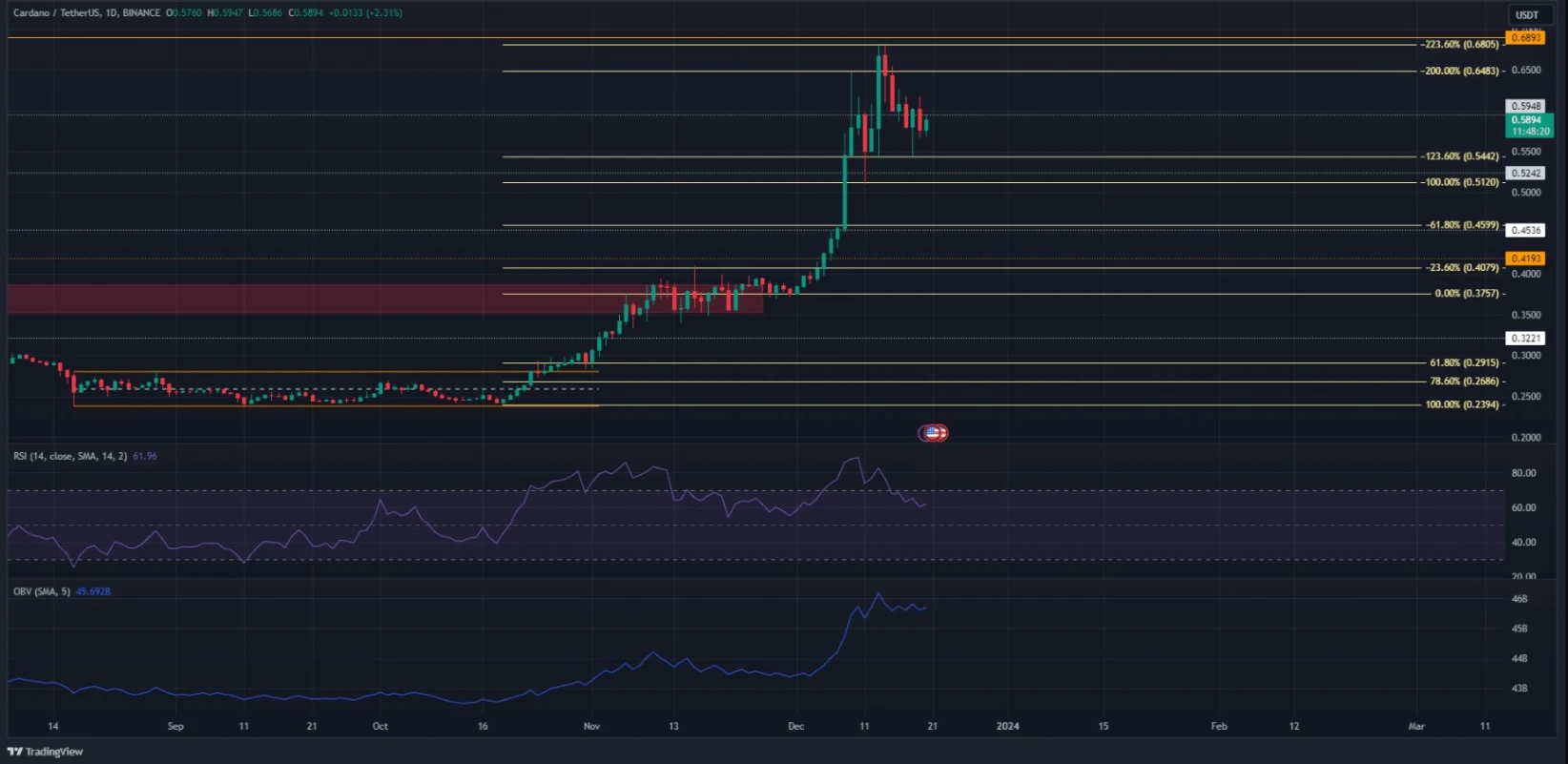

As the price of Cardano (ADA) approaches a crucial support zone, recent developments indicate both challenges and potential opportunities for the cryptocurrency. Notably, ADA experienced a peak at $0.68 on December 14th but faced a subsequent decline. Although the higher timeframe market structure maintained a bullish stance, the failure to defend the key support level at $0.6 in recent days has raised concerns.

In the recent week, Cardano witnessed a surge in development activity, with a notable increase in contributors. This surge in development not only reflects the project’s ongoing vitality but also signals to long-term investors that ADA remains a promising asset for investment.

Significance of the 23.6% Extension and Beyond

Examining ADA’s historical price movements, the 23.6% extension level has played a pivotal role. Initially reaching this level on November 16th, ADA encountered rejection before breaching it on December 5th, resulting in substantial gains. Notably, the 123.6% and 223.6% extension levels have also served as significant markers on the upward trajectory.

The 123.6% extension level demonstrated its importance on December 11th when it successfully acted as support, with a daily trading session avoiding closure beneath it. Similarly, the 223.6% level rejected buyers on December 14th, highlighting its significance in shaping ADA’s recent price dynamics.

Intriguingly, the $0.595 level, a noteworthy point in August 2022, has emerged as a crucial marker on the 4-hour and lower timeframes. Its significance is underscored by the price’s reaction to it, solidifying its status as a level warranting close observation.

For Cardano to shift its one-day market structure bearishly, a drop below $0.512 would be imperative. Meanwhile, despite a recent dip in the On-Balance Volume (OBV), there remains potential for an upward trend in the coming days.

With the RSI registering a decline to 61, signaling robust but slightly weakened bullish momentum compared to recent days, the market dynamics for Cardano (ADA) present a nuanced picture.

Potential Liquidity Pool Sweep to the North

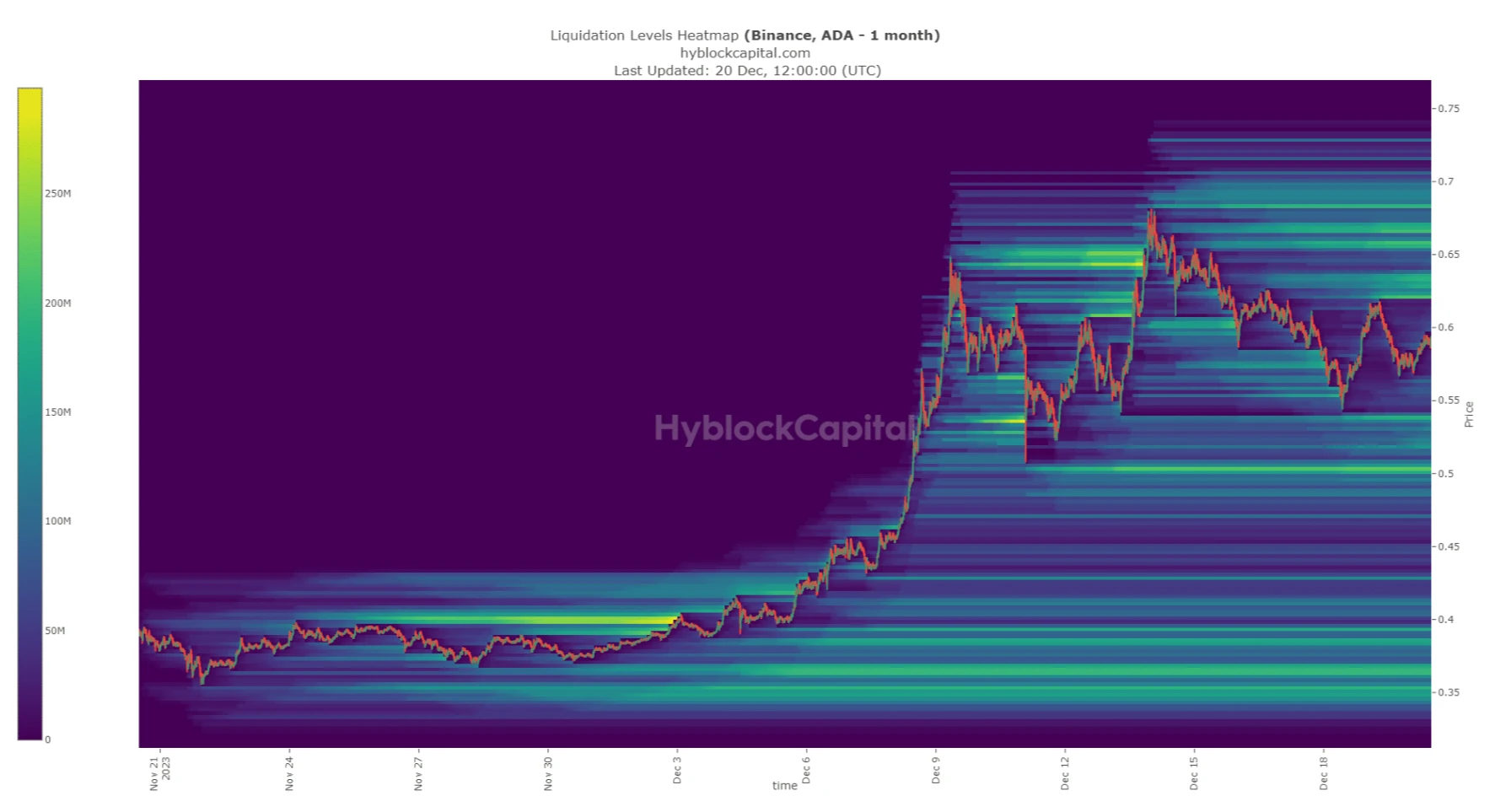

AZC News conducted an analysis of the liquidation levels heatmap, pinpointing the $0.54 level as a compelling candidate for a bullish reversal. However, the trajectory beyond this point remained uncertain, introducing an element of ambiguity into ADA’s immediate future.

Notably, the $0.62-$0.64 range emerged as a significant cluster of estimated liquidation levels, potentially influencing price movements. This observation suggested the possibility of ADA prices experiencing an upward shift to $0.64 before a subsequent downward movement. Looking even further, the $0.65-$0.67 zone loomed as an additional area where market forces could be tested.

Related: Cardano Founder Firmly Rejects XRP Partnerships

The failure of the bulls to uphold the technically crucial $0.595 level heightened the likelihood of a forthcoming dip to $0.54. This unfolding scenario added to the complexity of ADA’s current market dynamics, as the cryptocurrency navigated key support and resistance levels.

In essence, the nuanced interplay of technical indicators, liquidation levels, and pivotal price zones underscores the intricacies of Cardano’s current trajectory. As the market grapples with the evolving landscape, investors must remain attentive to the potential shifts and developments that could shape ADA’s short-term movements.