The strategy was led by Mark Casey, a portfolio manager with 25 years at the firm. According to The Wall Street Journal, Casey—deeply influenced by the investment philosophy of Benjamin Graham and Warren Buffett—has become one of the strongest advocates of Bitcoin within traditional finance. Speaking on a podcast with Andreessen Horowitz, he said: “I love Bitcoin. I think it’s one of the coolest things humanity has ever created.”

Over the past four years, Capital Group has expanded its exposure mainly through holdings in public companies that accumulate Bitcoin as part of their corporate treasury strategy.

MicroStrategy Bet Pays Off Big

The standout move was Capital Group’s investment in MicroStrategy (recently rebranded as Strategy), the software company that founder Michael Saylor transformed into the world’s largest corporate Bitcoin holder.

In 2021, Capital Group acquired a 12.3% stake in MicroStrategy for more than $500 million. Although its ownership has since been diluted to 7.89% due to share issuance and partial trimming, the stake is now valued at roughly $6.2 billion, thanks to MicroStrategy’s stock soaring more than 2,200% over the past five years.

Beyond Strategy, Capital Group also holds a 5% stake in Japan’s Metaplanet—a hotel operator turned Bitcoin adopter—along with shares in U.S. mining giant MARA Holdings.

Public Firms Hit 1M BTC Milestone as Buying Slows

According to the latest Bitcoin Treasuries Adoption Report, public companies’ Bitcoin holdings surpassed the 1 million BTC threshold in August. However, accumulation slowed sharply compared to July: just 47,718 BTC (worth $5.2 billion) were added, less than half of July’s 100,000+ BTC.

In total, public companies, ETFs, private firms, and governments now collectively hold 3.68 million BTC, valued at about $400 billion at the end of the month. The 1.2% monthly increase marked a steep slowdown from July’s 4.6%.

This cooling of corporate purchases partly explains why Bitcoin’s rally to an all-time high near $123,000 in mid-August quickly reversed. By the end of the month, prices had fallen more than 11.5%, dipping below $109,000.

Interestingly, despite a wave of fundraising announcements totaling more than $15 billion—from firms like Strategy, KindlyMD, and Metaplanet—those funds have yet to translate into immediate Bitcoin acquisitions, widening the gap between market hype and actual buying.

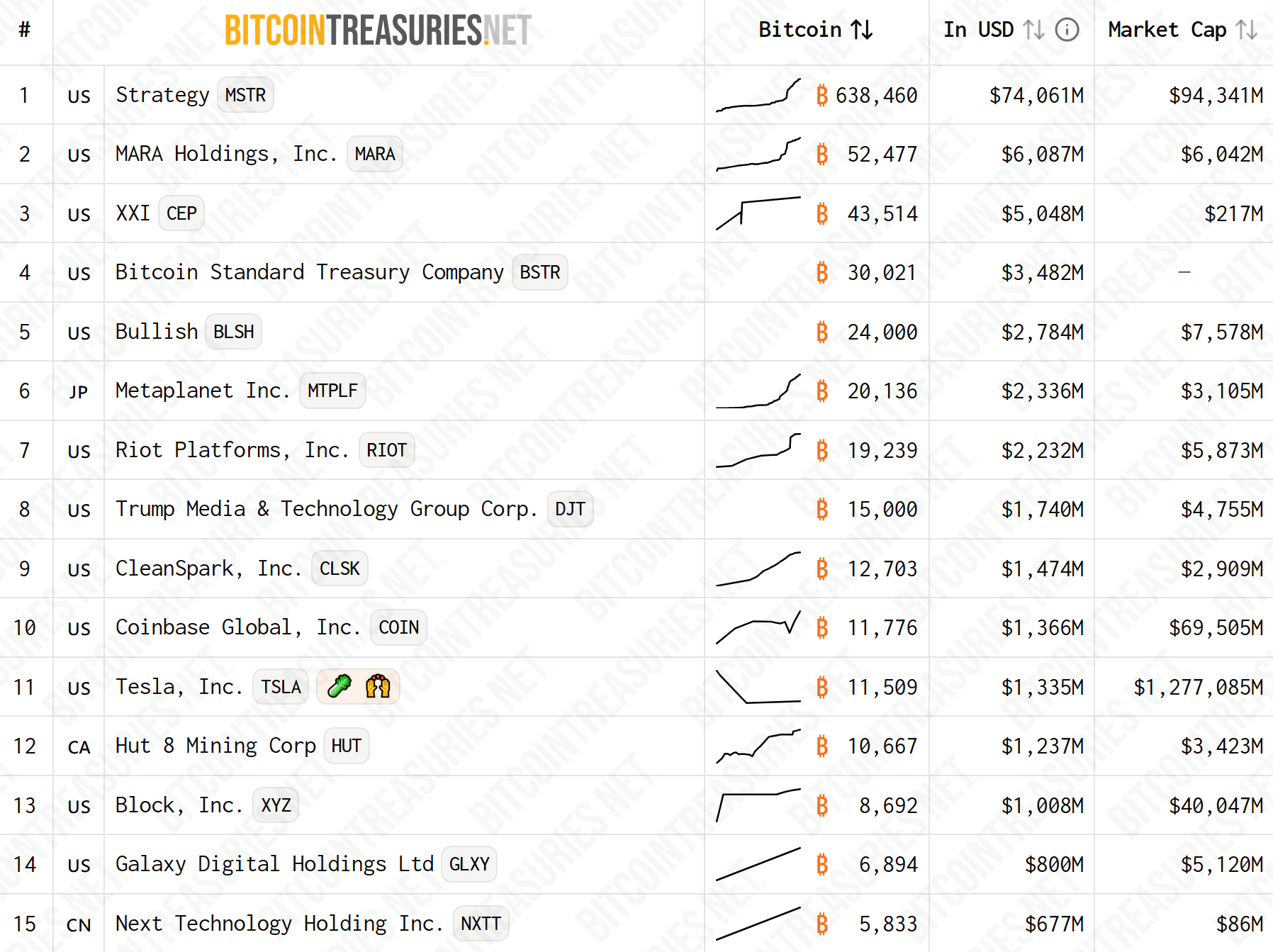

For now, Strategy remains the largest corporate holder with 636,505 BTC, followed by MARA Holdings with over 52,000 BTC. New entrants such as XXI and Bitcoin Standard Treasury are quickly climbing the ranks, while Metaplanet, Bullish, and Coinbase round out the top 10.