Brian Armstrong believes the United States now has “the most crypto-friendly Congress we’ve ever seen,” a shift that could trigger a global transformation in cryptocurrency regulations.

Coinbase CEO Brian Armstrong has declared that the U.S. is witnessing “the dawn of a new era for crypto” and predicts that by 2030, as much as 10% of the world’s GDP will be built on cryptocurrency infrastructure.

Speaking during Coinbase’s Q4 2024 earnings call on February 13, Armstrong stated, “Up to 10% of global GDP could be running on the crypto economy by the end of this decade.”

He compared the current wave of companies integrating crypto to the early 2000s when businesses had to rapidly adapt to the internet.

“On-chain is the new online,” he remarked.

If Armstrong’s prediction holds true, it would mean over $10 trillion in value being tokenized or operating on blockchain networks, based on the World Bank’s estimate of the current global GDP surpassing $100 trillion.

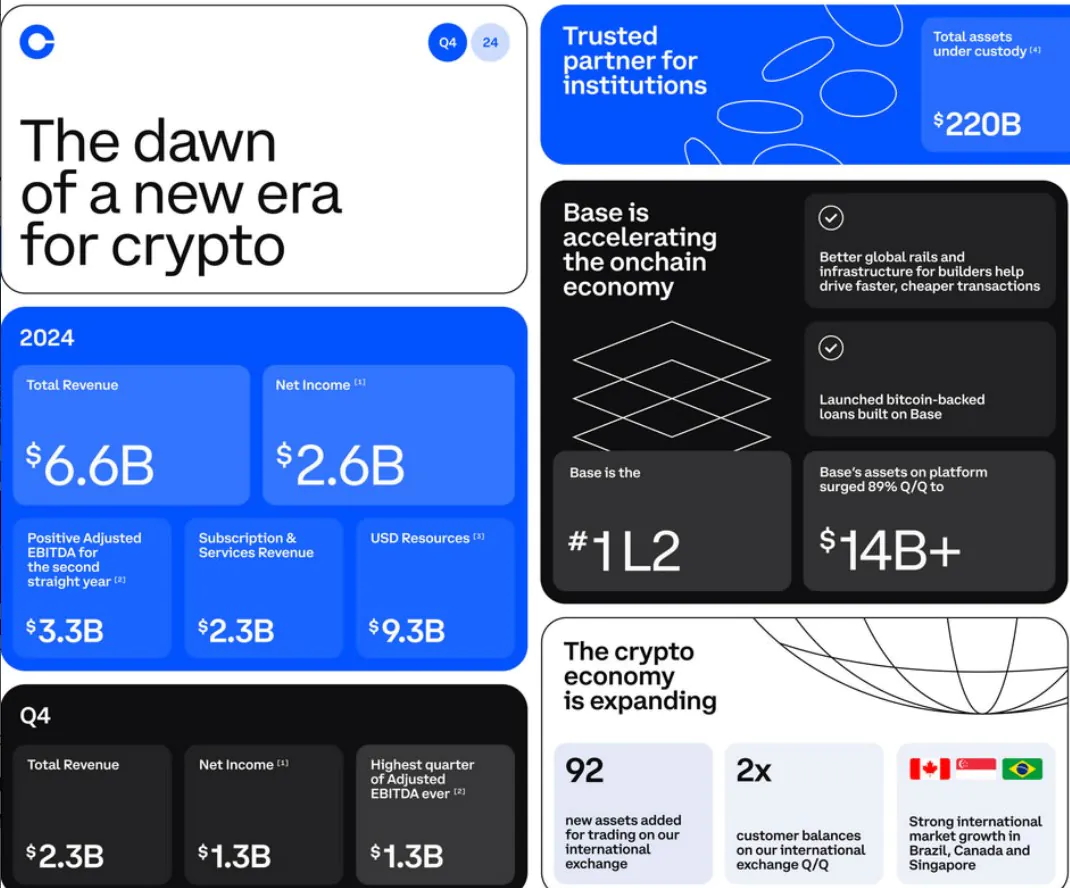

He assured investors that “Coinbase will be the go-to partner for companies looking to enter and build in this space,” as the company reported $2.3 billion in Q4 revenue—an 88% increase from the previous quarter.

Armstrong also emphasized that the U.S., which accounts for approximately 30% of global GDP, is poised to take the lead, citing former President Donald Trump’s swift actions to fulfill his promise of making America the world’s crypto capital.