BNB has officially reached the historic $1,000 mark for the first time, representing an extraordinary 999,900% surge from its initial coin offering price of just $0.10 eight years ago. This achievement has shaken the investment community, especially as the broader crypto market continues to grapple with volatility.

Amid heated debates over the causes of this record-breaking rally, Changpeng “CZ” Zhao – Binance’s founder and former CEO – shared his insights into the key factors behind BNB’s explosive growth.

Pro-crypto policy and the comeback of meme coins

According to CZ, a major turning point came from the U.S. government’s more crypto-friendly stance, which set off a ripple effect across other nations. At the same time, the resurgence of meme coins on BNB Chain reignited community interest and drove discussions on technical challenges such as MEV attacks, ultimately making the ecosystem more resilient.

Infrastructure upgrades and the role of Binance Alpha

BNB Chain has undergone significant improvements, reducing block times from 3 seconds to just 0.75 seconds while slashing transaction fees by 90%. These upgrades have made BNB Chain one of the most cost-efficient blockchains, fueling a surge in transaction volumes. Additionally, Binance Alpha provided projects with a smoother pathway from DeFi to CeFi without needing to go through smaller exchanges, further enhancing BNB’s liquidity.

Expanding ecosystem and token burn program

The growth extended beyond meme coins, with stablecoins, DeFi, AI, and real-world asset (RWA) projects gaining strong traction. Notably, the launch of the USD1 stablecoin filled the void left by BUSD, rapidly boosting liquidity. Alongside this, the ongoing BNB token burn program has played a vital role, with $1.6 billion worth of tokens removed from circulation in the latest quarter alone, directly supporting BNB’s value.

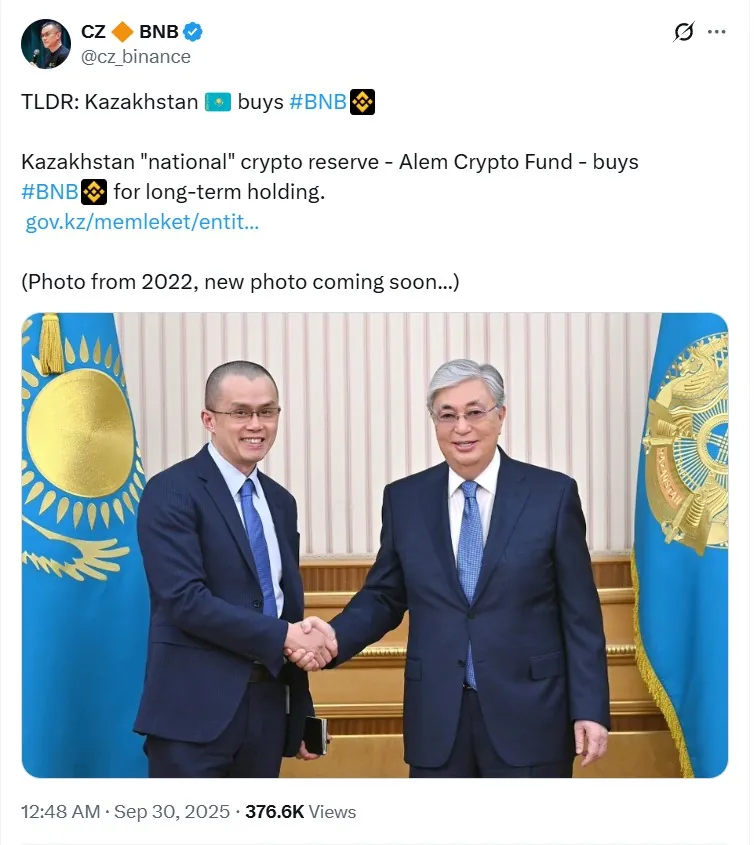

Regulatory clarity and institutional capital inflows

Regulation has also played a crucial role. The U.S. SEC’s decision to drop its lawsuit against Binance and CZ erased lingering fears that BNB might be classified as a security. Meanwhile, major funds such as YZiLabs, alongside other institutional investors, poured hundreds of millions of dollars into the BNB Chain ecosystem, reinforcing long-term growth prospects.

BNB – one of 2025’s standout assets

After peaking at $1,006 on September 18, BNB retraced to $981 before stabilizing near $994. Despite short-term fluctuations, the token has risen more than 41.7% since the start of the year, cementing its status as one of the best-performing digital assets in 2025.