Blockchain analytics firm Lookonchain has revealed that crypto exchange Bybit purchased approximately $742 million worth of Ether (ETH) between February 22 and 23 using two wallet addresses.

Bybit appears to have acquired nearly 266,700 ETH just days after suffering a $1.4 billion hack, allegedly carried out by the North Korean state-backed hacker group Lazarus, according to Lookonchain.

One wallet address linked to Bybit, “0x2E45…1b77”, reportedly bought 157,660 ETH (worth $437.8 million) from major crypto investment firms Galaxy Digital, FalconX, and Wintermute through over-the-counter (OTC) transactions, Lookonchain stated in a February 23 post on X.

Additionally, another $304 million ETH purchase was made using the wallet address “0xd7CF…A995”, through both centralized and decentralized exchanges. Lookonchain, citing data from Arkham Intelligence, suggested this transaction is also likely connected to Bybit. Arkham’s data further indicates that the address “0xd7CF…A995” has interacted with Binance and MEXC hot wallets.

Several transfers were made to these wallets to accumulate the reported amounts, with the first transaction from “0x2E45…1b77” occurring on February 22 at 4:44 PM UTC.

Bybit’s Efforts to Recover from Historic $1.4B Hack

Bybit’s large Ether purchases come in the wake of the $1.4 billion hack, the largest crypto theft in history, which accounted for over 60% of all stolen crypto funds in 2024.

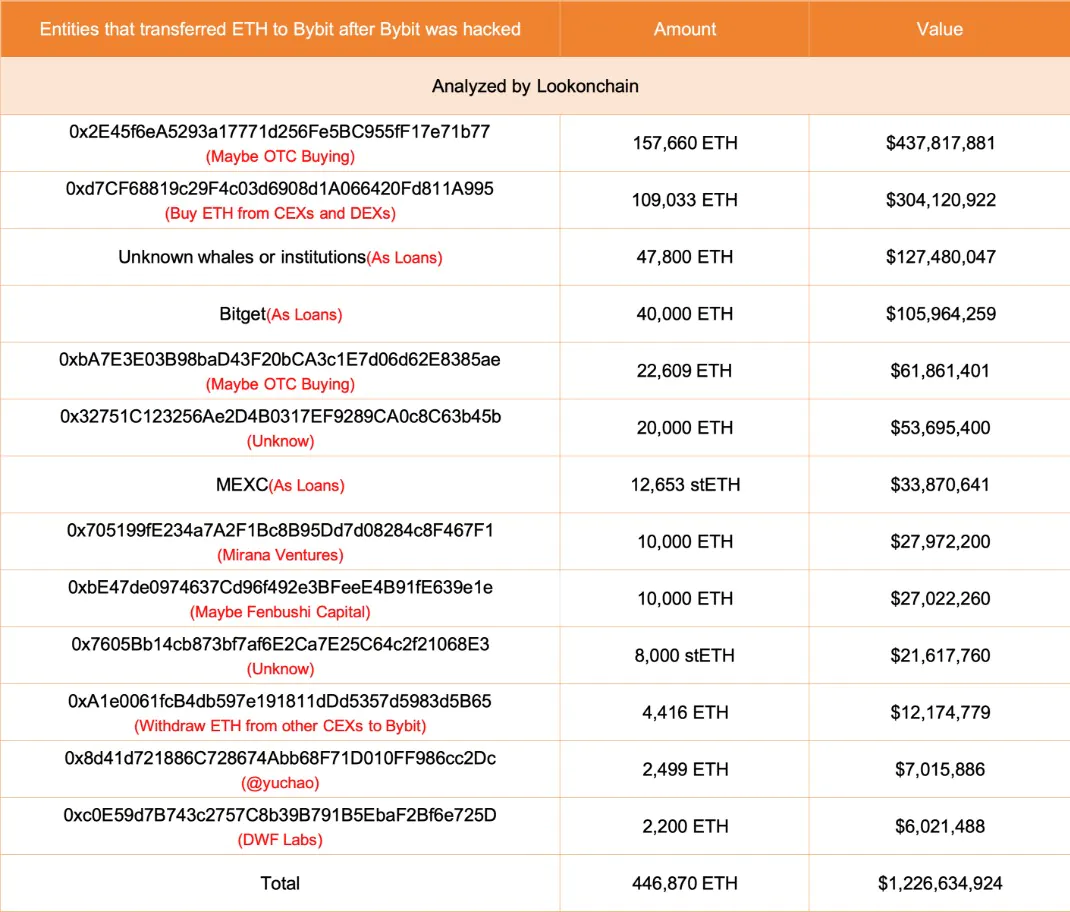

In a separate post, Lookonchain estimated that Bybit has now accumulated 446,870 ETH (worth approximately $1.23 billion) from a combination of loans, whale deposits, and direct purchases—covering nearly 88% of the stolen funds.

Meanwhile, Bybit’s customer withdrawals surged to $5.3 billion on February 22. Despite the massive outflows, proof-of-reserve auditor Hacken confirmed that Bybit’s reserves still exceed its liabilities, ensuring user funds remain fully backed.

Following the hack, Ether’s price plunged over 7% within seven hours, dropping from $2,831 to $2,629. However, it has since rebounded to $2,765, according to CoinGecko data.