The race for supremacy in the global monetary system is becoming more fierce than ever, with the rise of the Chinese yuan, which is currently valued higher than the US dollar. This currency is gradually asserting its position, especially through international and central trading activities in Russia, a sign that it may soon overthrow the dollar.

The predominance of the yuan in Russia

According to information from Reuters, the yuan has surpassed the dollar to become the main currency in transactions in Russia. The latest figures point to a major shift: 42% of foreign exchange transactions in Russia now involve yuan, compared with 35% of dollar transactions.

This advancement is evidence of a strong transformation of the yuan, reflecting Russia’s need to avoid harsh sanctions from the US. Sanctions have isolated Russia from many international financial markets, accelerating a shift toward China’s currency for international trade and investment.

Russia is expected to triple the amount of transactions in yuan, reaching a new record of 385 billion USD by 2023. This is a move to reduce dependence on traditional financial channels, which are currently being blocked. limited sanctions, to maintain and grow the national economy through other means.

Global currency trends

Global currency intervention activities and trends are becoming more exciting. In Asia, countries are trying to maintain their positions under pressure from the US dollar. Countries such as South Korea, Thailand and Poland are closely monitoring fluctuations in their national currencies and do not hesitate to intervene to ensure stability. Meanwhile, Indonesia has decided to sell a large amount of US dollars to strengthen the value of its currency.

Related: Bitcoin Recovers to $65K Amid Market Volatility

The situation becomes even more complicated when the latest economic reports from the US indicate that the inflation rate is higher than expected, which could cause the Federal Reserve (Fed) to delay its plan to reduce interest rates. This helps the dollar continue to maintain its strength, making it difficult for emerging markets to manage their currencies.

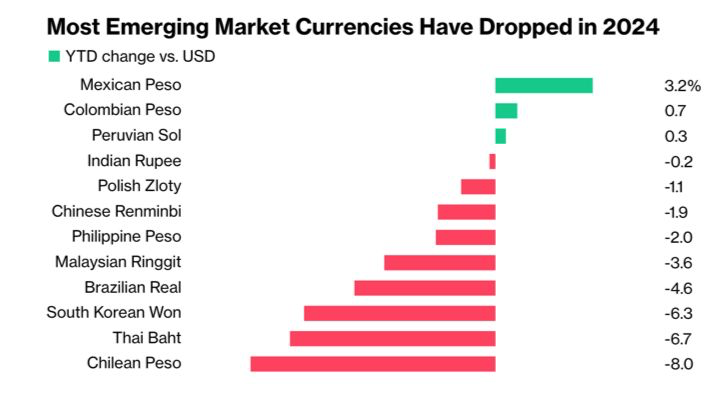

In addition, escalating tensions in the Middle East between Israel and Iran also caused many investors to seek safety in the dollar. This has contributed to the weakening of emerging market currencies in 2024. According to data from Bloomberg on April 12, 2024, currencies such as the Mexican Peso and Colombian Peso have seen a decline compared to dollars, with declines ranging from 0.2% to 8%.

Source: Bloomberg

Marcella Chow, a strategist at JPMorgan, pointed out that central banks have frequently intervened to stabilize their currencies. Ms. Chow shared in an interview with Bloomberg TV that there was a lot of verbal intervention from different central banks. She emphasized that with the Fed’s current policy, Asian currencies will likely continue to struggle and require additional strong intervention measures.

The dynamism in global central bank operations is a direct response to the Fed’s policy of maintaining higher interest rates for longer than expected. This causes market traders to readjust expectations about the possibility of US interest rate cuts, especially in the context of persistent inflation, leaving emerging markets having to navigate through a period of financial uncertainty this is ok.