China’s Unexpected NFT Move and Hong Kong’s $15M Bitcoin Fund

In a surprising development, the Chinese government has taken a significant step by ensuring legal protection for Non-Fungible Tokens (NFTs). This move comes in response to the prevailing ambiguity in judicial opinions regarding cryptocurrency in the country.

In an official legal commentary, the Chinese government addresses the issue of NFT theft and establishes the status of these digital assets as virtual property protected by law. The statement, published on November 9 by China’s state-controlled Southwest University of Political Science and Law (SUPL), emphasizes that NFTs, distinguished by their non-tamperable features, unique codes, and detailed transaction information, align with the characteristics of online virtual property.

Jurists argue that, unlike ordinary online images, digital collectibles like NFTs possess both use value and exchange value, highlighting their scarcity. Referring to Article 127 of the Civil Code, the commentary asserts that online virtual property is considered an object of rights separate from traditional property rights, creditor’s rights, or intellectual property rights, and is thus protected by civil law.

Related: NFT Sales Rebound, Surging in October

Furthermore, the legal experts at SUPL clarify that the theft of NFTs carries criminal penalties. These penalties can be assessed in conjunction with related offenses committed during the theft, such as computer system hacking or data theft. The unique technical characteristics of digital collections, which prevent duplication, grant exclusive control to the holder. Consequently, the theft of digital collections results in the loss of this exclusive control.

Although China has not yet opened a secondary circulation market for NFTs, the commentary emphasizes that consumers can rely on trading platforms for operations such as purchase, collection, transfer, and destruction. This ensures that users achieve exclusive possession, use, and disposal rights, even in the absence of a formal secondary market for NFTs in the country.

Rising Cryptocurrency Disputes in China, Bitget’s $10M Investment in India, and Linekong’s $15M Bitcoin Fund

China has experienced an uptick in civil disputes related to cryptocurrencies this year, with conflicting court rulings on whether virtual assets are protected by law. To further engage with the emerging market, the Chinese government-owned newspaper China Daily recently announced a grant of 2.813 million Chinese yuan ($390,000) for third-party contractors to design a Non-Fungible Token (NFT) platform. In response to concerns over “pseudo-innovations” in the NFT market, Chinese prosecutors declared a crackdown in May.

Bitget, a cryptocurrency exchange, is set to invest $10 million over five years in Indian startups. According to a November 7 announcement, startups will have the opportunity to pitch their projects to Bitget and prominent venture capitalists, including Sequoia Capital, Lightspeed Ventures, and Draper Labs, during the BUIDL for Web3 multichain summit in India. Bitget aims to identify and support valuable projects in the crypto space, accelerating innovation in emerging technologies.

To qualify for investment, projects must have a minimum viable product and incorporate multiple layers of security functionalities with auditing transparency. Gracy Chen, Bitget’s managing director, considers India the prime destination for investment in Asia due to its continuous advancements in blockchain and entrepreneurial spirit. Bitget has previously invested in Indian Web3 startups such as Grease Pencil, HAIr, and Derma360.

Linekong Interactive, a Chinese tech firm listed on The Stock Exchange of Hong Kong (HKEX), is launching a $15 million fund dedicated to revitalizing the Bitcoin (BTC) ecosystem. Founder Wang Feng named the fund “BTC Next” and outlined its focus on accelerating novel projects in asset issuance, exchanges, virtual machines, Non-Fungible Tokens (NFTs), and GameFi protocols on the Bitcoin blockchain.

Wang emphasizes BTC Next’s early participation in the research and investment of Bitcoin network ecological assets, regular publication of crypto investment portfolios, and updates on the list of Bitcoin ecological crypto assets involved in the fund’s investments.

Bitcoin’s Ecosystem Expansion, Linekong’s Innovations, and SEBA Bank’s Hong Kong License Approval

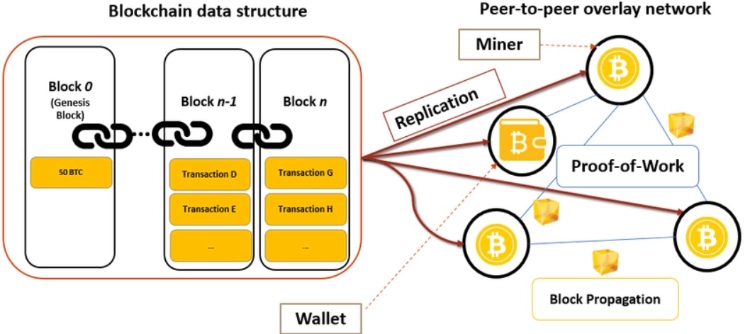

The Bitcoin ecosystem has witnessed significant growth this year, fueled by the introduction of Ordinals and Inscriptions, innovative data storage methods enabling the minting of unique digital assets on the Bitcoin blockchain. The market cap of Bitcoin tokens following the BRC-20 standard, modeled after Ethereum’s ERC-20 standard, has surpassed $1.4 billion since its inception.

Linekong, originally established in Beijing in 2007 with a primary focus on video games and cinema, has undergone a transformative journey. In 2018, Wang Feng stepped down as CEO to concentrate on blockchain initiatives, founding projects in non-fungible tokens (NFTs), decentralized finance (DeFi), and Bitcoin mining.

Returning as CEO in 2022, Wang aims to integrate Linekong’s products more effectively with Web3, aligning with the evolving landscape of blockchain technology.

In a notable development in the fintech sector, SEBA Bank, a Swiss financial technology company, has secured approval from Hong Kong’s Securities and Futures Commission (SFC). This license empowers SEBA Bank to engage in regulated activities in Hong Kong, including the distribution of virtual asset-backed securities, advisory services on crypto assets, and management of crypto investment accounts for clients.

Additionally, SEBA Bank is authorized to distribute, manage, and advise on traditional securities like stocks. SEBA Bank CEO Franz Bergmueller highlights Hong Kong’s significance in the crypto economy and expresses gratitude for adding the Hong Kong license to the existing ones in Switzerland (FINMA) and Abu Dhabi (FSRA). Amy Yu, the Asia-Pacific CEO, commends the SFC for creating a “facilitative” environment during the licensing process.

SEBA Bank has been actively expanding its services, launching institutional Ethereum staking services in September and securing $119 million in a Series C funding round in early 2022. This strategic positioning aligns with the evolving landscape of digital finance and blockchain technology.