In the world of decentralized finance, crypto treasuries—reserves of tokens and cash—are increasingly becoming strategic tools to generate sustainable demand and strengthen financial resilience for blockchain protocols. Rather than acting as passive stores of value, modern treasuries are being designed to actively support tokenomics, stabilize markets, and fuel long-term growth.

Common approaches include:

- Converting revenue into native tokens and conducting buybacks to create ongoing demand.

- Reallocating assets into yield-bearing instruments to preserve capital and support token buybacks.

- Combining token and cash reserves, ensuring flexibility for both operational needs and market stability.

The Race to Build Strategic Treasuries

A new wave is sweeping across the crypto sector: instead of simply hoarding assets, blockchain projects and corporate-backed ventures are actively deploying treasuries to stimulate token demand.

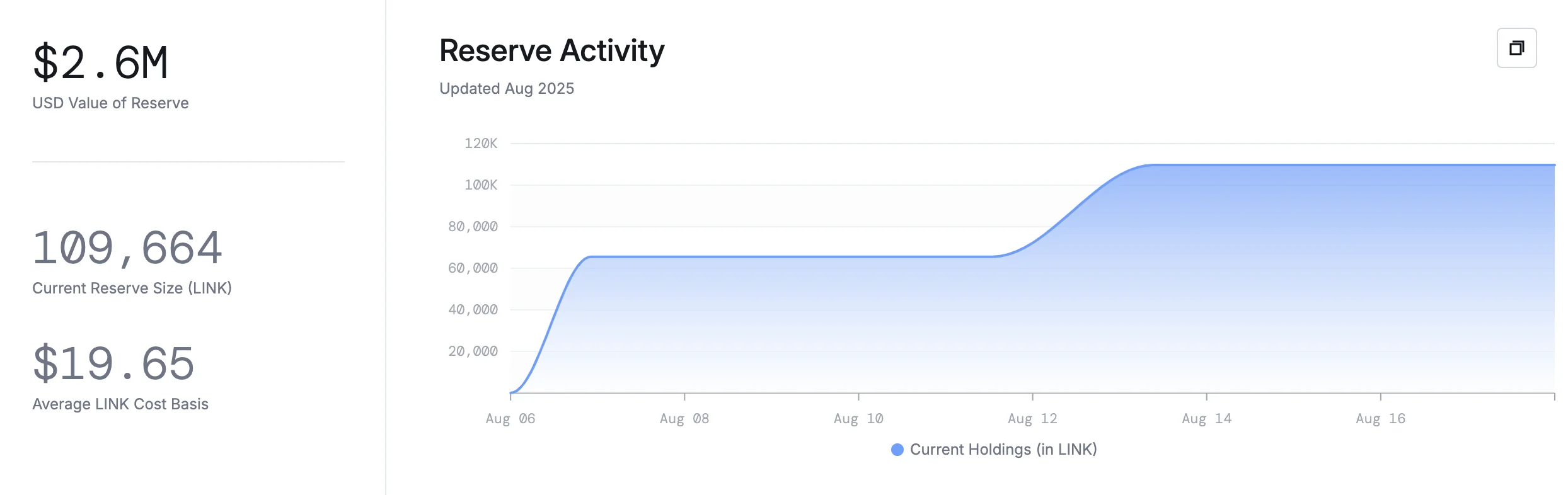

On August 7, Chainlink announced the launch of its onchain reserve, designed to accumulate LINK from both onchain service fees and offchain enterprise revenue. The system automatically converts all payments—whether stablecoins, gas tokens, or fiat—into LINK before depositing them into a dedicated smart contract.

According to Etherscan, the reserve has already recorded 109,661.68 LINK (worth about $2.6 million) after just two deposits. Chainlink Labs stated that its enterprise revenue amounts to hundreds of millions of dollars and confirmed there are no plans to withdraw LINK for several years, effectively building a long-term accumulation pool.

Other Models: Cardano & WLFI

Chainlink isn’t alone in this pursuit—other protocols are experimenting with different approaches:

Cardano: Founder Charles Hoskinson has proposed reallocating 5%–10% of the ADA treasury (around $100 million) into Bitcoin and stablecoins. The yield would then fund annual ADA buybacks estimated at $5–10 million, creating a perpetual demand loop. However, such reallocation could trigger short-term selling pressure during asset transfers.

World Liberty Financial (WLFI): The project plans to raise $1.5 billion by selling 200 million ALT5 Sigma shares at $7.50 each. Half of the proceeds will be held in WLFI tokens, while the rest will be kept as cash reserves. This corporate-style treasury launches at scale, combining immediate token and cash holdings to maximize both market impact and operational flexibility.

A New Era of Crypto Treasuries

Clearly, building treasuries is no longer about passively storing value—it has become a strategic weapon in the race among blockchain protocols. From Chainlink’s onchain accumulation model, to Cardano’s yield-driven reallocation plan, to WLFI’s large-scale corporate-style reserve, the trend is undeniable: crypto treasuries are evolving into key pillars for sustaining token value and driving long-term demand.