Crypto Market Last Week

Early June saw a strong and continuous inflow of capital into the cryptocurrency market through Bitcoin ETFs over many days. As of June 10th, there had been 18 consecutive days witnessing a surge of investment into the market. However, despite the abundant capital supply, Bitcoin’s price movement was unfavorable for investors.

At the beginning of the week, Bitcoin’s price rose from $67,600 to $71,900, but as the week neared its end, it was negatively impacted by unfavorable macroeconomic news from the United States, causing a sharp decline to $68,500. Currently, it is trading around $69,500. This steep price drop resulted in many altcoins losing 20-30% of their value, causing significant losses for investors.

Despite the adverse news severely impacting the market, especially altcoins, there were still positive signals. BNB and TON officially hit new all-time highs, while many projects began implementing airdrop programs for their communities.

BTC Chart

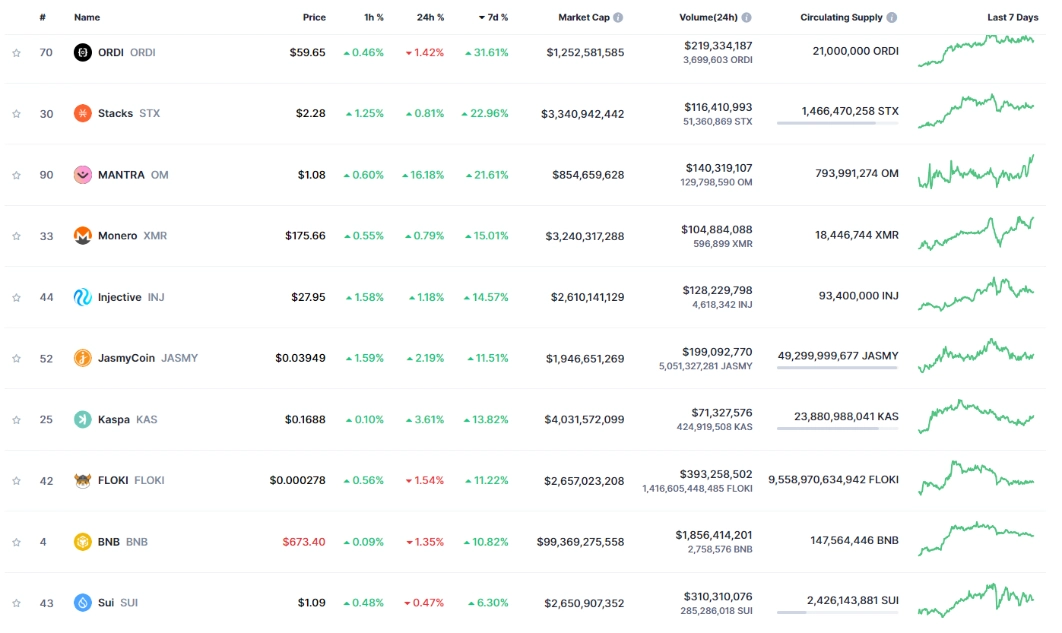

Top 10 Coins with Highest Gains Last Week

Source: Coinmarketcap

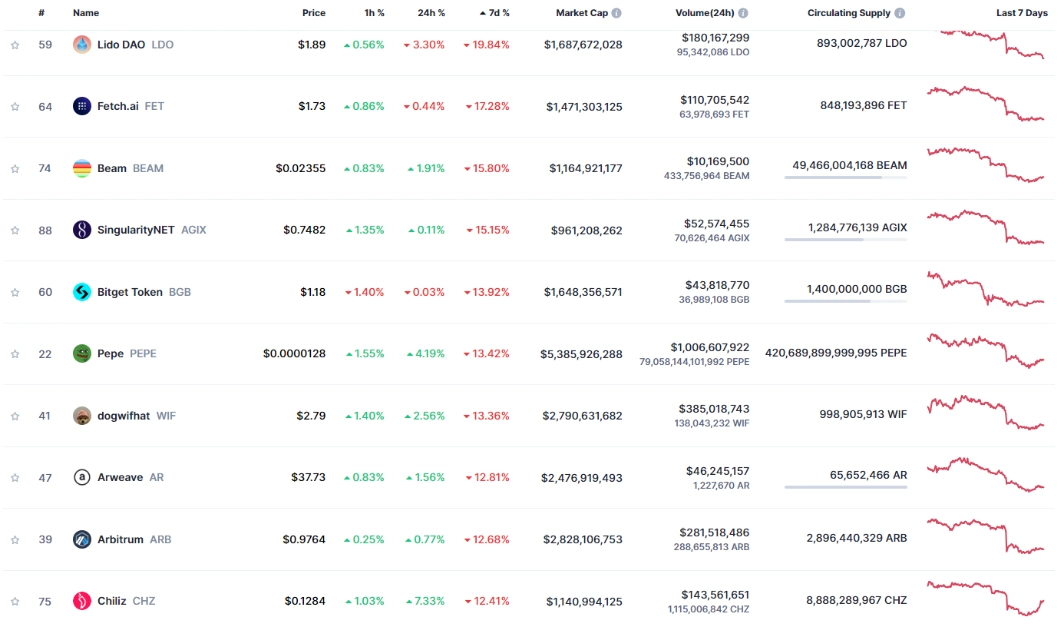

Top 10 Coins with Highest Losses Last Week

Source: Coinmarketcap

Important News Last Week

- Arbitrum Proposes $250 Million Gaming Fund

- DWF Labs Continues Funding for Memecoin, This Time with Floki Inu

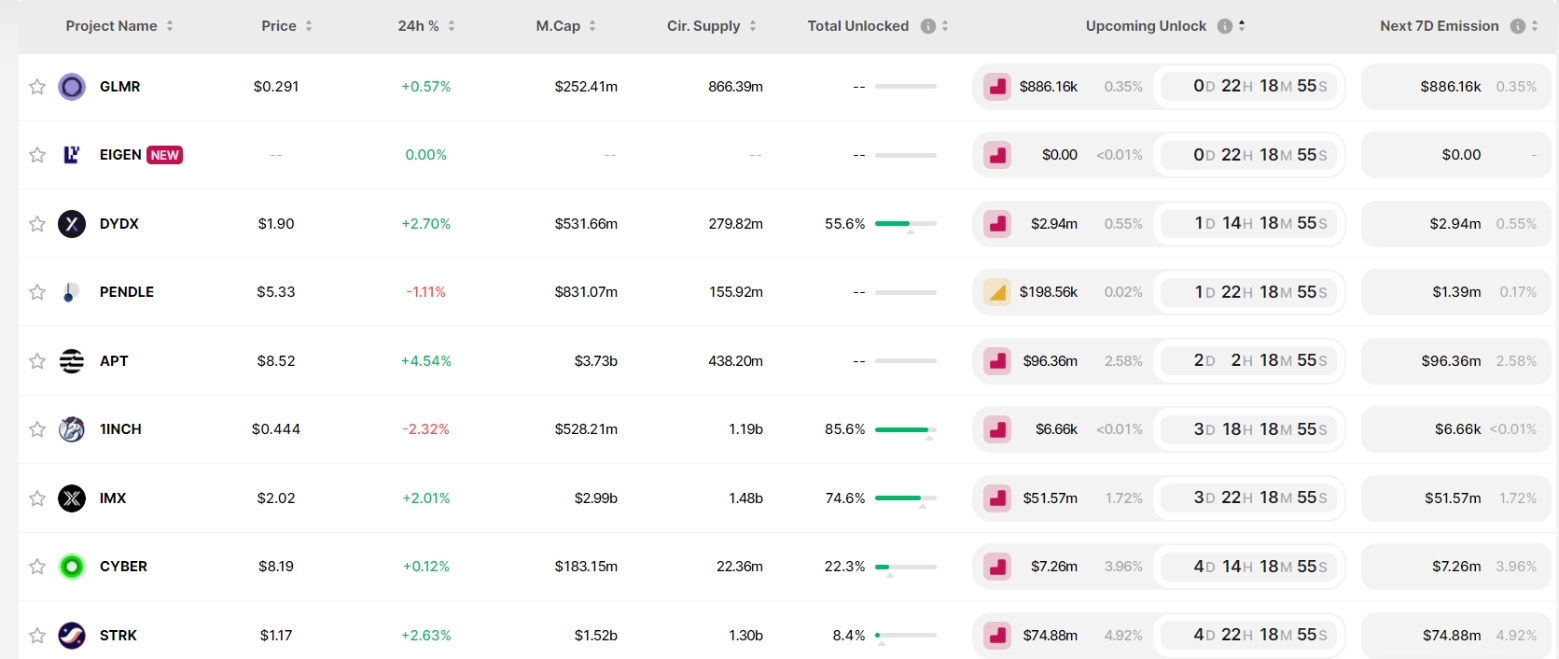

Token Unlocks This Week

This week, several projects are unlocking significant token amounts, such as: APT unlocking $96.36 million, IMX unlocking $51.57 million, and STRK unlocking $74.88 million.

Source: token.unlock

Macro News This Week

This week, there are several important economic data releases you should be aware of:

- Wednesday (12/6), at 12:30 PM (UTC), the US Consumer Price Index (CPI) will be released. This is one of the most critical economic indicators, reflecting changes in purchasing power and inflation. If the actual data is higher than forecasted, it will be seen as a positive signal for the US dollar, and vice versa.

- Wednesday (12/6), at 6:00 PM, the Federal Reserve (Fed) will announce its interest rate decision. A higher-than-expected interest rate announcement will be positive for the US dollar, and vice versa. However, according to forecasts, there is a high possibility that interest rates will remain unchanged.

- On Thursday (13/6), the Fed will release the US Initial Jobless Claims data, providing information on employment conditions and the overall health of the economy.

Don’t forget to follow us for the latest updates on the cryptocurrency market!

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE

I love AZ