Market situation last week

In the third week of 2024 (15/01 – 21/01), Bitcoin experienced a significant decline after the long-awaited approval of the Bitcoin ETF following 10 years of anticipation. The previous week saw Bitcoin’s price briefly surpass $49,000, but shortly after, there was a substantial correction, with the price dropping to $40,300 by the end of the week. This price reduction is likely attributed to selling pressure after the news and conversion pressure from Grayscale’s GBTC.

The sharp decline in Bitcoin had a cascading effect on various Altcoins, causing a widespread downturn. Notable events during the week included a series of Airdrop events on Manta Network and the staking activities of AigenLayer and Pyth.

BTC/USD Price Chart as of 1:59 AM on January 22, 2024.

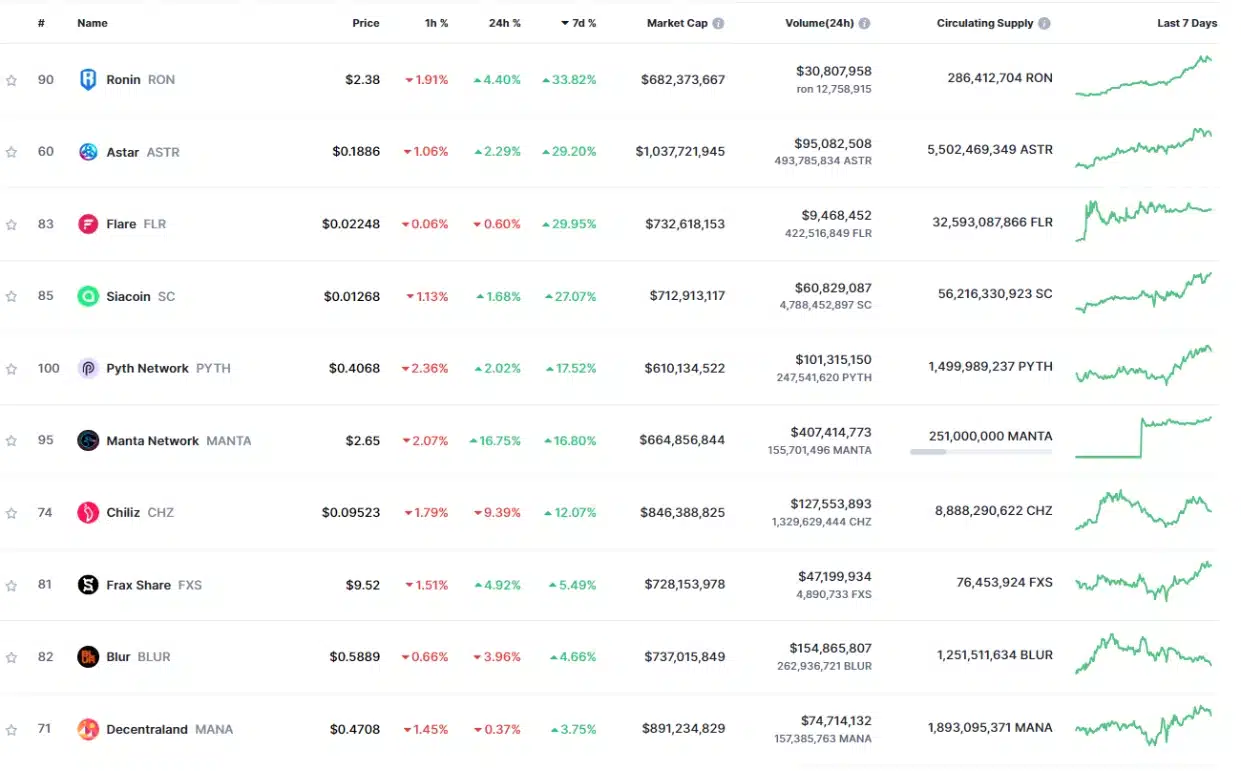

Top 10 coins in the top 100 increased the most in the past week

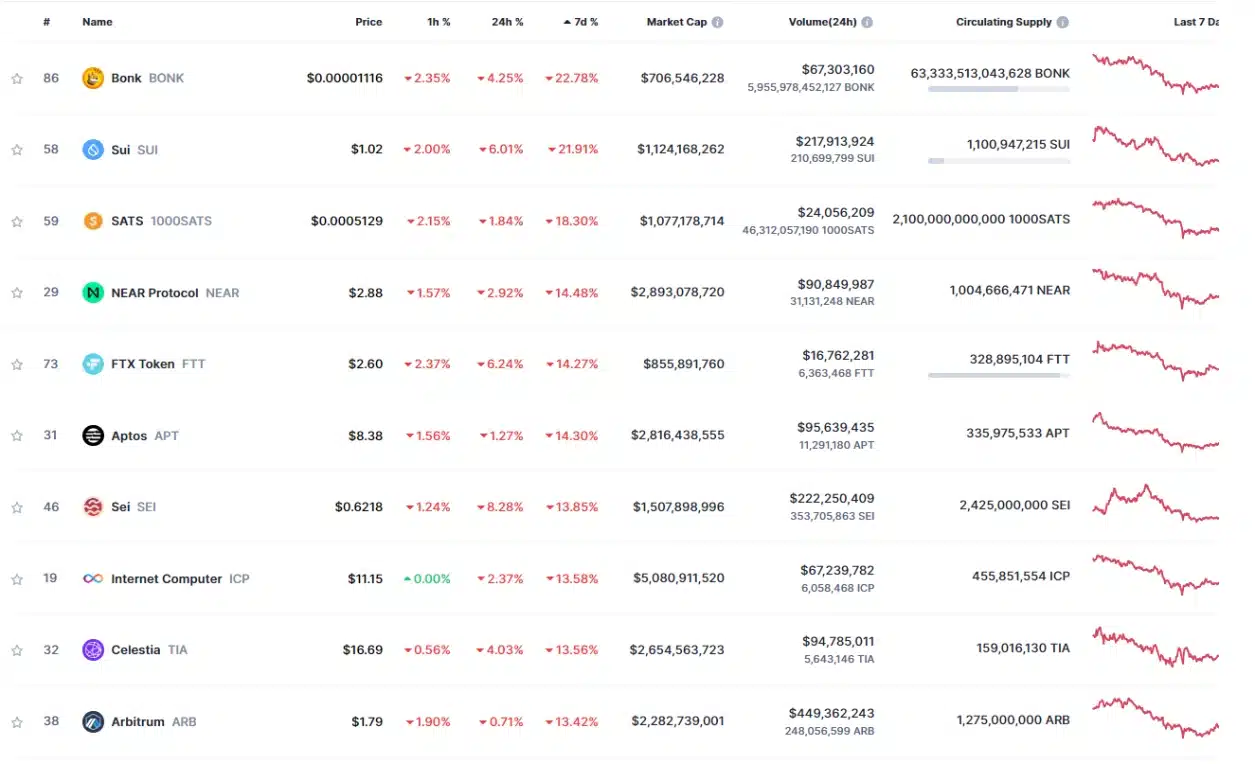

Top 10 coins in the top 100 decreased the most in the past week

Summary of outstanding news last week

- Ethereum’s Critical Vulnerability Exposed by Crypto Trader

- OKX Officially Lists Ice Network (ICE) for Spot Trading

Notable information this week

This week, in the market context, we will pay attention to two pieces of information scheduled for release on Wednesday (24/01) at 1:30 PM (UTC):

- Gross Domestic Product (GDP) figures: If the actual figures released are higher than forecasted, this will be a positive signal for the USD, and vice versa.

- Initial Unemployment Claims figures: In contrast to GDP, if the unemployment rate is higher than expected, this will be negative news for the USD, and vice versa.

AZC.News Crypto Weekly is a product of AZC.News produced weekly to provide the latest news about the world of cryptocurrency! Whether you are a seasoned investor or just starting out, AZC.News provides comprehensive information on market trends, price movements and important developments in the cryptocurrency space. Don’t miss important information that can affect your investment decisions. Stay informed, stay ahead – join AZC.News now!