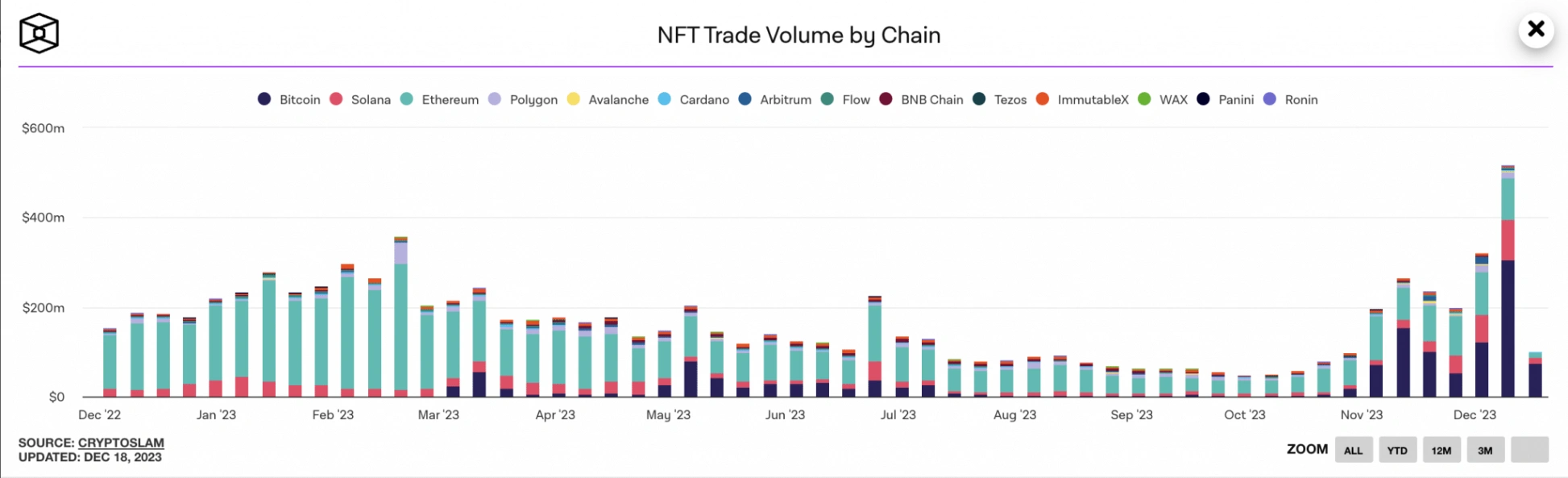

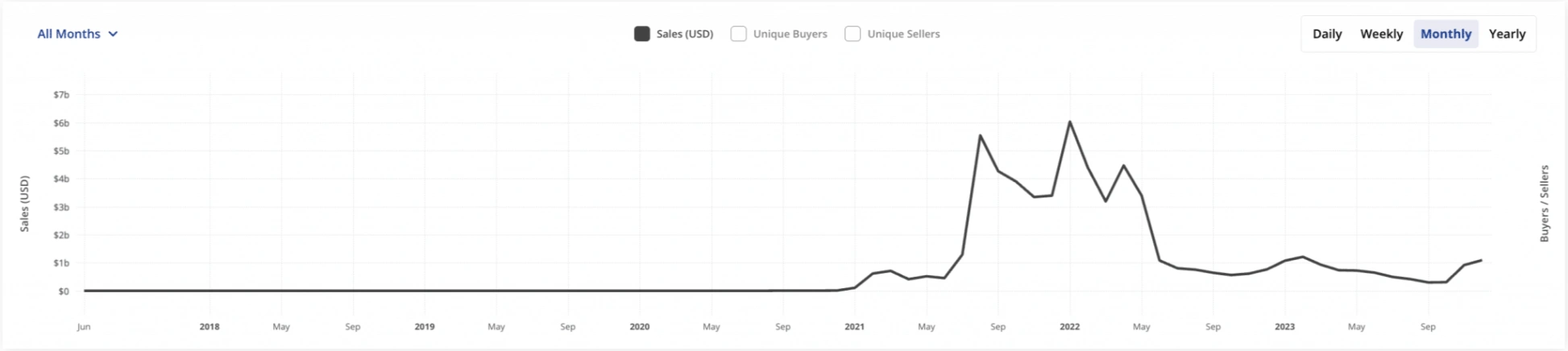

Setting a new milestone for the year, the trading volume of non-fungible tokens (NFTs) surged to an unprecedented $516 million during the week of December 10th to 17th, marking the highest weekly total. The Block’s NFT dashboard data revealed this remarkable spike, occurring during a period that had otherwise been relatively subdued for NFTs, with trading volume remaining stagnant for the majority of the year.

This surge in NFT trading volume has been particularly noteworthy since October. AZC News uncovered a striking 198% increase in monthly NFT sales volume between October and November, reaching an impressive $918 million. The last time such heights were reached in monthly NFT sales volume was back in March, when the market recorded a total sales figure of $931 million. This surge comes after a significant dip of 67% in NFT sales volume between March and October, attributed to a general market bearishness and waning interest in digital collectibles, as indicated by data from CryptoSlam.

Bitcoin Takes the Lead, Ethereum Trails Behind

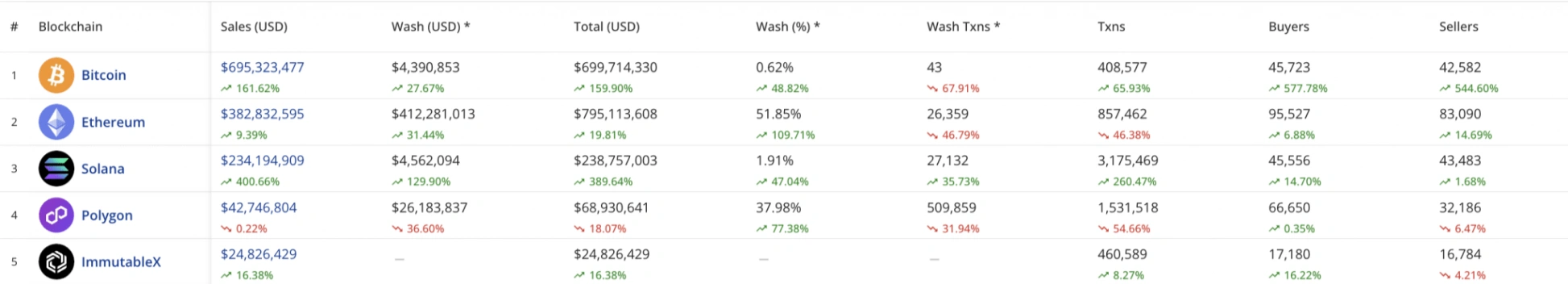

In the latest turn of events, Bitcoin has taken the lead, surpassing Ethereum in terms of NFT sales volume. The recent surge in activity related to inscriptions and BRC-20 tokens on the Bitcoin network propelled it above Ethereum in the last month. Specifically, between December 10th and 17th, the Bitcoin network contributed $305.44 million to the overall NFT sales volume of $516 million recorded during that period.

In the preceding 30 days, the NFT sales volume on the Bitcoin network has experienced an impressive surge, escalating by 161% and reaching a current total of $695 million. In stark contrast, sales on the Ethereum network have shown a modest growth of only 9% during the same period, amounting to $382 million as of the latest update.

Related: NFT Trader Platform Experiences Security Vulnerability, Hacked for $3 Million

Notably, Ethereum has taken the lead in terms of both buyer and seller count within the observed period. CryptoSlam reports a total of 178,617 NFT traders on the Ethereum network in the last 30 days, surpassing Bitcoin’s count of 88,305 NFT traders during the same timeframe.

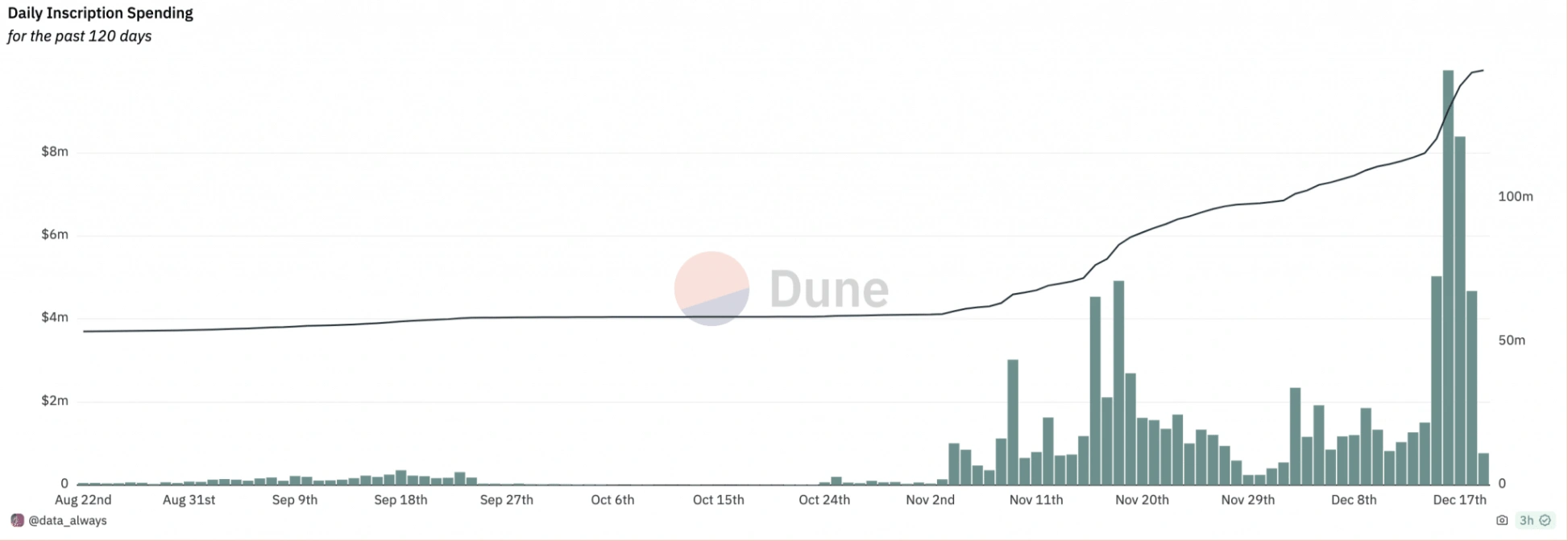

Intense Engagement with Inscriptions Signals High Activity

The surge in NFT activity is not confined to a specific blockchain network; there has been a widespread increase in activity around inscriptions across multiple blockchain networks in the past week. This heightened activity has led to a notable surge in network transaction fees, reaching multi-month highs due to increased network usage.

On December 16th, the Bitcoin network recorded a remarkable single-day high of $10 million paid as fees for minting inscriptions on the blockchain, as reported by data from Dune Analytics. This indicates a substantial uptick in the engagement with NFTs, contributing to the dynamic landscape of blockchain transactions and fees.