Over the past 24 hours, SOL rebounded from the lower boundary of the pennant, indicating increased buying pressure at this support level.

This crucial support could act as a springboard for a potential rally toward the next resistance level around $153. The $153 resistance is significant for SOL bulls, as a decisive break above this level could reignite buying interest and pave the way for a retest of previous highs.

Reduced Selling Pressure Fuels Bullish Momentum

In line with the price action, Net Flow data from DeFiLlama reveals a substantial decrease in selling activity over the last 24 hours. Net Flow dropped from 9.58 million to -0.32 million at the time of reporting, signaling a notable reduction in selling pressure.

SOL DeFi Demonstrates Its Strength

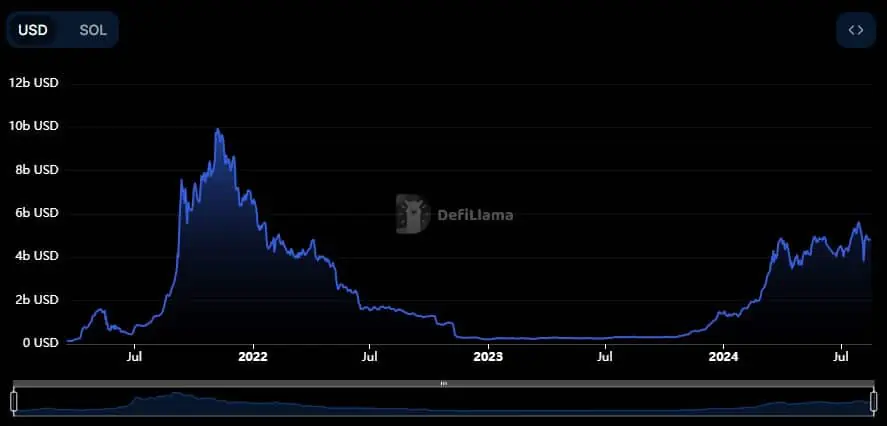

In addition to the decrease in net flow, Solana’s Total Value Locked (TVL) is also trending upward, reflecting growing confidence in the network’s DeFi ecosystem among users.

This growth suggests that more capital is being funneled into Solana-based protocols, which is a positive indicator of network adoption. Moreover, data from Santiment shows that development activity aimed at enhancing the Solana network has accelerated in recent weeks.

Historically, such spikes in development activity have triggered significant price rallies, presenting a bullish signal for Solana enthusiasts. At the same time, Social Volume has shown a gradual increase, with this rising social attention often leading to heightened trading activity and price volatility.

The convergence of SOL’s technical and on-chain metrics paints a bullish picture. If Solana manages to break through the resistance level, the price could continue its upward trajectory.