Canary Capital has filed for approval of a Solana-based exchange-traded fund (ETF), as many firms ramp up efforts to see if they can get approval from U.S. regulators.

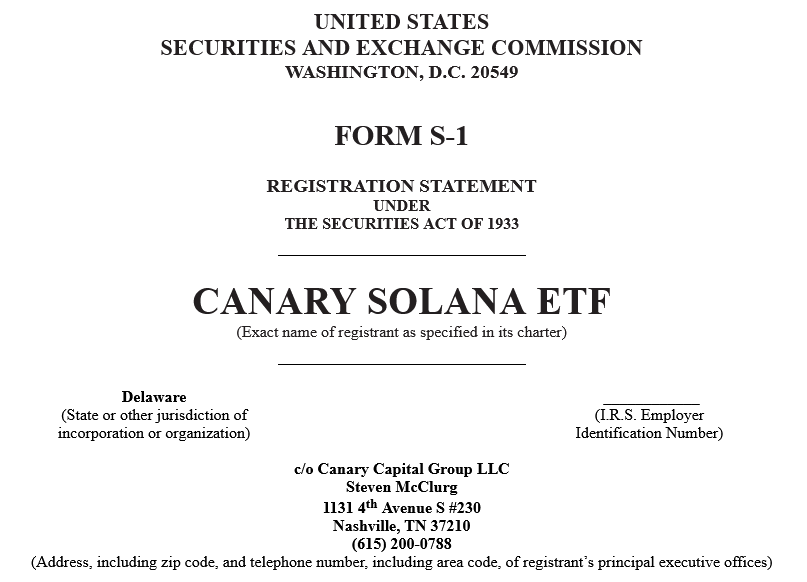

The crypto investment firm filed an S-1 for the Canary Solana ETF on Wednesday. The fund aims to “provide access to the value of Solana (‘SOL’) held by the Fund,” according to the filing. However, no custodian or administrator has been appointed.

“With a robust DeFi ecosystem, Solana has maintained strong and stable on-chain metrics, including daily transactions, active addresses, and new addresses, while ensuring low fees for all users,” the company said in a statement.

Steven McClurg is the founder of Canary Capital and previously founded Valkyrie Funds, which owns other spot cryptocurrency ETFs. Canary Capital has also filed for spot Litecoin and XRP ETFs.

Read more: Robinhood’s Q3 Revenue Surges by 165%

Similarly, fund manager VanEck filed for a Solana spot ETF in June. Matthew Sigel, head of digital asset research at VanEck, asserted in a post on X that SOL is a commodity because it “behaves similarly” to bitcoin and ether. However, the SEC last year determined SOL to be a security when it filed charges against cryptocurrency exchange Binance.

The U.S. Securities and Exchange Commission (SEC) approved 11 spot bitcoin ETFs earlier this year and soon after approved eight more Ethereum ETFs.