The recent crypto market crash has wiped out billions in assets, leaving many investors deep in the red. One of the biggest casualties is a crypto whale currently facing a staggering $17.5 million unrealized loss on leveraged positions across multiple cryptocurrencies. However, the situation could become even more dire—if Bitcoin (BTC) drops to $74K, the trader’s losses would surpass $25 million.

Crypto Portfolio at Risk: Trader Incurs $17.5M Loss Amid Market Downturn

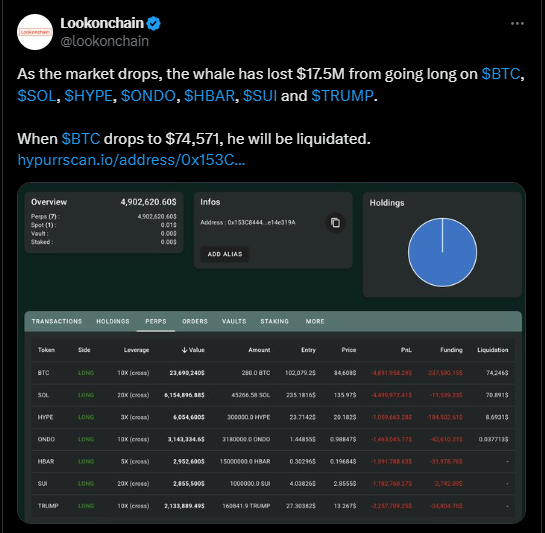

According to on-chain analytics platform Lookonchain, the trader’s portfolio is bleeding, with significant losses across leveraged positions in BTC, SOL, HYPE, ONDO, HBAR, SUI, and TRUMP tokens.

The largest losses stem from Bitcoin and Solana (SOL). The trader opened a $23.69 million position on BTC at an entry price of $102,079.2, using 10x leverage. Meanwhile, their Solana trade involved a $6.15 million position at an entry price of $235.18, leveraging 20x—both suffering heavy losses amid the market’s steep decline.

With several other leveraged positions in play, the trader is currently grappling with $17.5 million in unrealized losses—an amount that could escalate if the market downturn continues.

$25M Loss Looms if Bitcoin Plummets to $74K

Bitcoin has taken a severe hit, trading at $86K after a 3% dip in the past 24 hours and an 11% decline over the week. Earlier, BTC even fell to $82K, sparking fear among investors.

If Bitcoin slides further to $74K, the trader’s losses could balloon to $25 million due to a dangerously high margin usage of 80.92%, putting them on the brink of massive liquidation. The potential total loss would comprise the current $17.5 million unrealized losses plus an additional $7.4 million.

However, if Bitcoin stabilizes or rebounds, the trader could avoid liquidation—and if the price surges, they might even turn a substantial profit.