Crypto Market Recap for the Past Week

The first week of Q2 started with a significant downturn in Bitcoin, as BTC dropped from $71,300 to $65,000, triggering liquidations among investors. Following this dip, BTC continued to fluctuate around $65,000, and by the end of the week, it had rebounded back to $70,000.

This week, funds flowed back into Bitcoin after witnessing strong selling pressure from many investment funds the previous week.

As for ETH, the coin did not have any notable movements and mainly reacted to Bitcoin. Currently, the price is oscillating around the $3,400 mark.

Last week also saw two major airdrops from Ethena (ENA) and Wormhole (W), as well as significant news such as Ripple’s announcement of launching a stablecoin. Particularly, Wormhole conducted a large airdrop where many users received amounts totaling tens of thousands of USD.

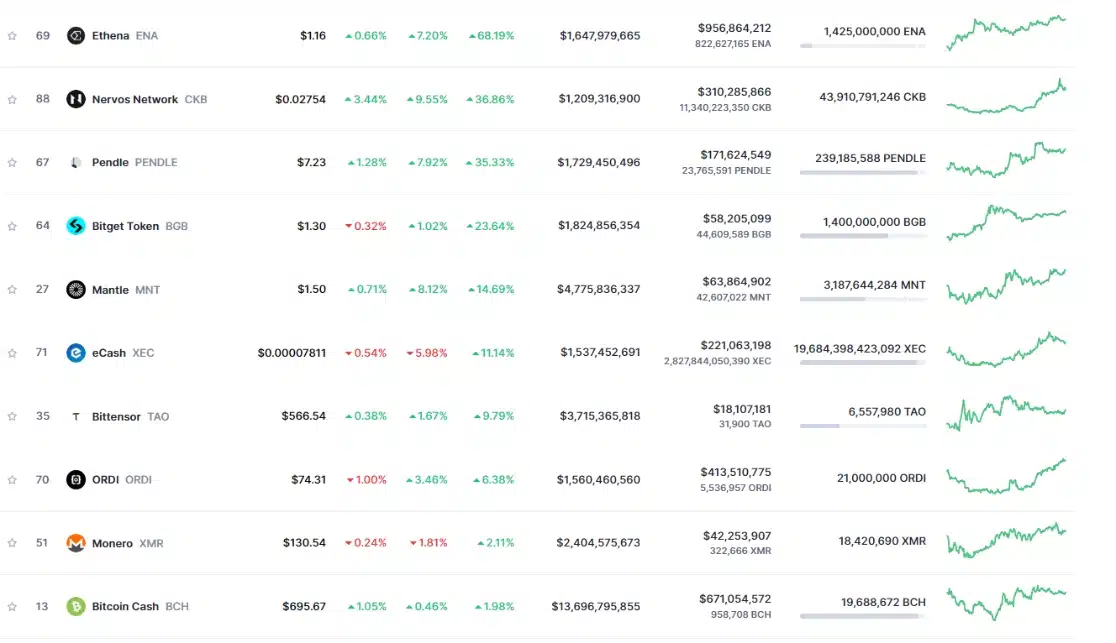

Top 10 Coins with the Highest Gains This Week

Top 10 Coins with the Highest Losses This Week

Source: CoinMarketCap

Highlighted News:

- Tether Acquires $627 Million Worth of Bitcoin in Q1 2024

- TRON Foundation Asserts Strongly Against SEC Lawsuit

Macro News for this Week

Wednesday (10/4/2024):

- At 12:30 PM (UTC), the US Consumer Price Index (CPI) figures for the year-over-year comparison will be released. This is an important report reflecting the inflation situation in the US economy.

- If the actual CPI figures are higher than the market forecast, it will be seen as a positive signal for the USD, indicating increasing inflation pressure, and the Federal Reserve (Fed) may continue to raise interest rates to curb inflation. Conversely, if the CPI figures are lower than expected, it will be viewed as negative for the USD.

- Also on Wednesday, at 4:10 PM (UTC), Fed Chair Jerome Powell will deliver a speech. Powell’s statements are often closely watched by the market as they reflect the Fed’s views on the economic situation and monetary policy in the near future.

Thursday (11/4/2024):

- At 12:30 PM (UTC), the US Initial Jobless Claims figures will be released. This is an important indicator of employment and economic activity.

- If the actual Initial Jobless Claims figures are higher than forecasted, it will be considered a negative signal for the USD, indicating weakening employment conditions. Conversely, if the figures are lower than expected, it will be viewed as positive for the USD.

Good

Hello

pas de probleme de l’adresse email