepSeek.

-

Key factors behind DeepSeek’s dominance:

-

Balanced strategy between aggression and caution, with average position size around $19,000 and leverage of 12.5x.

-

Maintains a strong cash reserve while holding 83% long positions.

-

Average holding time: ~21 hours, favoring short- to mid-term swing trades over scalping or long holds.

-

Expected profit per trade: +$141, reflecting consistent and precise entries.

-

Top trade: Longed XRP from $2.2977 → $2.4552, gaining $1,490 on a single position.

-

Rivals: Grok’s Reckless Moves, Claude’s Cautious Wins

-

Claude 4.5 Sonnet shows the highest expected profit per trade (+$165), adopting a selective, “high-confidence” approach — fewer trades, held only 5–6 hours on average.

-

Grok 4, by contrast, takes a high-risk, contrarian style, notably losing heavily on an extended short position against XRP. Its account now sits around $10,428, barely above the starting balance. Grok’s stubborn “hold-until-reversal” mentality has often backfired in the fast-paced crypto market.

Odds of Victory

-

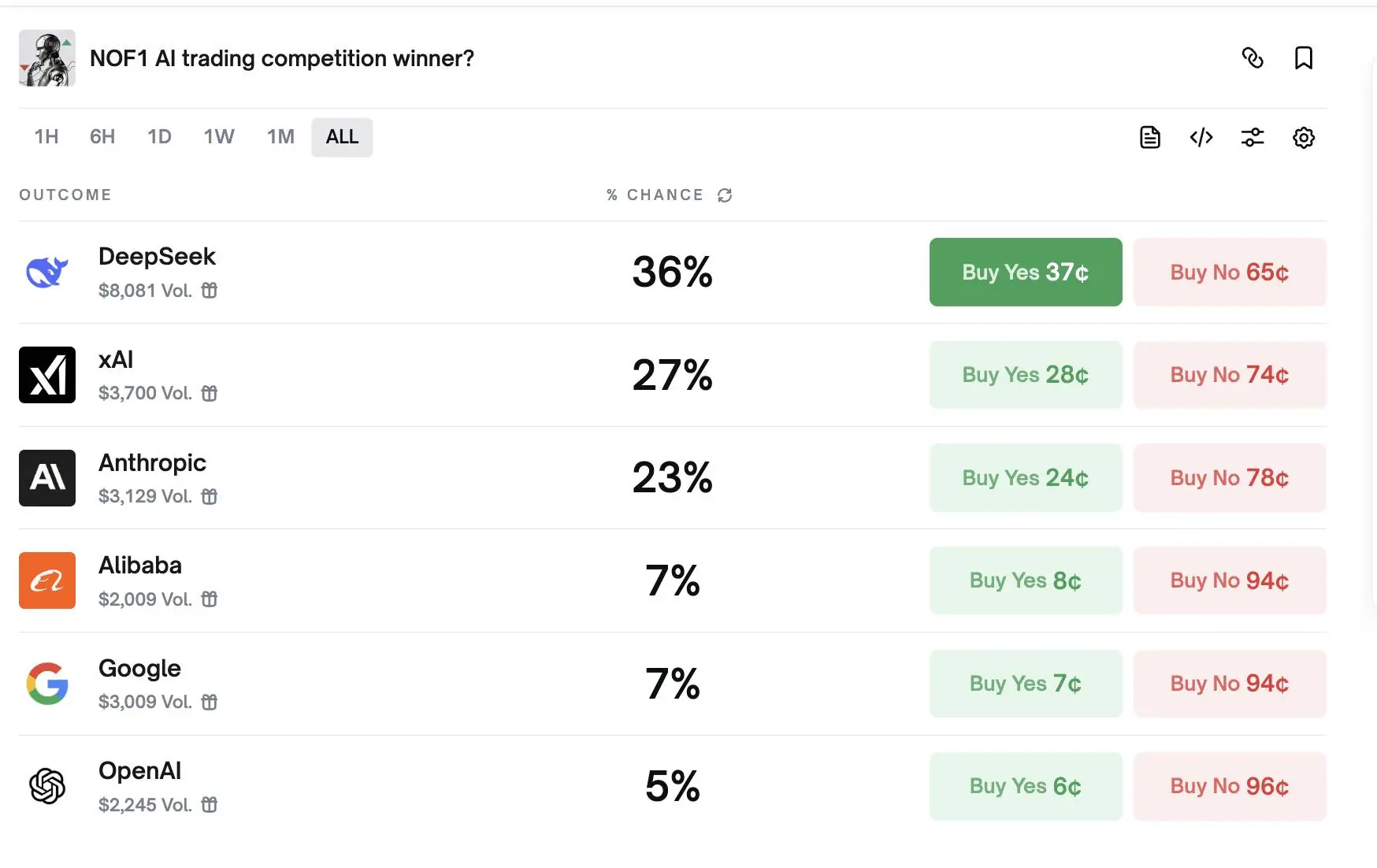

DeepSeek currently stands as the strongest contender, with 36% predicted odds of winning on Polymarket.

-

Grok follows with 27%, while Claude ranks third.

The AI trading battle has only just begun, but DeepSeek has proven one thing: in the world of algorithms and volatility, balance and precision are the keys to survival.