In the rankings of the top 100 cryptocurrencies by market capitalization, LINK climbed into the leading group thanks to this sharp rally. This marks the first time since February 1, 2025, that LINK has broken above the $24 level, hitting a multi-month high fueled by the spike in TVS.

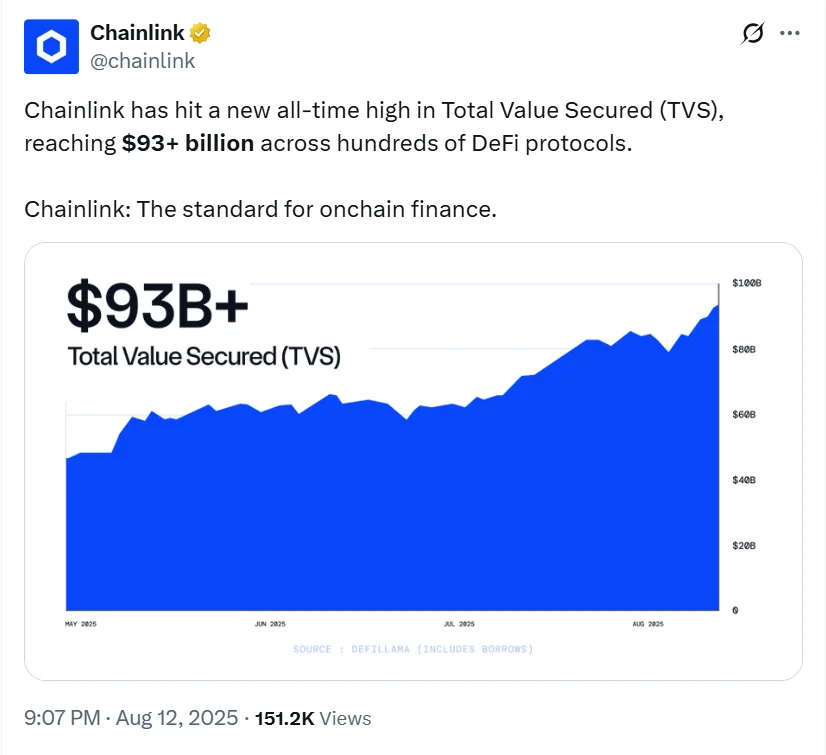

According to an update on X, Chainlink’s oracle network has now secured over $93 billion worth of assets. TVS represents the total value of all assets protected by the blockchain, spread across hundreds of decentralized finance (DeFi) protocols, including canonical bridges, externally bridged assets, and native tokens.

Data from Token Relations shows that Chainlink’s TVS has jumped 90% year-to-date, with more than $93.5 billion worth of assets currently deposited or borrowed through smart contract applications secured by Chainlink.

Network Growth and Long-Term Strategy

LINK’s rally comes alongside a series of key network developments. In addition to its Chainlink Data Streams service, the platform has recently launched Chainlink Reserve—a strategic upgrade aimed at building an on-chain reserve for LINK to support long-term growth and sustainability.

According to the latest announcement, this reserve will be funded by off-chain revenue generated from major enterprises adopting the Chainlink standard, as well as on-chain service revenue used to purchase additional LINK. As of August 7, 2025, the reserve had already accumulated over $1 million.

Another major highlight this week is the partnership between Chainlink and Intercontinental Exchange (ICE)—the parent company of the New York Stock Exchange—to deliver real-time, on-chain pricing data for foreign exchange and precious metals.

Previously, LINK traded near $30 in December 2024 and reached its all-time high of $52.88 in May 2021.