The cryptocurrency market maintained strong momentum over the weekend, with the total global market capitalization once again surpassing $4 trillion, marking a dynamic start to “Uptober” — a period often associated with bullish sentiment in the crypto space. Over the past 24 hours, the total market cap rose by more than 1%, coinciding with Bitcoin’s (BTC) new all-time highs. On-chain data revealed a sharp increase in activity from crypto whales — large investors who are strategically buying, selling, and reallocating across major digital assets.

Ethereum (ETH): Strong Recovery and Significant Whale Movements

Ethereum (ETH) — the world’s second-largest cryptocurrency — has risen by more than 10% over the past week, reclaiming the $4,500 level after losing it in late September. This price recovery has fueled a surge in large-scale transactions involving ETH.

A new wallet address (0x982) received 26,029 ETH worth approximately $116.8 million from crypto exchange Kraken, while another whale purchased 7,311 ETH at an average price of $4,514. These tokens were later supplied to the lending protocol Aave, and the investor transferred 33 million USDC to the Hyperliquid platform to facilitate these purchases.

In contrast, the institutional investor Trend Research continued to reduce its Ethereum exposure, transferring 77,491 ETH (worth $354.5 million) to Binance. Since early October, the firm has sold a total of 143,124 ETH — roughly $642 million — reflecting ongoing profit-taking among large holders.

Bitcoin (BTC): New All-Time High Reinforces Institutional Confidence

Bitcoin continued to demonstrate its dominance, surpassing $125,000 to set a new all-time high. The rally prompted several whales to move assets to exchanges, likely to realize profits. Wallet 3NVeXm transferred 1,550 BTC (worth $193.75 million) to Binance, while an address linked to Alameda Research moved 250 BTC (worth $30.1 million) to the same platform.

Despite these sell-side movements, institutional demand for Bitcoin remains strong. According to BitcoinTreasuries, 14 publicly listed companies increased their Bitcoin holdings over the past week, while only one reduced its position. Notably, Metaplanet added 5,268 BTC, followed by Marathon Digital, CleanSpark, and MicroStrategy. In total, the top 100 public companies now collectively hold more than 1,038,000 BTC, underscoring institutional investors’ long-term confidence in the asset.

Altcoins: Whale Activity Expands Beyond BTC and ETH

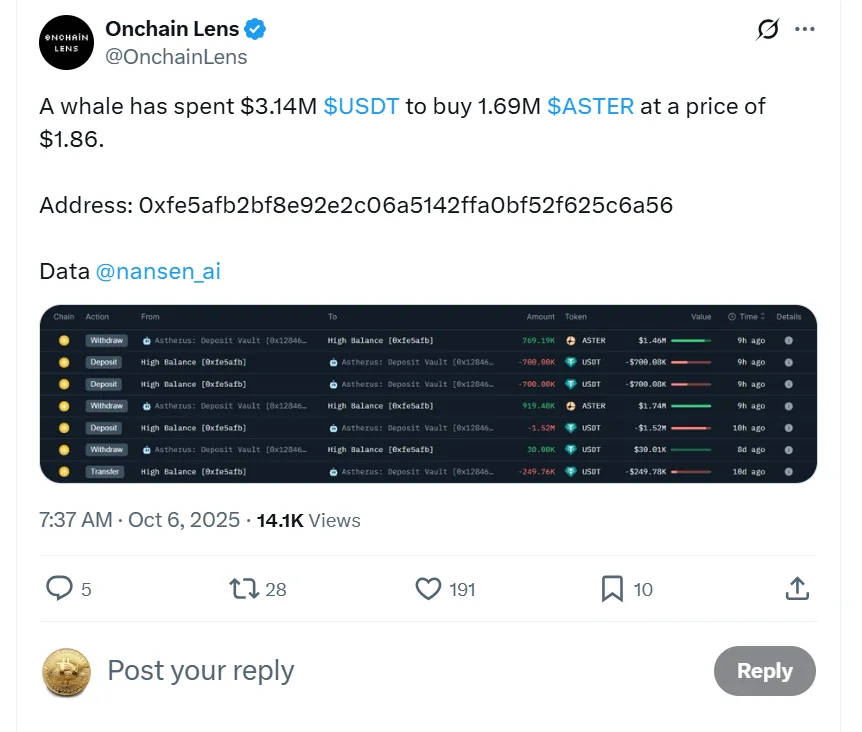

Beyond Bitcoin and Ethereum, whales have also been active across several major altcoins. One large investor acquired 1.69 million Aster (ASTER) tokens worth approximately $3.14 million, while a Gnosis Safe Proxy wallet transferred 11.67 million ONDO tokens ($10.87 million) to exchanges, potentially signaling profit-taking.

Data from OnChainLens showed that 3.89 million ONDO ($3.63 million) were sent to Arthur Hayes’ Bybit deposit address. Over the past month, a total of 40.77 million ONDO ($41.25 million) has been transferred to this address. Meanwhile, according to Arkham Intelligence, another whale deposited 700,000 Chainlink (LINK) tokens worth $15.52 million to Binance.

Market Outlook: Confidence Persists Amid Potential Correction Risks

Overall, recent whale activity reflects divergent market strategies — with some investors accumulating assets ahead of a potential next leg up, while others are locking in profits after the latest surge. Despite short-term volatility, institutional demand remains robust, signaling sustained confidence in the broader cryptocurrency rally.

If this trend continues, Uptober could pave the way for a more durable and broad-based uptrend across the crypto market, though short-term corrections remain a possibility.