BNB Chain faced a significant upheaval following the departure of its CEO, Changpeng Zhao (CZ), who resigned as part of a $4 billion settlement with U.S. regulators. This event led to a noticeable decline in BNB’s price over the past week, creating an opportune moment for a whale to strategically accumulate more assets.

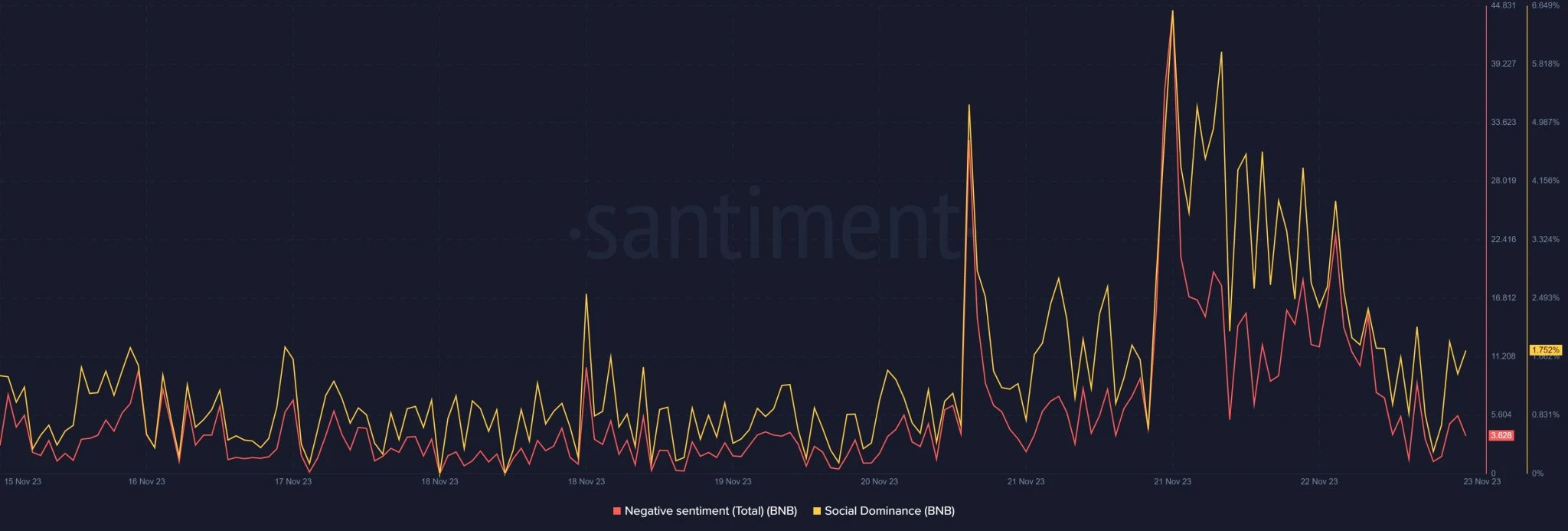

Despite the price downturn, the aftermath of CZ’s exit brought BNB Chain into the spotlight, with discussions proliferating within the crypto community. Santiment’s chart, analyzed by AZC News, revealed a surge in Social Dominance for BNB, but the prevailing sentiment was predominantly negative.

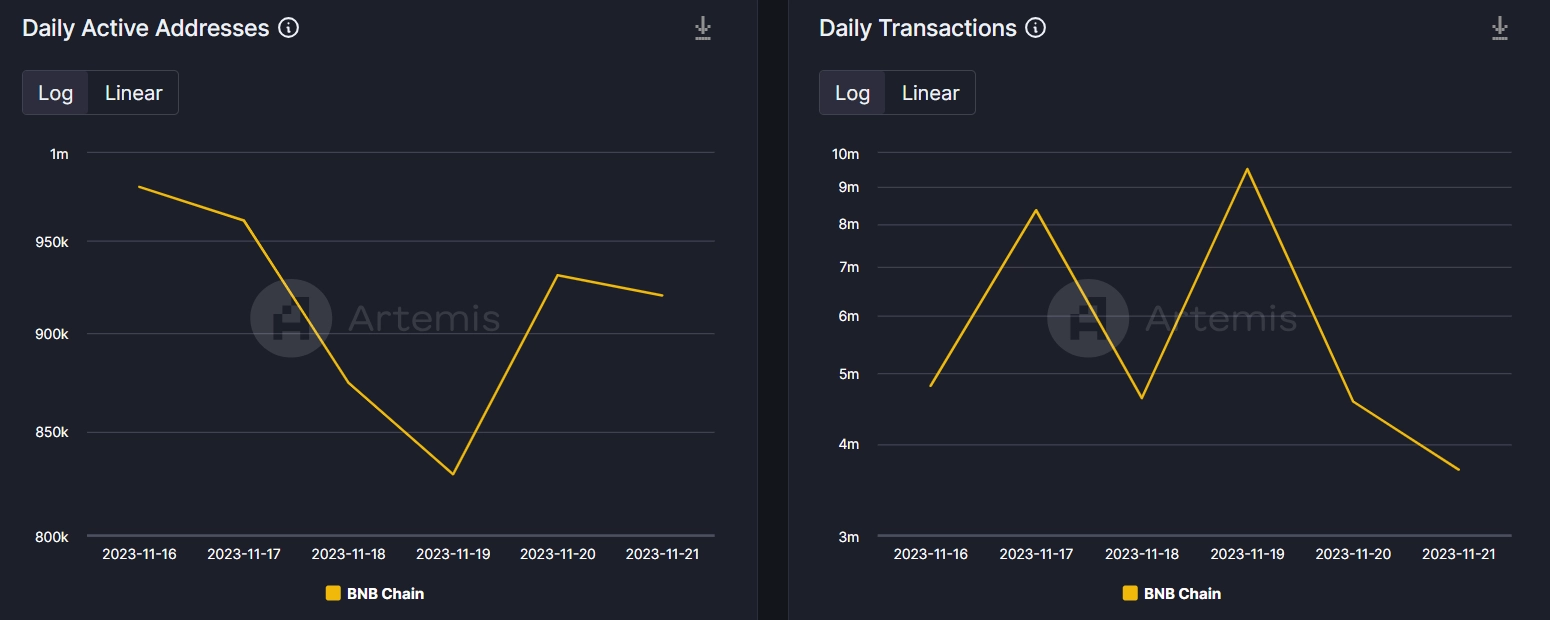

The repercussions extended beyond market sentiment, impacting BNB Chain’s network activity. Examination of Artemis’ data indicated a decline in Daily Active Addresses and Daily Transactions in the aftermath of the CEO’s resignation. Furthermore, the blockchain’s performance in the DeFi space suffered as its Total Value Locked (TVL) experienced a notable decrease.

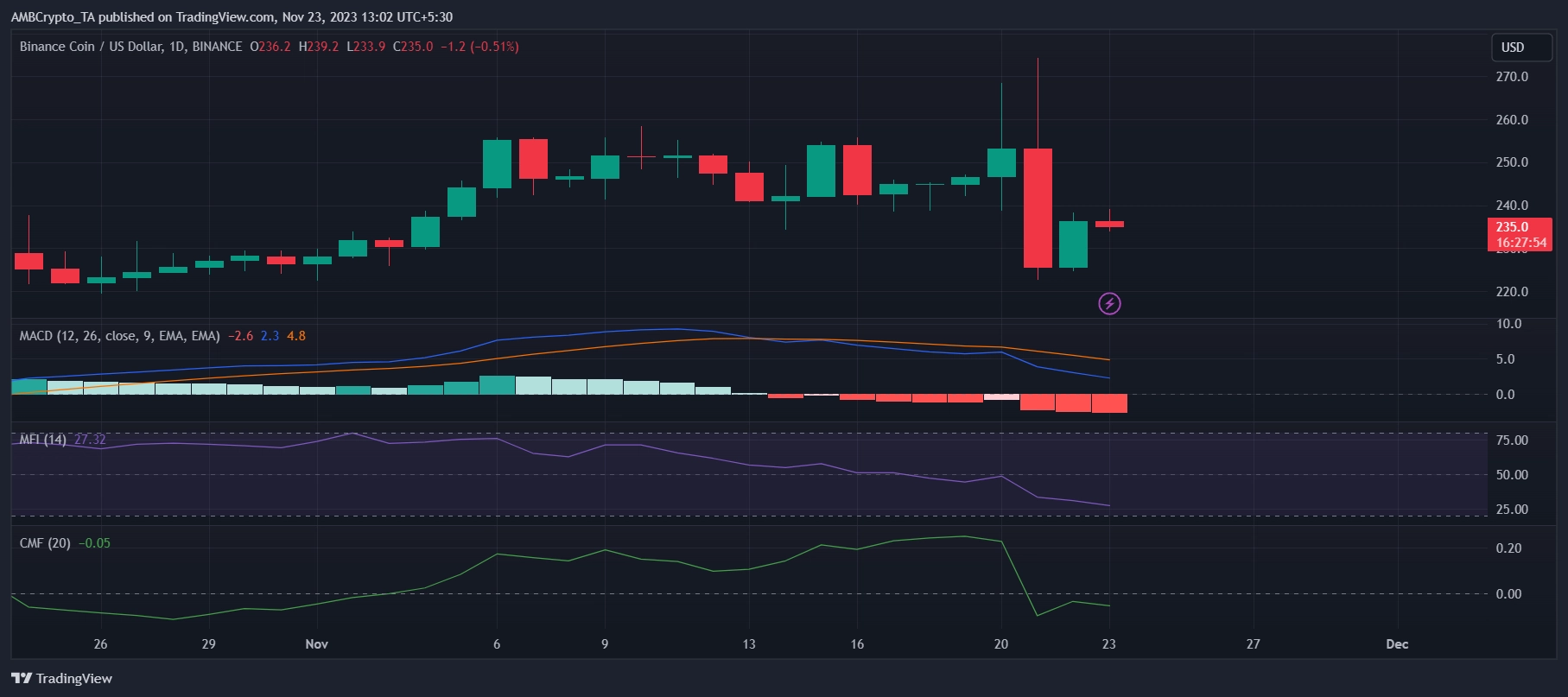

CoinMarketCap reported a more than 7% drop in BNB’s token value over the past seven days, with the cryptocurrency trading at $235.57 at the time of writing. The market capitalization, however, remained substantial, exceeding $35 billion. This confluence of events raises questions about BNB Chain’s stability and resilience in the face of the recent crisis, as stakeholders closely monitor its trajectory in the evolving crypto landscape.

Opportunity to Accumulate BNB

Amidst the apparent challenges reflected in the aforementioned metrics, astute participants in the crypto sphere seized the opportunity presented by BNB’s reduced valuation. Despite concerns, significant players in the market capitalized on the lower price point, with notable whale activity catching the attention of observers. Lookonchain, for instance, spotlighted intriguing actions by a whale on November 22nd.

Related: BNB Plunges Sharply, With Outflows of Around $1 Billion

According to a tweet by Lookonchain, a discernible whale, known for acquiring BNB at lower prices, amassed a substantial holding of more than 2,700 BNB on that day, translating to a value exceeding $646,000. Impressively, this particular whale has been consistently accumulating BNB since May 10th, accumulating a total of 17,152 BNB valued at $4.06 million, with an average price of $253. This substantial accumulation serves as a compelling indicator of the whale’s confidence in the future trajectory of BNB.

Seeking further insights, AZC News delved into BNB’s daily chart to assess its potential price movement in the short term. The analysis revealed that both the MACD and Chaikin Money Flow (CMF) metrics displayed downtrends, with the CMF descending further from the neutral mark of 0 at the time of reporting.

However, amidst these bearish indicators, the Money Flow Index (MFI) presented a slightly bullish outlook. Hovering near the oversold zone during the same period, the MFI suggested an uptick in buying pressure on BNB. This optimistic signal hints at the possibility of a price increase for BNB in the days ahead, adding an intriguing dimension to the unfolding dynamics in the crypto market. As market participants weigh the risks and rewards, the strategic moves of discerning whales underscore the potential opportunities that may lie ahead for those keen on navigating the volatility of the crypto landscape.