Binance’s BNB token is setting new records almost daily, entering an exciting “price discovery” phase as investors grow increasingly optimistic about further gains. However, not everyone is buying into the “super cycle” narrative. Many analysts warn that the current hype around BNB could be nothing more than a bubble waiting to burst.

The “Super Cycle” Frenzy and the Rise of Speculative Hype

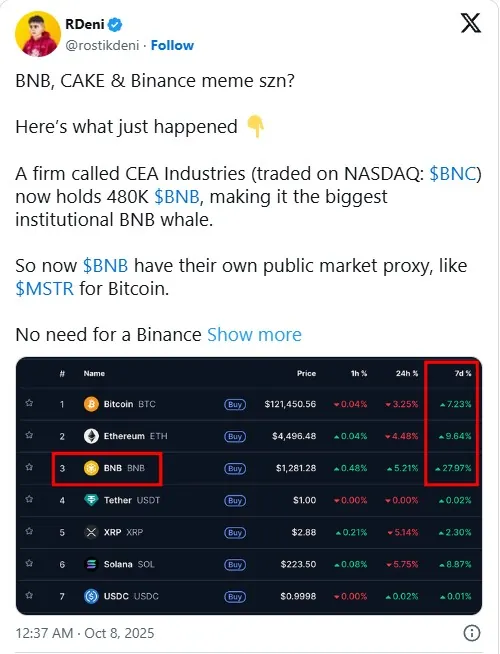

Over the past 24 hours, BNB’s price has risen nearly 3%, reaching around $1,287 and sending the Binance Smart Chain (BSC) ecosystem into overdrive. Data shows that BSC led all decentralized exchanges (DEXs) with over $6 billion in trading volume in just one day.

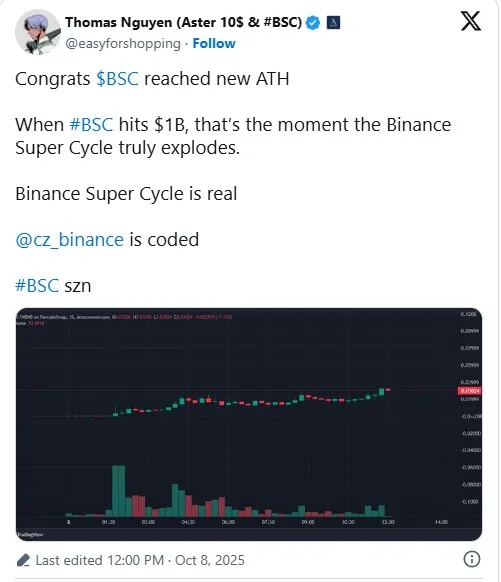

The excitement exploded after Changpeng Zhao (CZ), Binance’s founder, tweeted “BSC stands for?”, to which the community replied, “BNB Super Cycle.” The phrase quickly went viral. Within hours, the meme token BSC launched on PancakeSwap, skyrocketing from under $1 million to over $32 million in market capitalization as major investors and influencers rushed in.

Analyst Stitch described the moment as a perfect storm of timing, official endorsement, and community enthusiasm: “This was when the BNB community woke up — BNB is back, CZ is back, and the Super Cycle begins.”

Hype or Real Growth? Analysts Sound the Alarm

Some experts see troubling similarities to past collapses. Market commentator Marty Party drew parallels to the FTX/FTT crash of 2022, warning: “BNB — Binance’s personal blockchain asset — has surpassed BlackRock in market capitalization while remaining unregulated. This could be the next FTT, yet regulators are silent.”

Similarly, pseudonymous analyst Seg questioned the fundamentals behind the so-called BNB Super Cycle: “What structural advantage does BSC have over Solana to justify this surge? Or is it just pure hype?”

Meanwhile, well-known trader Ansem argued that BSC’s renewed activity is less about technology and more about capital rotation: “BSC doesn’t have a technical edge over Solana. The uptick comes from new money flowing in, fewer coins to buy, and the wealth effect from BNB’s all-time highs combined with CZ’s influence.”

Bubble Risk and Investor Caution

Although BNB’s price continues to soar, on-chain data paints a less bullish picture — showing declining investor confidence, weaker stablecoin inflows, and shorter holding periods. This suggests that speculation, not conviction, is fueling the rally.

Some optimistic traders believe the “BNB Super Cycle” could go parabolic once BSC meme coins reach a $1 billion market cap, but many analysts caution that this could simply mark the euphoric peak before a sharp correction.

As BNB flies higher and the “Super Cycle” chant grows louder across social media, experts emphasize one thing: investors should stay vigilant and conduct thorough research before joining Binance’s latest wave of hype.