In a statement on August 29, CZ emphasized that more traditional financial institutions and even governments are now adding Bitcoin to their balance sheets than ever before.

“We’ve witnessed a remarkable evolution. It’s great to see not only major corporations but also nations and governments embracing Bitcoin alongside other cryptocurrencies,” CZ said. “I believe we’ve come a very long way.”

A long-time Bitcoin advocate, CZ has supported the asset since its early days. When BTC hit a new all-time high of $122,000 on July 14, he reminded traders that this was just the beginning of a much larger upward journey. CZ compared the market’s excitement with the time Bitcoin first crossed $1,000 back in 2017—an analogy later validated when BTC soared to a fresh record of $124,128 just a month later.

Who’s Stockpiling Bitcoin?

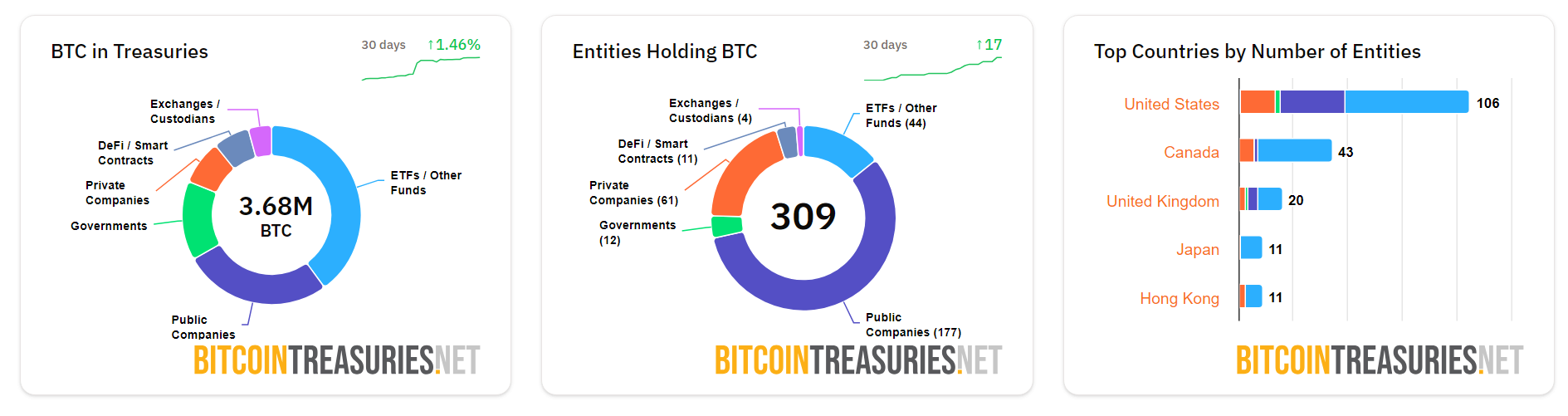

According to BTC Treasuries, 17 new entities have added Bitcoin to their reserves in the past month alone. In total, 309 entities—including public companies, investment funds, crypto exchanges, and even governments—now hold BTC on their balance sheets.

Publicly listed companies make up more than one-third of this figure, with 177 corporations holding Bitcoin. This marks a significant acceleration compared to 2024, when only 37 new companies adopted BTC for their treasuries. In the first half of 2025 alone, 51 new firms joined the trend. By mid-2025, more than 35 public companies held at least 1,000 BTC each—up from 24 at the end of Q1.

Another notable point: stock prices often rally after companies announce large-scale Bitcoin acquisitions, creating a powerful incentive to keep accumulating.

Michael Saylor’s Bitcoin Empire

Leading the charge is Michael Saylor’s company, which remains the top Bitcoin holder among corporations, with 632,457 BTC—about 3% of the total circulating supply.

Overall, about 3.68 million BTC are held in reserves by ETFs, funds, exchanges, private firms, and government institutions. Compared to the global circulating supply of approximately 19.9 million BTC, there’s still a significant amount left to be acquired—leaving plenty of room for accumulation.