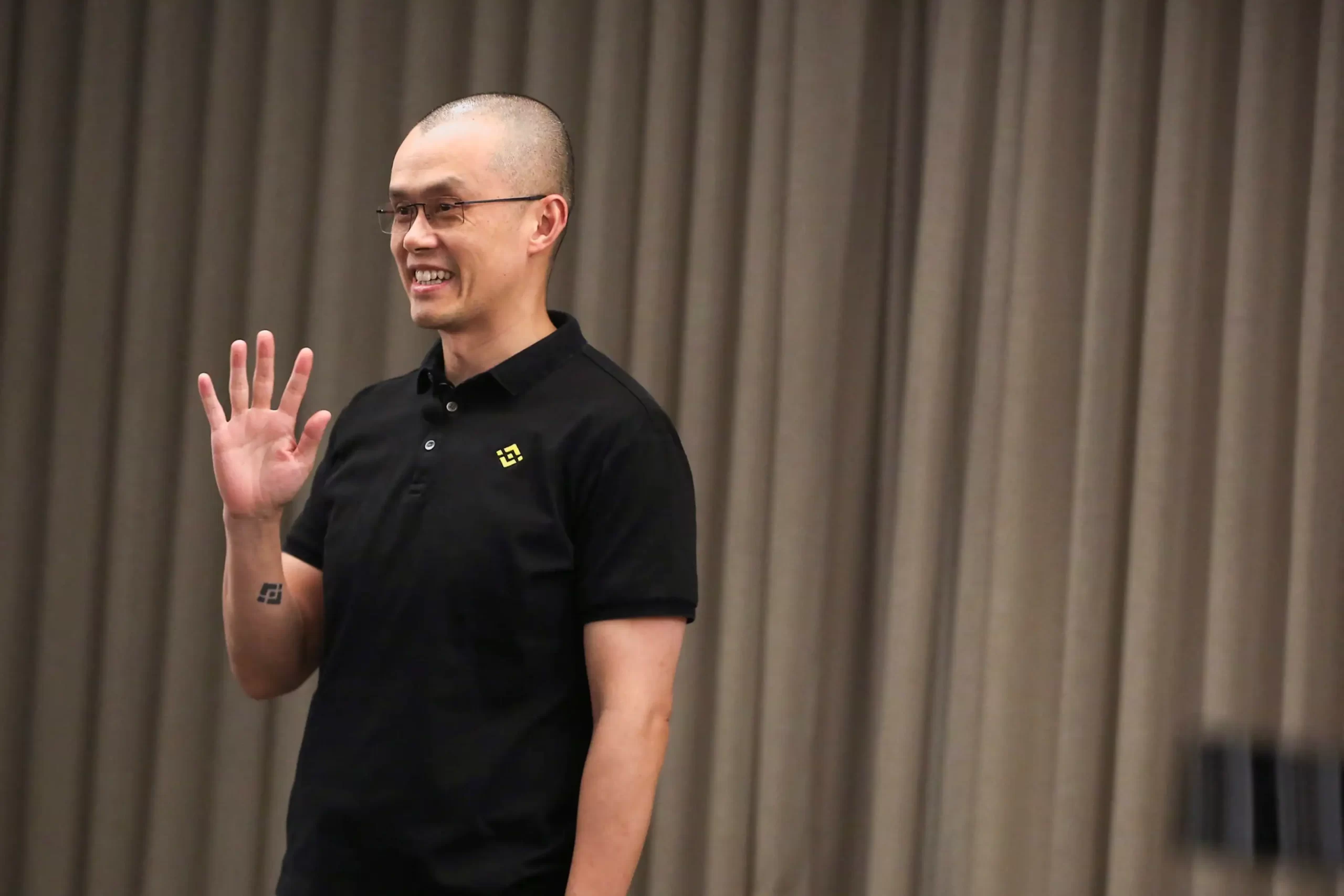

Despite offering an unprecedented $4.5 billion bond, Changpeng Zhao, the former CEO of Binance, faces an obstacle in his attempt to leave the U.S. This comes in the aftermath of his admission of guilt to anti-money laundering charges, adding a significant chapter to the ongoing scrutiny of the cryptocurrency industry by authorities.

U.S. Authorities Bar Zhao’s Departure Despite $4.5 Billion Binance Stake Proposal

Zhao, who relinquished his position at Binance in November 2023, has become embroiled in a complex legal situation with the U.S. justice system. His proposal to pledge his entire $4.5 billion stake in Binance.US in exchange for permission to travel to the United Arab Emirates was met with a firm denial from the U.S. District Court in Seattle. This denial underscores the gravity of the charges against him and the court’s serious consideration of the case.

The ruling, outlined in a court filing by Judge Richard A. Jones of the Western District of Washington at Seattle, emphasizes the substantial financial offer made by Zhao in his bid for travel approval. Despite the magnitude of the bond, the court upheld its decision to confine Zhao within U.S. borders, citing the necessity to ensure his presence throughout the sentencing process scheduled for February 2024.

The court order states, “It is ordered that the condition permitting Defendant to return to the UAE pending sentencing is stayed until such time as this Court resolves the Government’s motion for review.”

This legal saga marks a pivotal moment in the ongoing regulatory and legal hurdles confronting the cryptocurrency industry. Changpeng Zhao, a dual citizen of Canada and the United Arab Emirates, now stands at the epicenter of a case with potentially profound implications. The court’s refusal to grant him travel permission reflects a zero-tolerance stance by U.S. authorities toward any violations of anti-money laundering laws.

CFTC Issues Groundbreaking Ruling Against Binance and Changpeng Zhao

Adding to Zhao’s complexity is the substantial financial penalties imposed on both him and Binance as part of a settlement with the Commodity Futures Trading Commission (CFTC). The court mandates that Zhao personally pay a $150 million civil monetary penalty. Additionally, Binance is obligated to disgorge $1.35 billion in alleged ill-gotten transaction fees and pay an additional $1.35 billion penalty to the CFTC.

Related: The US Court Continues to Deny CZ’s Application to Return to the UAE

These penalties underscore the gravity of the violations and emphasize the U.S. government’s commitment to enforcing regulations within the cryptocurrency sector. Facing a maximum prison sentence of 10 years, Zhao has committed not to appeal any sentence up to 18 months, signifying his acknowledgment of mistakes and his determination to take responsibility.