The exchange, which suffered a major hack resulting in the loss of ETH-based tokens, has now regained a significant portion of its holdings. Mirana Ventures, closely tied to Bybit’s co-founders, played a pivotal role in replenishing these assets by acquiring and transferring Ethereum.

Bybit Hack Update: $600M ETH Restored to Mitigate Losses

In the wake of a $1.5 billion crypto heist, Bybit has secured $600 million in ETH deposits from Mirana Ventures, helping to stabilize its financial standing. This capital injection aims to offset the losses and restore confidence in the exchange’s operations.

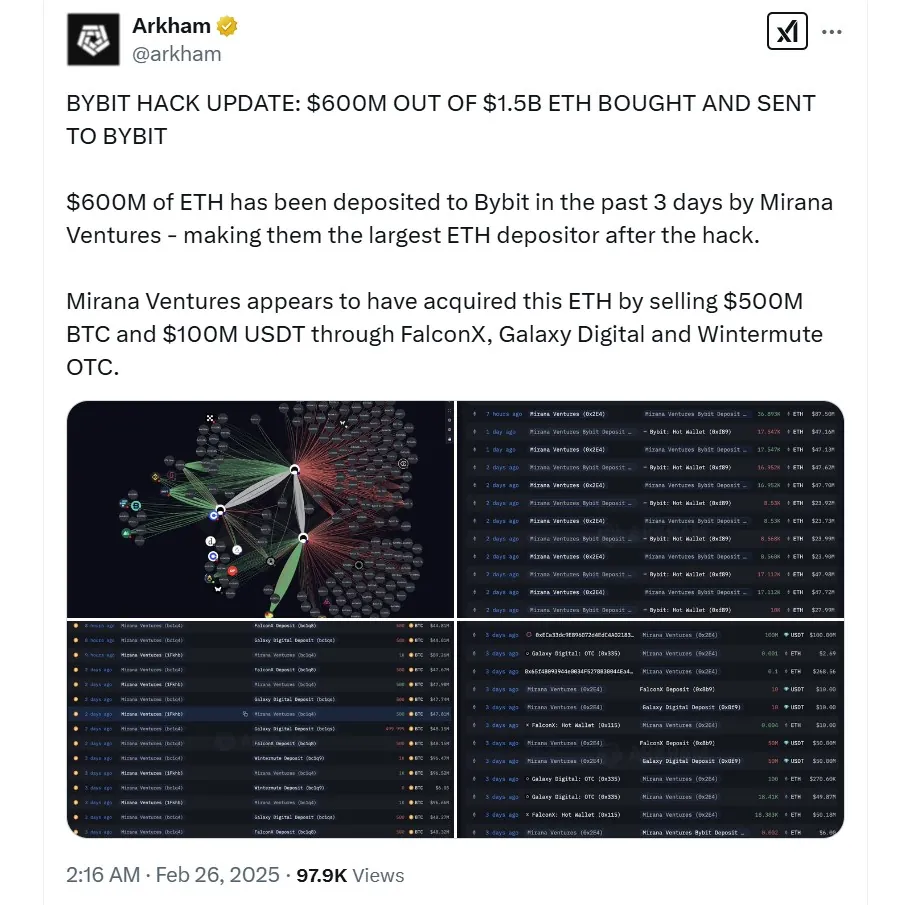

According to Arkham Intelligence, Mirana Ventures sourced the Ethereum by liquidating $500 million in Bitcoin (BTC) and $100 million in Tether (USDT). These transactions were executed through leading over-the-counter (OTC) trading platforms, including FalconX, Galaxy Digital, and Wintermute. The strategic liquidation provided the liquidity necessary to shore up Bybit’s reserves without causing major market disruptions.

To safeguard customer assets and maintain withdrawal capabilities, Bybit had previously secured a bridge loan. However, with the fresh ETH deposits from Mirana Ventures, withdrawal demand has eased, signaling improved liquidity conditions for the exchange.

Mirana Ventures Leads ETH Recovery Effort Post-Hack

Mirana Ventures played a critical role in replenishing Bybit’s depleted ETH reserves. Backed by Bybit’s co-founders, the firm facilitated the acquisition and transfer of Ethereum over three days, making it the largest ETH depositor since the attack.

To amass the required funds, Mirana Ventures sold off substantial BTC and USDT holdings through multiple OTC trading firms. This careful maneuver ensured a smooth asset transfer without triggering market volatility.

While Bybit has yet to fully recover from the staggering $1.5 billion loss, the substantial ETH injection has reinforced its financial stability. The move not only strengthens Bybit’s position but also underscores Mirana Ventures’ commitment to supporting the exchange during one of its most challenging crises.