Celsius transferred 125 million USD ETH to the exchange

According to data from Arkham, the cryptocurrency lending company Celsius, which recently filed for bankruptcy, has transferred 125 million USD worth of Ethereum (ETH) to Coinbase and FalconX exchanges, indicating a likely intention to sell in the market.

Looks like Celsius took the opportunity to unload >$125M of ETH over ETF Week.

In the past week, they’ve deposited $95.5M to Coinbase and sent $29.73M to FalconX.

They still have $1.4 billion (540K ETH) remaining.https://t.co/jp1PJbN46r pic.twitter.com/xgfX6yU5Ye

— Arkham (@ArkhamIntel) January 13, 2024

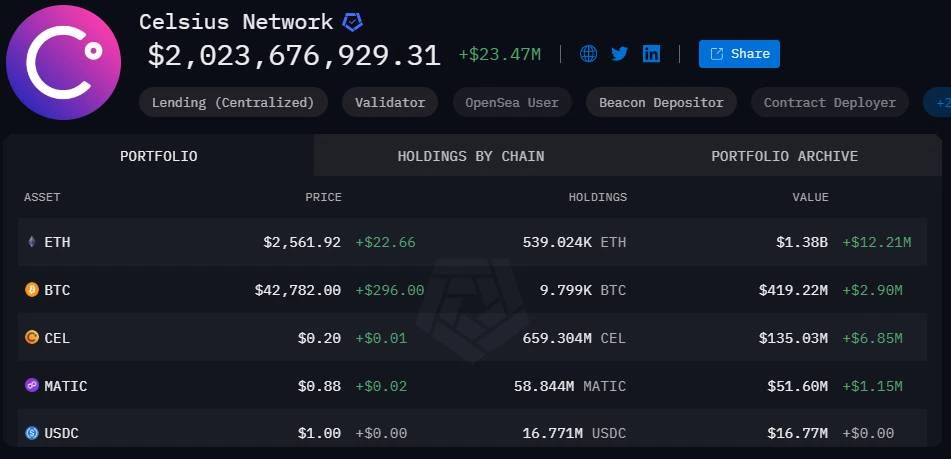

Arkham further reports that Celsius’ wallets still hold over 539,000 ETH (valued at approximately 1.4 billion USD), nearly 9,800 BTC (419.2 million USD), and various other altcoins such as MATIC,…

Assets still held by Celsius. Source: Arkham (January 14, 2024).

This is the second series of Ethereum sales by Celsius recorded in recent months. As reported by azc.news, in December 2023, the company sold up to $243 million worth of ETH along with some other altcoins.

At the beginning of January 2024, Celsius announced its intention to start unstaking Ethereum to prepare for asset liquidation and repay debts to customers. Blockchain data indicates that the company has been staking nearly $800 million worth of Ethereum.

Related: Celsius Announces Discontinuation of ETH Staking Activities

ETH experienced significant growth last week, driven by investor expectations that, following the approval of Bitcoin spot ETFs, Ethereum would be the next asset to have its own ETF. Several major Wall Street players have submitted applications to the SEC to launch Ethereum spot ETFs, with the decision expected to be made between May and August this year.

BlackRock CEO Larry Fink, representing one of the entities seeking to establish an Ethereum spot ETF, has stated that this product will bring tangible value to the market.

Proposed Ethereum spot ETFs are currently awaiting approval from the SEC. Source: Bloomberg (November 30, 2023).

However, SEC Chairman Gary Gensler has issued a statement indicating that the decision to approve the Bitcoin spot ETF by the commission applies only to Bitcoin and implies the SEC’s stance that many cryptocurrencies are still classified as securities.