Changpeng Zhao’s Perspective

Drawing from his experiences and observations during the past three halvings, he has provided profound insights challenging some common misconceptions.

While many may anticipate an immediate surge in price following a halving event, CZ’s perspective diverges from this viewpoint. He asserts that Bitcoin’s price doesn’t magically double overnight after the halving. Instead, the actual price action, according to his experience, tends to unfold over the following year. It’s during this phase that Bitcoin tends to reach all-time highs.

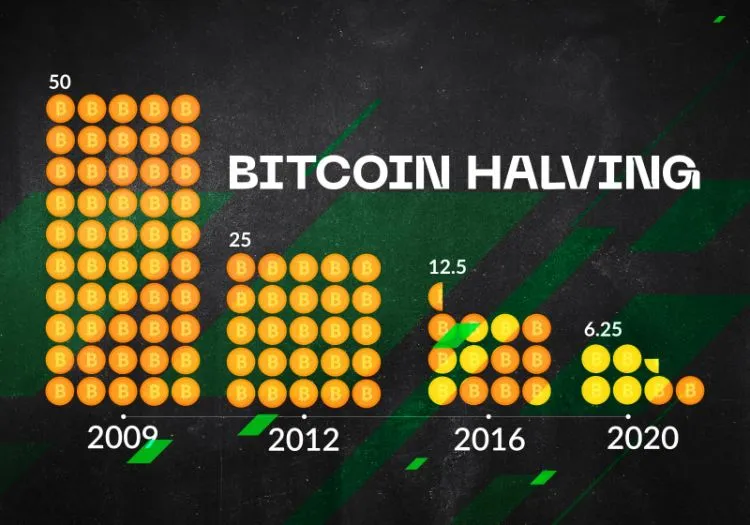

This viewpoint aligns with historical data. Halving events, inherent to Bitcoin’s design, occur roughly every four years. Throughout history, these events have been associated with significant price increases for Bitcoin, albeit not immediately. Price surges are a gradual process, influenced by the diminishing influx of new Bitcoin into the market and the increasing demand.

For market observers and cryptocurrency enthusiasts, CZ’s observations serve as a valuable reminder. Bitcoin’s journey, especially after halving, is not about instant gratification but about understanding its fundamental principles and the broader market dynamics.

With the next halving event approaching, the cryptocurrency community will keenly watch whether history repeats itself and whether Bitcoin indeed aims for new all-time highs, as CZ predicts.

Next Week for Bitcoin and Cryptocurrencies: Watch U.S. CPI and Other Macros

The recent surge in crude oil prices following the Israel-Hamas conflict has exerted liquidity pressure on Bitcoin and the cryptocurrency market. After a strong start in October 2023, the first week remains quite volatile for Bitcoin and the overall crypto market. Bitcoin has exhibited relatively stable price action, trading around $28,000, while altcoins have faced some selling pressure.

Developments in traditional financial markets have dampened the crypto market’s recovery momentum, with the 10-year Treasury bond yields reaching their highest level in 16 years.

Key Macroeconomic Developments for Bitcoin Investors

This week, a series of critical macroeconomic data will be released. The United States will announce Consumer Price Index (CPI) and Producer Price Index (PPI) data for September, and the Federal Reserve will release minutes from its September meeting. Additionally, several Fed officials are expected to deliver speeches.

Investors will closely scrutinize the Fed’s comments in the coming weeks as the U.S. central bank prepares for another interest rate hike in 2023. Consequently, investors are treading cautiously, and there is no clear trajectory in sight.

Bloomberg’s senior commodities strategist, Mike McGlone, suggests that Bitcoin is exhibiting a “risk-off” trend following the recent escalation between Hamas and Israel. He believes that the 100-week moving average is likely to gain an upper hand over the upward-trending 50-week moving average. McGlone also notes that the soaring crude oil prices are contributing to liquidity pressures in the market.

Positive On-Chain Developments for Bitcoin

Over the past weekend, Bitcoin witnessed one of the largest outflows of capital in over a month. Online data provider Santiment explained that Bitcoin experienced its largest movement of funds, totaling more than 10,000 BTC, leaving exchanges since September 7th.

Meanwhile, the leading cryptocurrency, with the highest market capitalization, is making a second attempt to breach the $28,000 price level. Utility importance is emphasized, especially as the number of unique addresses has reached a six-week low.

Alongside Bitcoin, the altcoin market has faced selling pressure, with Ethereum (ETH), Solana (SOL), Cardano (ADA), and others adjusting by 3-5% over the past week.

The cryptocurrency market has entered the final quarter with a historical upward trend. Traders are also optimistic about the upcoming price action. However, the current price trend presents a contrasting picture as Bitcoin continues to struggle around the $28,000 mark. While the overall trend remains upward, market experts believe a notable pullback could potentially hinder the recovery process.

In such market conditions, here are the top three reasons suggesting that Star Crypto may have entered a period of price increase:

Bitcoin Breaks the Monthly Downtrend:

Historical price trends show that BTC has risen above the monthly downtrend line early in 2023. The price has been on a strong upward trajectory, marking new highs, albeit with some minor pullbacks. Therefore, Bitcoin’s price may revisit levels near or below $20,000 before triggering a significant upward rally towards nearly $100,000.

Bitcoin Approaches the Pre-Halving Phase:

The halving event is considered one of the most crucial factors driving substantial price increases. As seen in the chart above, the price has experienced significant rallies following a consolidation period after the halving event. However, the price seems to be entering the pre-halving phase, which may involve testing lower support levels as seen in the past.

>>> Bitcoin Represents a ‘Super logical’ Advancement in Technology

Bitcoin is Set for a Strong Recovery:

Bitcoin has largely followed a cyclical trend since its inception. After each price surge, a notable market correction typically occurs, marked by a red candle on the chart. Furthermore, the bullish camp regains dominance, followed by a recovery phase and a substantial price increase. Following the price surge in 2021, Bitcoin faced significant price depreciation in 2022. Now, as the price approaches the recovery trigger, a strong recovery phase may follow, paving the way for the next significant price increase in the years ahead.

Conclusion

In the long term, Bitcoin is undoubtedly poised to return to an upward trend, as it has demonstrated throughout its history. The potential for Bitcoin is substantial, especially when considering that the total market capitalization of the entire crypto market is only around a trillion dollars, representing a very small portion compared to other global financial markets.