In a recent announcement on January 26, Bybit disclosed its plan to launch JUP, Jupiter’s native token, on both its spot and derivatives platforms on January 31. This move signifies a significant stride in the execution of Jupiter’s decentralized governance model.

Recognized for commanding 65% of the volume on Solana’s decentralized exchanges, Jupiter has gained acclaim for its efficient execution and minimal slippage across various decentralized exchanges (DEXs). The inclusion of JUP into Bybit’s platform is poised to capture the attention of investors navigating the diverse landscape of cryptocurrency assets, particularly within the Solana ecosystem.

Prior to the listing, Bybit diligently conducted due diligence on Jupiter. CEO Ben Zhou emphasized Jupiter’s pivotal role in managing Solana DEX volume, expressing confidence that the addition of JUP will unlock new opportunities for Bybit users in the decentralized finance (DeFi) sector.

Trading for JUP on Bybit is scheduled to commence at 3 PM UTC on January 31, with withdrawal functionalities available from 10 AM UTC the following day. Initially, JUP will be accessible on the spot market, with perpetual contracts becoming available an hour later.

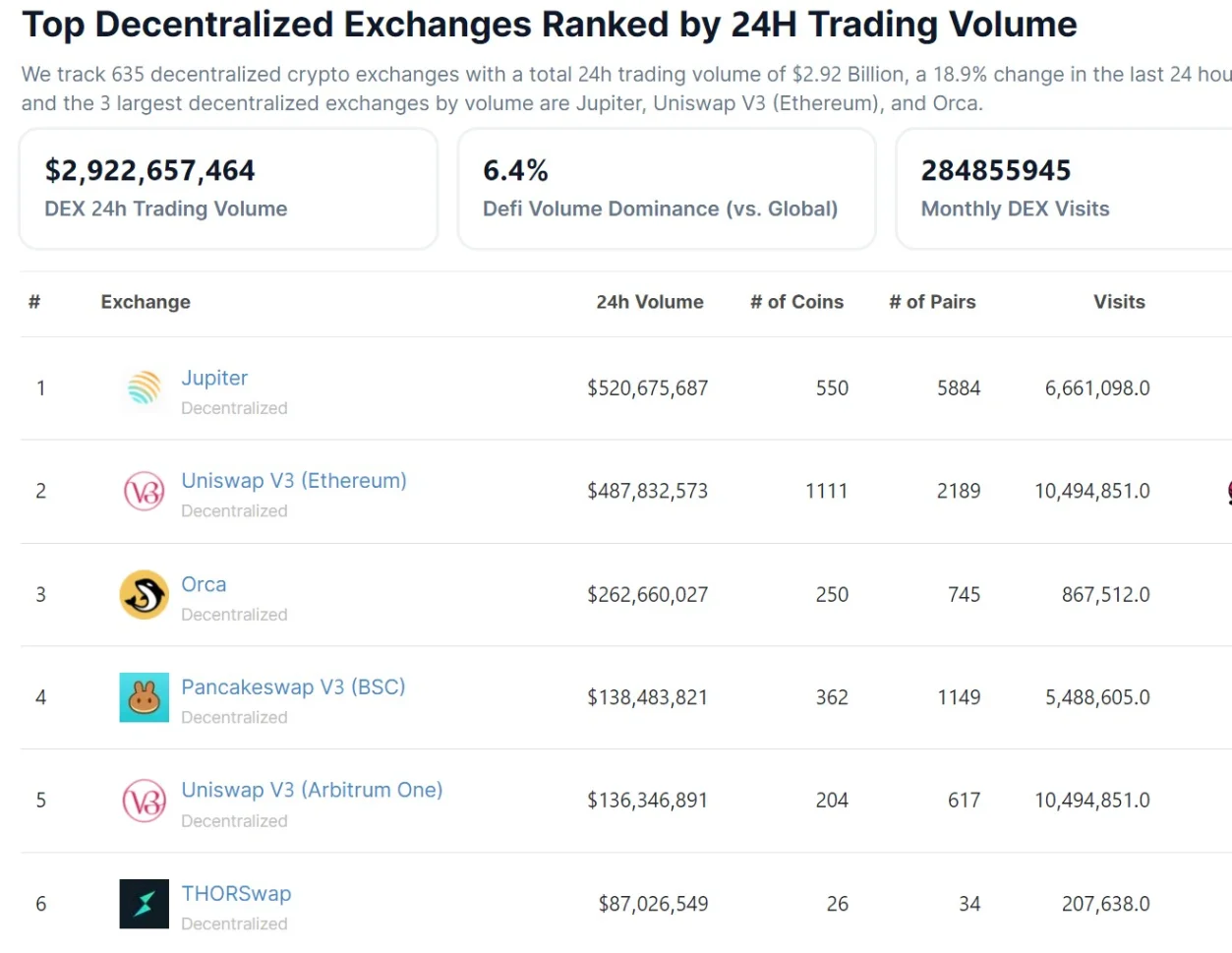

Amidst this surge in activity, Jupiter’s decentralized exchange witnessed an impressive spike in trading volumes, soaring to $520 million within the last 24 hours. This surge is primarily fueled by the buzz surrounding a new memecoin airdrop and an uptick in stablecoin swaps on the platform.

What’s noteworthy is that Jupiter’s trading volume has outpaced that of Ethereum-based Uniswap’s V2 and V3 protocols, according to recent data from CoinGecko.

Approximately $50 million of Jupiter’s trading activity is attributed to transactions involving “Wen,” a memecoin specifically available to Solana users with prior interactions with Jupiter and owners of the Solana Saga phone. This memecoin, conceived as an experimental venture by Jupiter’s developers, precedes the highly anticipated airdrop of the exchange’s native token, JUP, scheduled for release on January 31.

Related: DEX Jupiter (JUP) Begins Distributing Airdrops to Users

Notably, the lion’s share of Jupiter’s recent trading volume originates from the conversion of Solana (SOL) to Circle’s USD Coin (USDC) and Tether (USDT), accounting for $191 million of the total volume within the day.

As per data from Aevo, a decentralized exchange, the pre-market trading value of JUP tokens hovers around $0.65. Anticipation builds further with the impending airdrop of 1 billion JUP tokens, potentially pushing the total estimated value at current prices beyond $600 million.