Coinbase Believes in Bitcoin ETF Approval

Coinbase’s Chief Legal Officer (CLO), Paul Grewal, exudes confidence in the U.S. Securities and Exchange Commission (SEC) finally granting approval for a Bitcoin spot Exchange Traded Fund (ETF). Grewal firmly believes the regulator will fulfill its obligations by approving this highly anticipated investment product.

In a conversation with CNBC, Coinbase’s CLO emphasized the strong belief within the American cryptocurrency exchange that the U.S. regulatory body will grant the applications for the new spot Bitcoin ETF offering. However, Grewal did not specify a timeline for when this approval might be expected or the sequence of events leading to it.

“I’m quite hopeful that these [ETF] applications will be granted, if only because they should be granted under the law,” stated Grewal.

His perspective aligns with that of two Bloomberg ETF analysts who recently raised the odds of SEC approval for a spot Bitcoin ETF to 90%, up from their previous estimate of 75%. This heightened confidence in the regulator’s decision reflects the evolving landscape.

Furthermore, the recent development in the SEC’s lawsuit with Grayscale indicates that a Bitcoin-related ETF may be on the horizon. Following a judge’s ruling that the SEC lacked grounds to reject Grayscale’s proposal to convert its Bitcoin Trust into a physically-backed ETF, there is growing anticipation that the regulator may not contest the decision, as seen in previous cases with Ripple Labs and XRP.

In the Bitcoin ETF race, several major players, including BlackRock, Fidelity, and Invesco, are seeking approval to list this product. Beyond their previous victories, Coinbase’s CLO believes that the reputation and standing of most of the applicants will play a significant role in obtaining approval this time.

“I think that the firms that have stepped forward with robust proposals for these products and services are among some of the biggest blue chips in financial services,” Grewal added.

Bitcoin Lightning Network Developer Resigns Over Security Worries

A significant Bitcoin Lightning Network developer has resigned from his role due to the discovery of a critical security vulnerability in the scaling solution.

On October 20, Antoine Riard, a key developer for the Lightning Network, announced his departure from the project upon identifying a severe vulnerability.

The vulnerability in the Lightning Network pertained to replacement cycling attacks, which could potentially enable malicious actors to siphon funds from users by exploiting inconsistencies within individual mempools.

Riard highlighted that while basic security measures might thwart simple attacks, they would be insufficient to deter advanced attackers. Consequently, he stressed the importance of implementing comprehensive changes at the network’s foundational level to enhance transparency and security.

Riard also indicated his intention to return by October 30 to address another issue on the public mailing list. Furthermore, he revealed that his focus would shift towards core Bitcoin development during this time.

Related: Bitcoin Could Surge 11-Fold with Blackrock’s ETF Approval

Lightning Network Adoption and Statistics

The Lightning Network serves as a ‘layer 2’ payment protocol built on top of Bitcoin, facilitating faster and more cost-effective transactions between nodes to address Bitcoin’s scalability challenges.

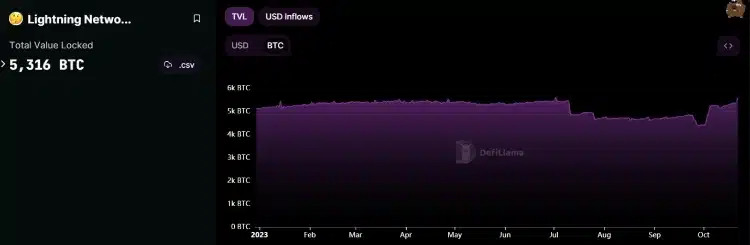

Data from DeFiLlama reveals that the total number of BTC locked within this solution experienced significant growth over the past year, reaching a peak of more than 5,600 BTC in June. As of the present, the total value locked (TVL) has decreased to 5,316 BTC.

A report from River indicates that the Lightning Network processed approximately 6.6 million transactions in August 2023, marking a substantial 1,212% increase from the estimated 503,000 transactions in August 2021.

Prominent cryptocurrency exchanges, including Binance, have adopted the Lightning Network as part of their offerings.

Pro-XRP Lawyer’s Critique

In the midst of these developments, a well-known pro-XRP lawyer named John Deaton criticized the Bitcoin Lightning Network while favorably comparing it to another protocol on the XRP Ledger.

Deaton argued that XRP’s SpendTheBits protocol is a superior alternative to the Lightning Network. However, it’s important to note that his perspective may be influenced by his role as an angel investor and Chief Legal Officer in SpendTheBits.