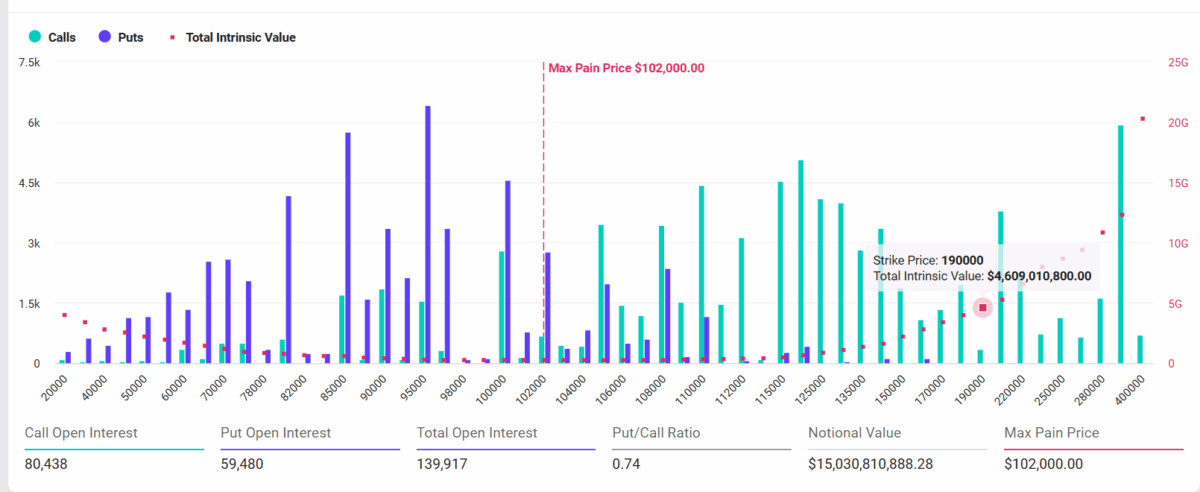

With less than two weeks remaining until the expiration of former U.S. President Donald Trump’s tariff pause (July 9), the crypto market is experiencing mounting selling pressure. Adding to the tension, 139,392 Bitcoin options contracts with a notional value of nearly $15 billion are set to expire this Friday, increasing investor caution.

Bitcoin is holding steady at $107,500, while major altcoins like Ethereum (ETH), XRP, Solana (SOL), and Dogecoin (DOGE) are down 2–5%. According to Deribit, the current put-call ratio stands at 0.74, indicating bullish dominance, with the maximum pain point at around $102,000.

Market data platform Greek.Live notes mixed sentiment among Bitcoin traders. Despite recent price movement, many are seeing flat or break-even outcomes. A strong resistance level at $110,000 is seen as a significant barrier in the short term.

Former BitMEX CEO Arthur Hayes believes several macroeconomic factors—such as the SLR exemption and the GENIUS Stablecoin Act—could fuel digital asset growth, predicting a new all-time high for Bitcoin.

Meanwhile, institutional interest remains robust, as evidenced by significant inflows into Bitcoin ETFs. Net inflows have already surpassed $1.7 billion this week alone, with BlackRock’s IBIT leading the pack.

On the policy front, the looming end of the tariff suspension is weighing on global markets. Key changes anticipated with the reintroduction of Trump’s tariff plan include: the return of country-specific reciprocal tariffs, up to 50% duties on European Union imports, and maintaining a global 10% baseline tariff rate.

Since the tariff pause began in April, both global markets and crypto have rallied. The S&P 500 has jumped over 1,200 points. Recently, the U.S. signed a trade agreement with China and is eyeing a major deal with India. In a Thursday speech, Trump remarked:

“We’re going to open up India. In the China deal, we’re starting to open up China. Things that never really could have happened. We just signed [a trade deal] with China. We’re not going to make deals with everybody… But we’re having some great deals. We have one coming up, maybe with India — a very big one.”

Investors remain on the sidelines for now, as expectations of a potential Fed rate cut in July continue to rise.