OKX, headquartered in Singapore, announced on Monday the official launch of X Layer, an Ethereum-based layer 2 network, to the public mainnet. X Layer, developed from Polygon’s Polygon CDK, stands out for its ability to provide fast transactions and lower costs compared to Ethereum. This is also one of the first initiatives to apply Polygon’s AggLayer technology, which helps different blockchains connect smoothly as one, thereby enhancing liquidity and allowing seamless currency flow between networks.

OKX Chief Marketing Officer Haider Rafique shared: “We are working to build a seamless, highly interoperable ecosystem, and X Layer is the key to unlocking the possibilities endlessly from our strong [OKX] community.”

With over 50 million global users, OKX is not only one of the leading cryptocurrency exchanges in terms of trading volume but also a testament to the industry’s rapid growth. In just one recent day, OKX recorded $4.9 billion worth of cryptocurrency transactions, surpassing Coinbase, the leading US cryptocurrency exchange, by $4 billion according to CoinGecko.

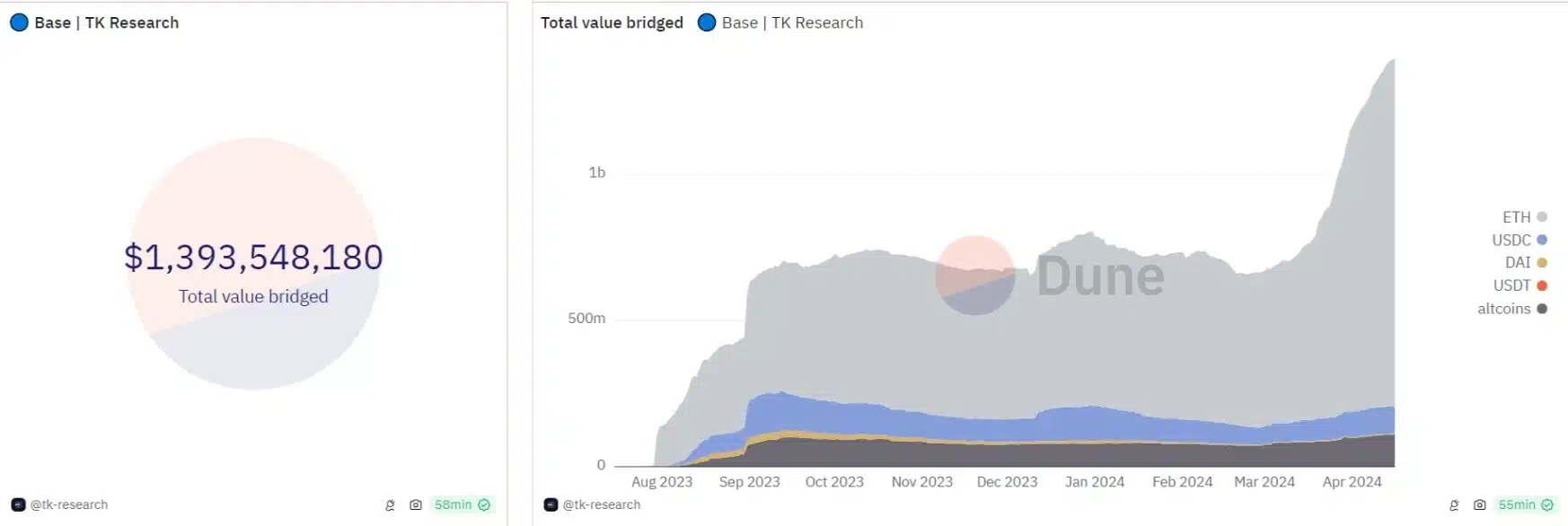

This model is similar to the Polygon technology implementation at OKX, which Coinbase has also adopted in the development of their layer 2 network, Base, based on Optimism’s OP Stack. Since launching last July, Coinbase’s Base has attracted about 8 million users and processed a total of 154 million transactions, according to data from Dune Analytics.

Related: OKX Announces Listing of Venom (VENOM)

Layer 2 networks not only provide lower-cost transactions, but also make interacting with decentralized applications (dapps) more convenient because usage fees are significantly reduced. X Layer, OKX’s new initiative, has opened the doors for users with access to 170 dapps and this number is expected to grow rapidly, according to a statement from OKX.

Currently, prominent dapps deployed on X Layer include the QuickSwap decentralized exchange, the Galxe community development platform, and the Thirdweb infrastructure platform. What sets X Layer apart from other base layers is its integration of zero-knowledge (ZK) proof technologies, which allow proving a claim without revealing the content of that claim. This reflects Polygon’s updated platform and its aim towards greater interoperability between chains.

“X Layer marks a giant step forward in the industry’s goal to build a truly unified Web3,” said Marc Boiron, CEO of Polygon, in a statement. X Layer’s connection to AggLayer has solved the problem of fragmentation in liquidity and user experience between different chains.”