Whale accumulation signals a bullish phase ahead

On-chain data shows that three newly created wallets collectively withdrew over 825,000 LINK, worth approximately $15 million, from Binance. This move often indicates that large holders are transferring assets off exchanges for long-term storage, anticipating higher valuations ahead.

Historically, large-scale withdrawals by whales have marked accumulation phases rather than distribution periods.

At the same time, network engagement on LINK is climbing — a pattern that often precedes major rallies. Still, traders remain cautious as LINK continues to move within a mid-term consolidation range, awaiting a confirmed breakout.

Next target: Could LINK test $20 soon?

After bouncing strongly from the $16.5 support zone, LINK is now approaching resistance at $20.02. A decisive breakout above this level could propel prices toward $23.72 and $27.89, signaling a full-fledged recovery after several weeks of lower highs.

Notably, recent daily candles show growing buy-side strength gradually overpowering selling pressure. However, a rejection near $20 could prolong consolidation before LINK attempts its next breakout.

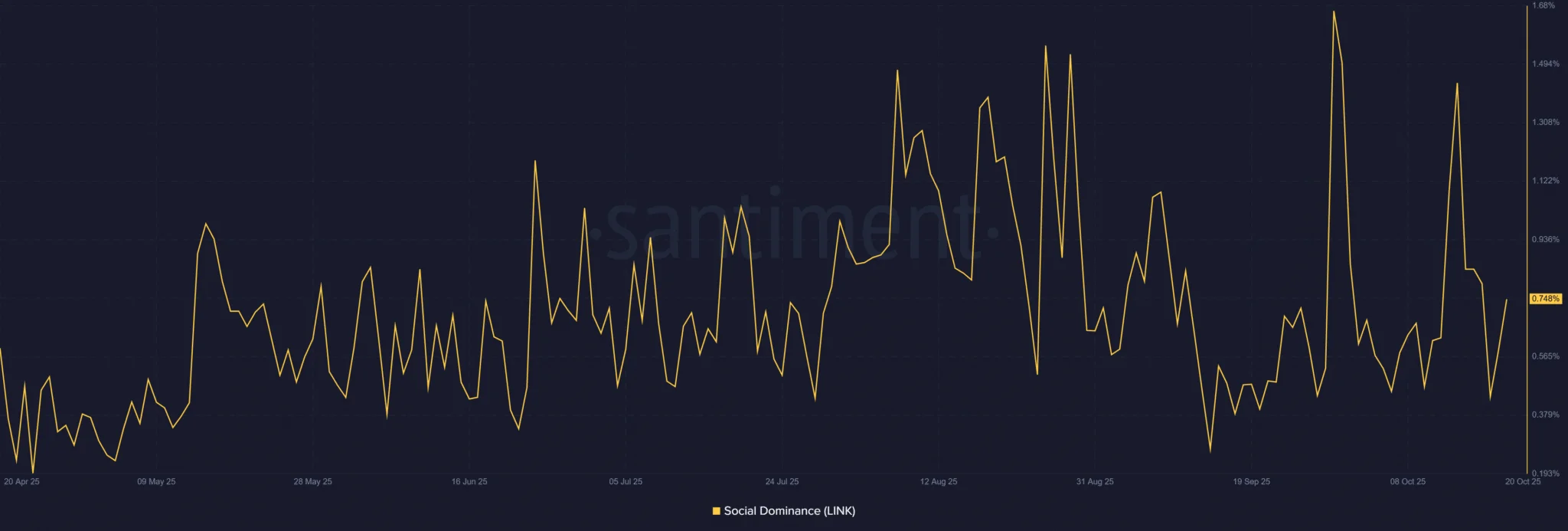

Social sentiment makes a steady comeback

Data from Santiment shows LINK’s social dominance has climbed to 0.74%, reflecting a revival in community interest after a quiet period.

This gradual rise suggests a healthy resurgence of confidence among both retail and institutional investors — not just short-lived hype.

Historically, increased attention during accumulation phases has strengthened bullish setups, as higher awareness and engagement drive liquidity inflows.

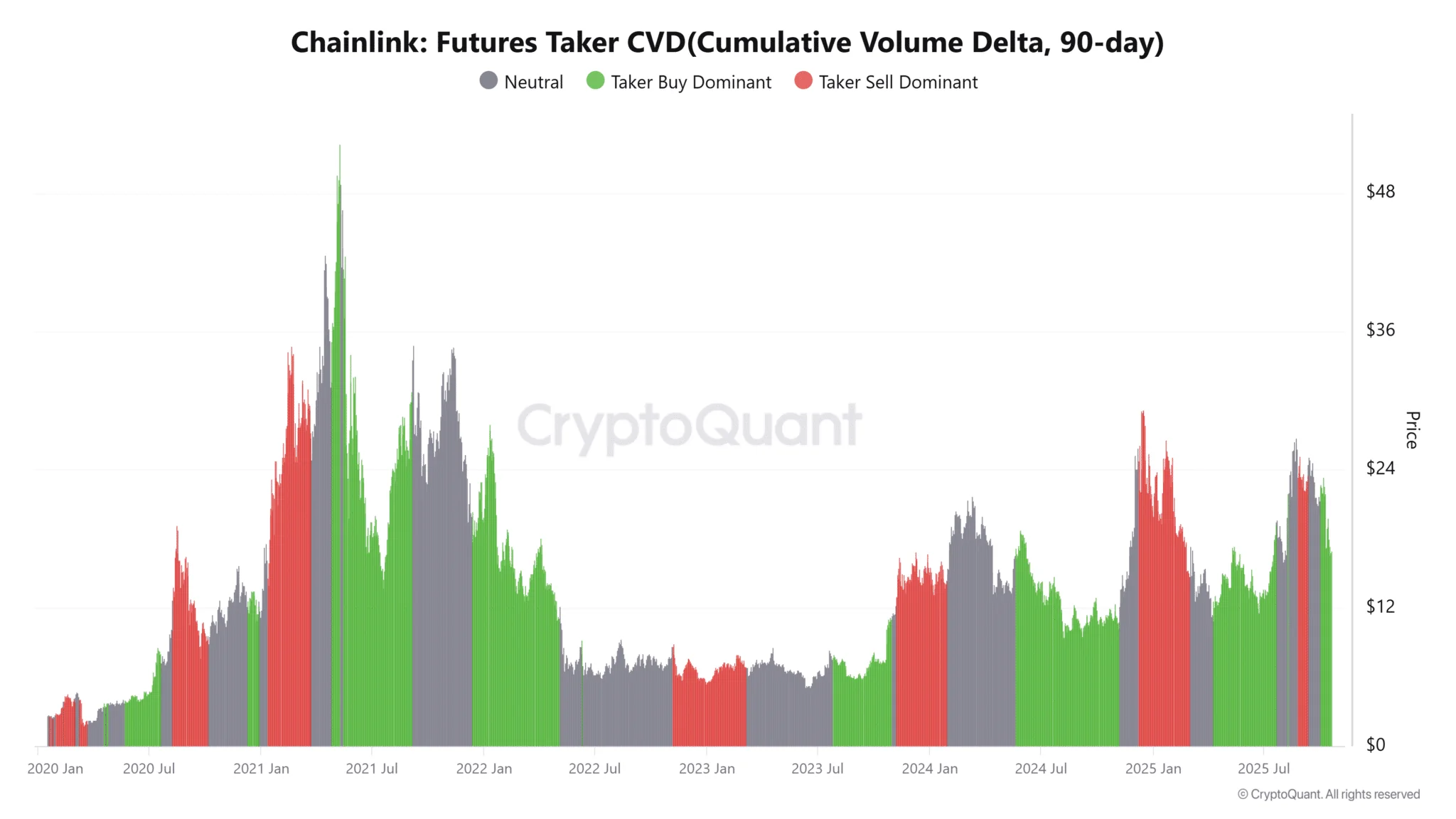

Futures data confirms buy-side control

The 90-day Cumulative Volume Delta (CVD) reveals a clear taker buy dominance in the futures market, meaning market participants are placing more long positions than shorts.

At the same time, Open Interest is climbing again, confirming that capital is flowing back into LINK after weeks of decline.

This alignment between spot accumulation, derivatives activity, and renewed sentiment forms a strong foundation for LINK’s mid-term bullish outlook.

Can LINK break above $27?

Whale accumulation, improving sentiment, and buy-side dominance in derivatives are collectively shaping a powerful bullish setup for Chainlink.

The convergence of these factors suggests that LINK’s upside momentum is no longer speculative — it’s now structurally supported by real market dynamics.

If this trend continues, LINK could soon break above the $27 barrier, signaling the start of a new upward phase in its market cycle.