Bitcoin continues to fluctuate around the $105,000 mark, with several positive signals emerging. One of the most notable highlights comes from the aggressive actions of major investors (whales), led by Aguila Trades — the top trader among Bybit’s 500 leading traders.

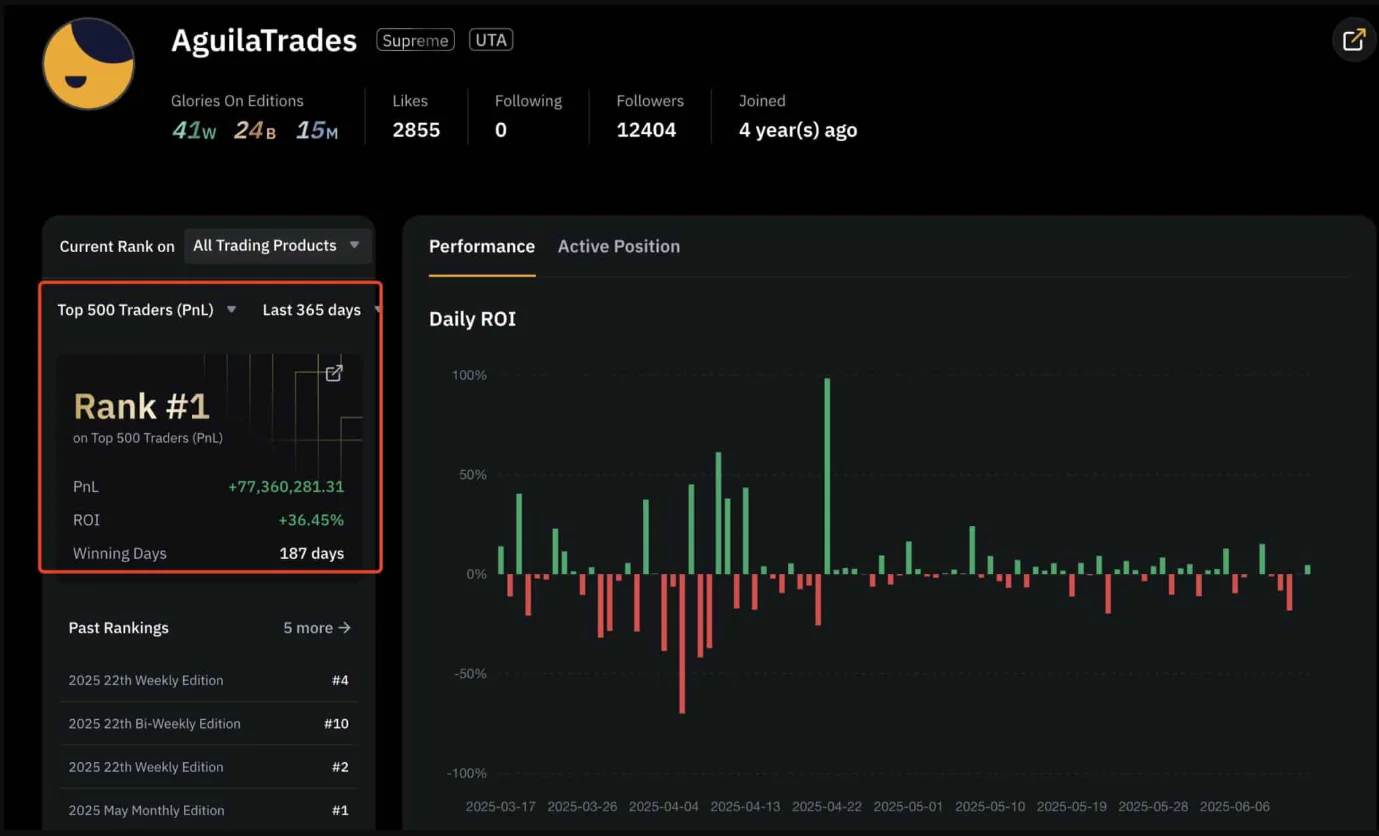

With a stellar track record of $77.36 million in 365-day profits, a 36.45% ROI, and 187 successful trades, Aguila has demonstrated his mastery in the volatile crypto market. However, following a $12.47 million loss in a previous Bitcoin purchase, his latest strategy is even riskier. Aguila has opened a highly leveraged long position on Bitcoin, valued at $200 million (equivalent to 1,894 BTC) with 20x leverage — a bold move amid continued market uncertainty.

ROI charts show that while his strategy has yielded impressive short-term gains during successful trades, it also comes with steep drawdowns, particularly in early April. His decision to liquidate positions after achieving 100% ROI in April, along with more cautious recent trades, suggests that Aguila is carefully balancing risk and reward.

With high leverage back in play, a breakout above current resistance levels could yield substantial profits. However, failure to break through could result in significant losses.

According to liquidation maps, the $103,800–$104,000 range is highly sensitive, with roughly $700 million in long orders pending. A pullback to this range could trigger a liquidation cascade, jeopardizing Aguila’s position. Conversely, the $106,500–$107,000 zone holds nearly $1 billion in short orders. Should Bitcoin surpass this level, a “short squeeze” could fuel further upside momentum, favoring highly leveraged long positions like Aguila’s.

Nonetheless, analysts remain cautious about Bitcoin’s weekend prospects. The cryptocurrency likely needs to stay above $104,000 to maintain its bullish trajectory. Successfully holding above $106,000 could pave the way for another strong rally. Otherwise, a sharp correction might occur before any renewed push toward fresh highs.

From a valuation perspective, the MVRV indicator currently estimates Bitcoin’s fair value at $105,767, slightly above the +0.5 sigma level of $102,044. If Bitcoin fails to hold this level, a pullback toward the mean at around $82,570 is possible. However, breaking above $102,000 and sustaining momentum could validate Aguila’s aggressive strategy, with potential targets extending to the +1.0 sigma level at $121,519.

At present, the MVRV bands have opened a “decision window” where Bitcoin’s next move will determine the outcome: either confirming Aguila’s bold gamble or forcing him into a painful reset.