The global cryptocurrency market has officially crossed the historic $4 trillion market cap milestone, surpassing tech giant Microsoft for the first time. In just the past 24 hours, the market added another 4%, continuing its impressive rally since early July, with over $700 billion injected into digital assets.

This surge is fueled by a wave of favorable policies. Two major crypto bills – the GENIUS Act and the CLARITY Act – have just been passed by the U.S. House of Representatives. President Donald Trump is also expected to sign an executive order allowing 401(k) retirement funds, worth $9 trillion, to invest in cryptocurrencies.

Amid this momentum, Bitcoin remains steady above $120,000, while Ethereum jumped 8%, and XRP hit a new all-time high with an 18% gain. Other altcoins like SOL, BNB, and DOGE also saw strong rallies between 5–10%.

Institutional interest is surging as well, with inflows into spot Bitcoin and Ethereum ETFs rising sharply. Asset management giant BlackRock is currently leading the crypto ETF market, while expectations grow for XRP and SOL ETFs to be approved by year-end.

With its current valuation, the crypto market is now less than 5% away from overtaking Nvidia – the world’s most valuable company. If the current pace continues, crypto could surpass Nvidia by the end of July.

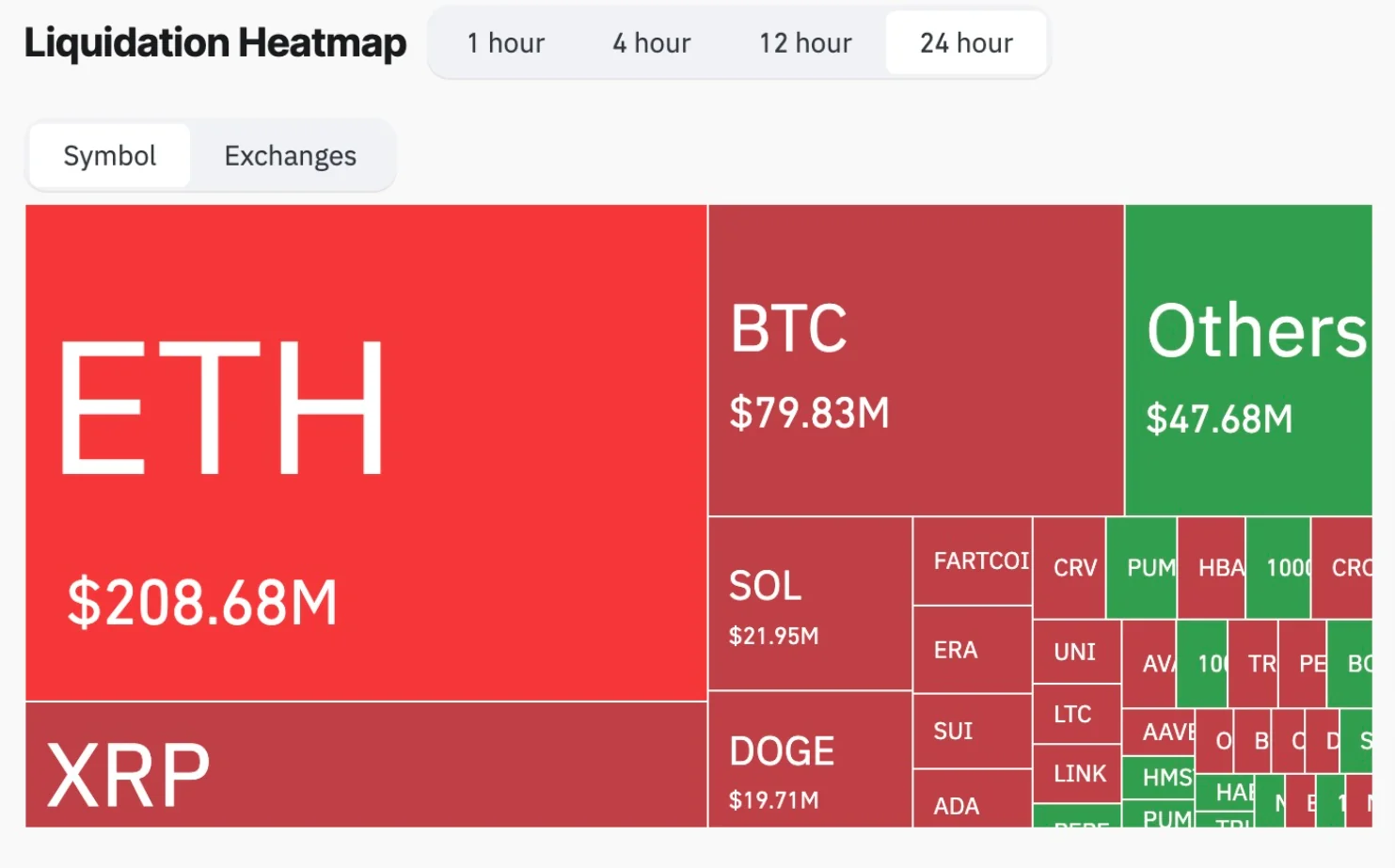

However, the rally has also triggered a wave of liquidations. In the last 24 hours alone, over $600 million has been liquidated across the market, mostly from short positions.

Analysts believe that the recently passed policies, especially the GENIUS Act (focused on stablecoin regulation) and the CLARITY Act (market structure reform), along with the opening of 401(k) funds to crypto, will serve as key catalysts for future growth. Meanwhile, the passing of the anti-CBDC law clears a regulatory path for private digital assets to flourish without competition from a state-backed digital currency.