Two financial giants, Coinbase and Strategy Inc. (formerly MicroStrategy), have reported stellar Q3 2025 earnings while significantly expanding their Bitcoin holdings. The results highlight a deepening wave of institutional Bitcoin accumulation, even as BTC hovers around the $107,000 level.

Key Highlights:

-

Coinbase posts its strongest quarter since 2021:

-

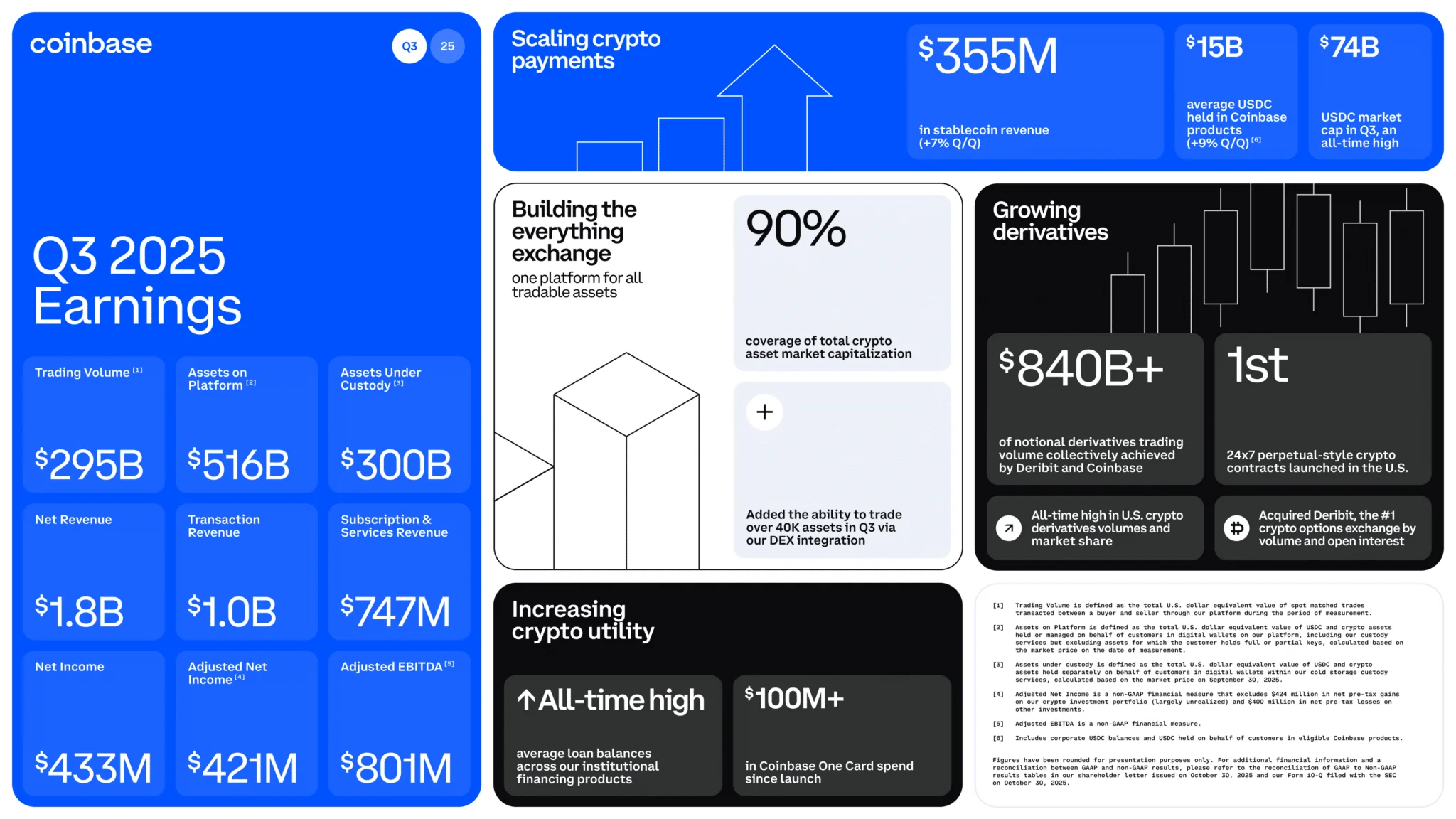

Revenue reached $1.8 billion, with $433 million in net income.

-

Added 2,772 BTC in Q3, bringing total holdings to 14,548 BTC, making it the ninth-largest corporate Bitcoin holder.

-

Stablecoin revenue climbed to $355 million, while derivatives trading volume surpassed $840 billion, positioning Coinbase as the top U.S. exchange for perpetual contracts.

-

Assets under custody now total $300 billion.

-

-

Strategy Inc. remains the Bitcoin leader:

-

Reported $2.8 billion in quarterly profit and $12.9 billion in unrealized Bitcoin gains.

-

Currently holds 640,808 BTC worth approximately $70.9 billion, maintaining its position as the largest corporate Bitcoin holder worldwide.

-

Targets a 30% annual Bitcoin yield by year-end — a bold move emphasizing its view of BTC as a core reserve asset.

-

-

Institutional Bitcoin accumulation intensifies:

Corporations are no longer relying solely on ETFs — they are directly purchasing Bitcoin and expanding crypto-linked revenue streams.

This trend aligns with:-

Stablecoin market capitalization surpassing $160 billion.

-

Record on-chain derivatives volumes.

-

Growing corporate treasury exposure to digital assets.

-

Bitcoin Outlook

Despite a 2% decline in the past 24 hours, bringing BTC to $107,585, on-chain data shows strong accumulation between $106K and $115K.

If institutional inflows from firms like Coinbase and Strategy persist, Bitcoin could reclaim the $110,000 level in November.