Investors are apprehensive about increasing their SOL holdings due to venture capitalists inflating the supply by continually minting new tokens. When SOL reached its peak, the circulating supply was 301 million. However, three years later, an additional 161 million tokens have been introduced.

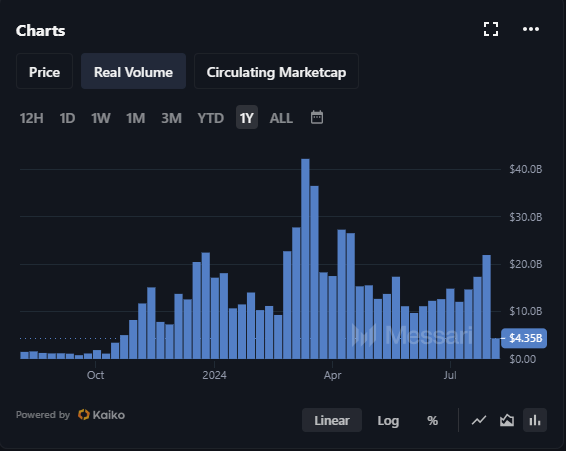

As of August 2023, another 60 million SOL have been added, resulting in an annual inflation rate of 15%. With trading volumes hitting a five-year low according to Messari’s data, Solana is at risk of collapsing, as previous research has indicated.

Moreover, market analyst Duo Nine highlighted on X, formerly Twitter, that Solana suffered a net loss of $2.53 billion over the past four quarters, according to data from Bankless. This massive financial setback has wiped out the company’s revenue, plunging it into significant debt.

This financial strain underscores the unsustainable nature of Solana’s current economic model. Duo Nine believes that SOL may never break its all-time high due to its high inflation rate.

Subsequent investments have become increasingly risky as mounting losses and inflationary pressures could jeopardize Solana’s long-term viability and market performance.

The price of SOL reflects a pessimistic sentiment following the global M2 money supply reaching an all-time high. The global M2 money supply has hit a record high, infusing liquidity into the economy, as depicted by TradingView charts. This increased liquidity typically boosts cryptocurrency prices as the value of money decreases.

Despite this trend, Solana (SOL) has not reached new record highs like Bitcoin (BTC). This disparity suggests that SOL is likely to decline significantly in the market. While BTC thrives on the additional money supply, SOL’s inability to rise similarly indicates potential issues or market conditions that may restrict its growth compared to other cryptocurrencies.

Comparing the all-time charts of BTC and SOL provides objective insights, indicating that Solana may peak in this cycle while many remain unaware. Bitcoin has reached new record highs, but Solana has failed to surpass its previous peak, as illustrated by the comparative chart on Walletinvestor.com.

This discrepancy highlights the challenges Solana faces, even as the overall market trends upwards. In practical terms, this is SOL’s market capitalization compared to BTC.

Bitcoin’s rise emphasizes its dominance, whereas Solana’s failure to reach new heights suggests potential issues or lower demand. Investors should pay close attention to these charts, as Solana’s performance indicates it may not achieve the same success as Bitcoin in the current cycle.

I need to have wallet USD account number

it’s very nice azc