Crypto Market Recap Last Week

In the second week of May, the crypto market experienced a relatively quiet period. Bitcoin, the king of cryptocurrencies, fluctuated within the range of ($60,000 – $65,500 USD) with no significant movements. Notably, this is the fourth consecutive week Bitcoin has traded in this price range, creating a sense of boredom for many investors.

It’s worth mentioning that former U.S. President Donald Trump voiced his support for the crypto market last week. However, this statement seems to have had little impact as trading volumes continued to languish in anticipation of fresh news.

BTC Chart

With Bitcoin in a sideways phase, the majority of other cryptocurrencies (Altcoins) also followed the footsteps of the “crypto king” and moved within narrow ranges. However, some Altcoins with inflated valuations relative to their actual utility began to experience liquidity pressures and witnessed sharp price declines.

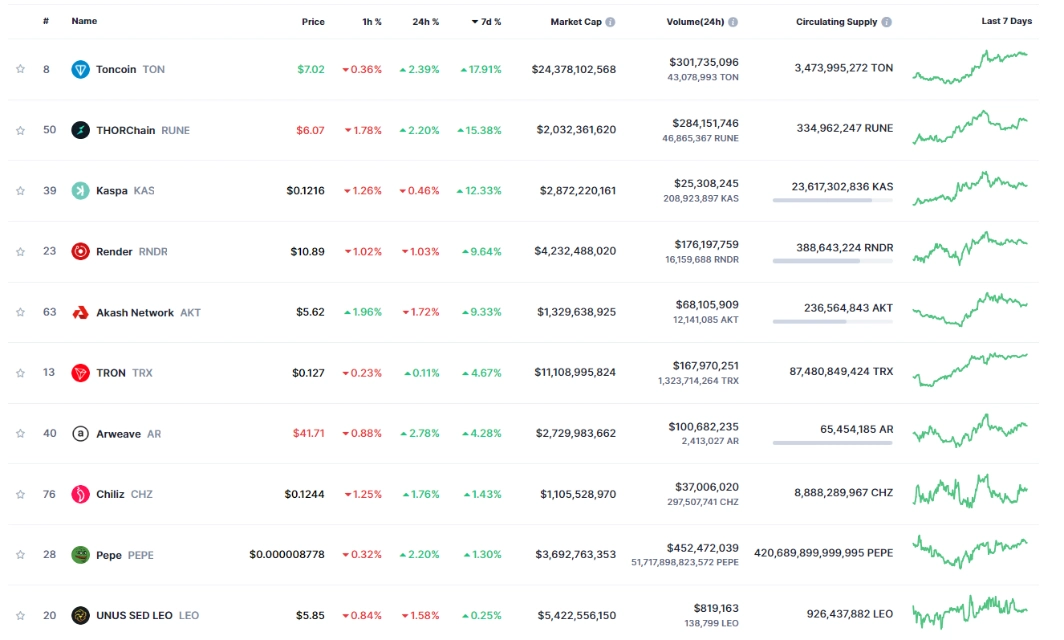

Top 10 Strongest Performing Coins Last Week

Source: Coinmarketcap

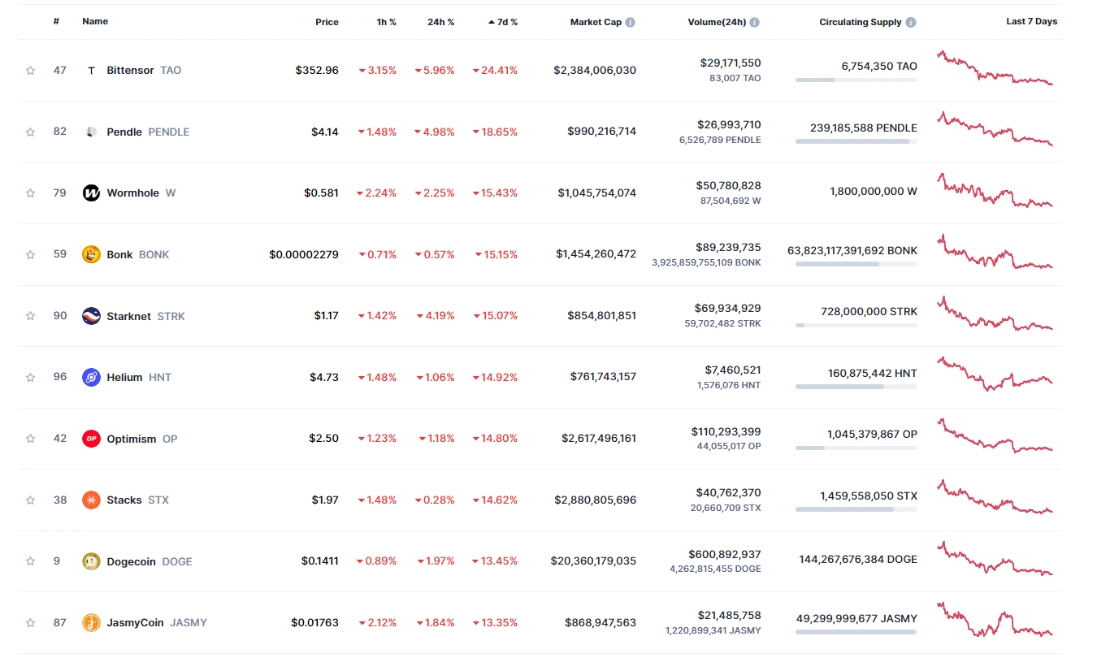

Top 10 Biggest Losers Last Week

Source: Coinmarketcap

Key News Last Week

- OKX Announces Listing of ZeroLend (ZERO)

- Whale Profit-Taking on Ethereum Sends Market Tumbling

- AILayer’s Official Account X Unexpectedly Deleted

Macro News This Week

This week, there are two important economic events that investors should pay attention to:

Firstly, at 12:30 (UTC) on May 15, 2024, the U.S. Consumer Price Index (CPI) will be released. This is a key indicator reflecting the level of inflation in the world’s largest economy. Typically, if the CPI figure exceeds expectations, it will be seen as a positive signal for the U.S. dollar, and vice versa.

Secondly, at the same time of 12:30 (UTC) on May 16, 2024, the Initial Jobless Claims data will be released by the U.S. Department of Labor. Traditionally, if this figure is higher than forecasted, the market will view it as a negative signal for the U.S. dollar, and vice versa.

Don’t forget to follow us for the latest updates on the crypto market!