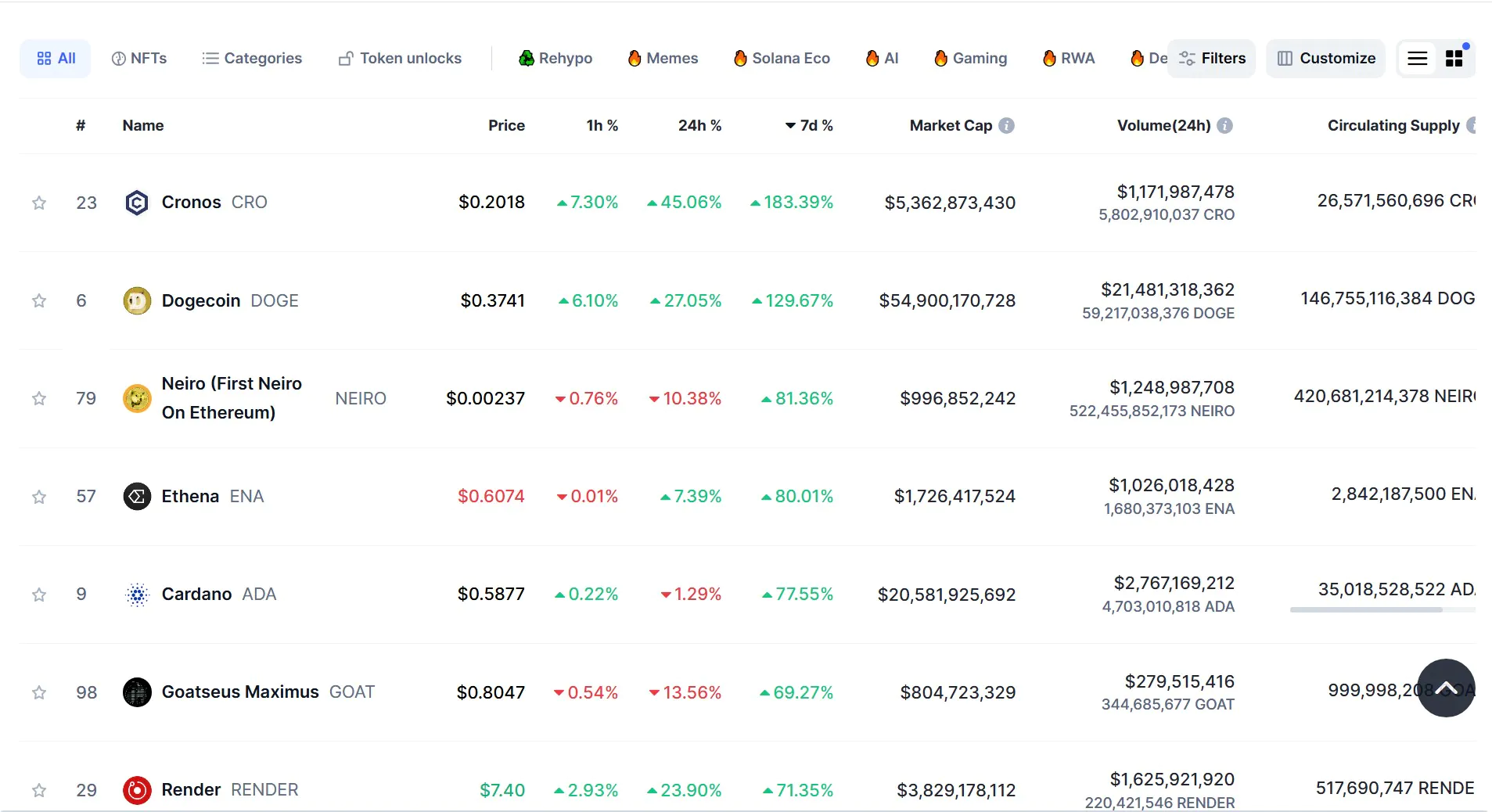

Cronos (CRO) has surged 183% in the past 7 days, making it the top gainer on the market. This impressive rally has pushed many indicators into overbought territory, reflecting strong investor enthusiasm.

However, some signs suggest that the current bullish momentum may be weakening, potentially leading to a consolidation phase or a price correction.

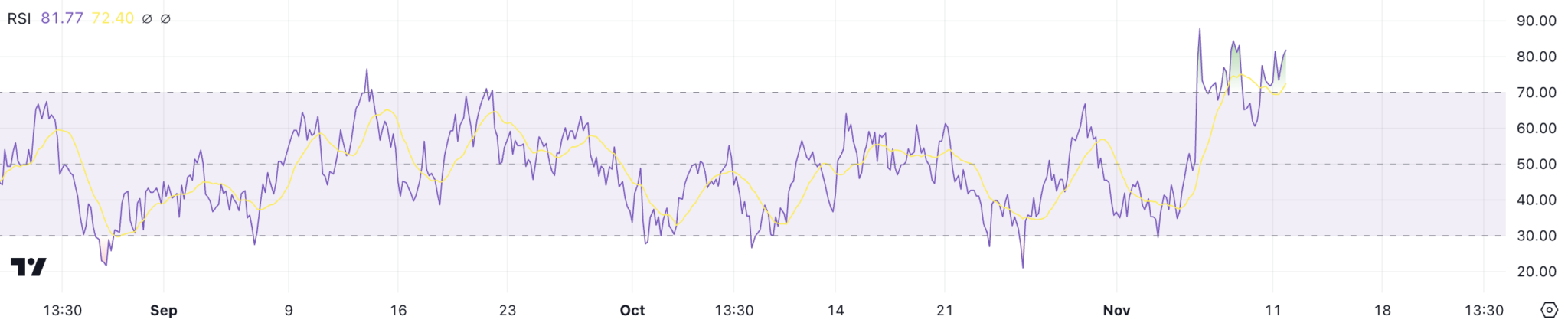

CRO RSI Indicates Overbought Status

CRO’s recent rally has pushed its Relative Strength Index (RSI) to 81.77, indicating that it is deep in overbought territory. This reflects strong buying momentum in CRO, perhaps fueled by investor enthusiasm.

Such a high RSI suggests that the asset may be overbought. This means that the risk of a price correction is high. When the RSI is above 70, it usually indicates that the asset may be overvalued, and a correction may occur as investors begin to take profits.

The Relative Strength Index (RSI) is a popular momentum indicator that measures the speed and change of price movements. The RSI ranges from 0 to 100, with values above 70 typically indicating that the asset is overbought, while values below 30 indicate that the asset is oversold.

With CRO’s RSI at 81.77, this suggests that CRO is under strong buying pressure but may be about to enter a consolidation or correction phase.

Cronos’ CMF Still Positive

CRO’s Chaikin Money Flow (CMF) is currently at 0.14, down significantly from levels above 0.40 on November 6. This decline suggests that buying pressure has decreased significantly over the past few days.

Read more: FTX Sues Binance and CZ, Demanding Compensation of Up to $1.76 Billion

While the CMF remains positive, meaning inflows are still higher than outflows, the sharp decline suggests that buying momentum is waning.

The Chaikin Money Flow (CMF) indicator is an indicator that measures the average volume of accumulation and distribution over a given period of time.

While CRO’s current CMF remains positive at 0.14, the decline from previous highs suggests that buying momentum may be waning. This could signal a decline in buying enthusiasm, potentially leading to a period of accumulation or even a mild correction if selling pressure begins to take over.