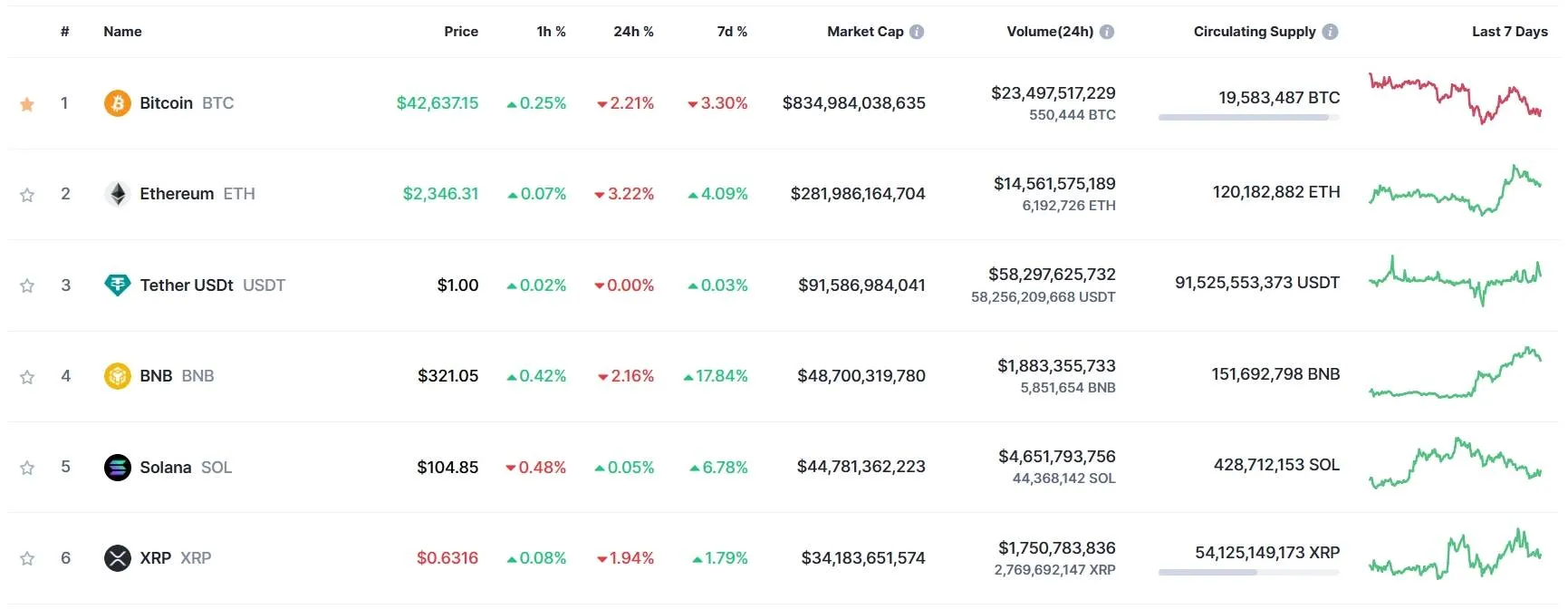

BNB regained the top 4 in the market capitalization table from Solana

Solana (SOL) is fluctuating in the price range around 100 USD after experiencing a strong peak break last week. The excitement about memecoin has decreased, and the appeal of Bonk’s airdrop is no longer as attractive as before.

In the last 24 hours, the SOL price has recorded a decrease of nearly 10%, each time moving further away from the peak reached in April 2022 (125 USD). As of this writing, SOL is trading around $107.

4h chart of the SOL/USDT trading pair on Binance. Photo taken at 08:56 AM on December 29, 2023

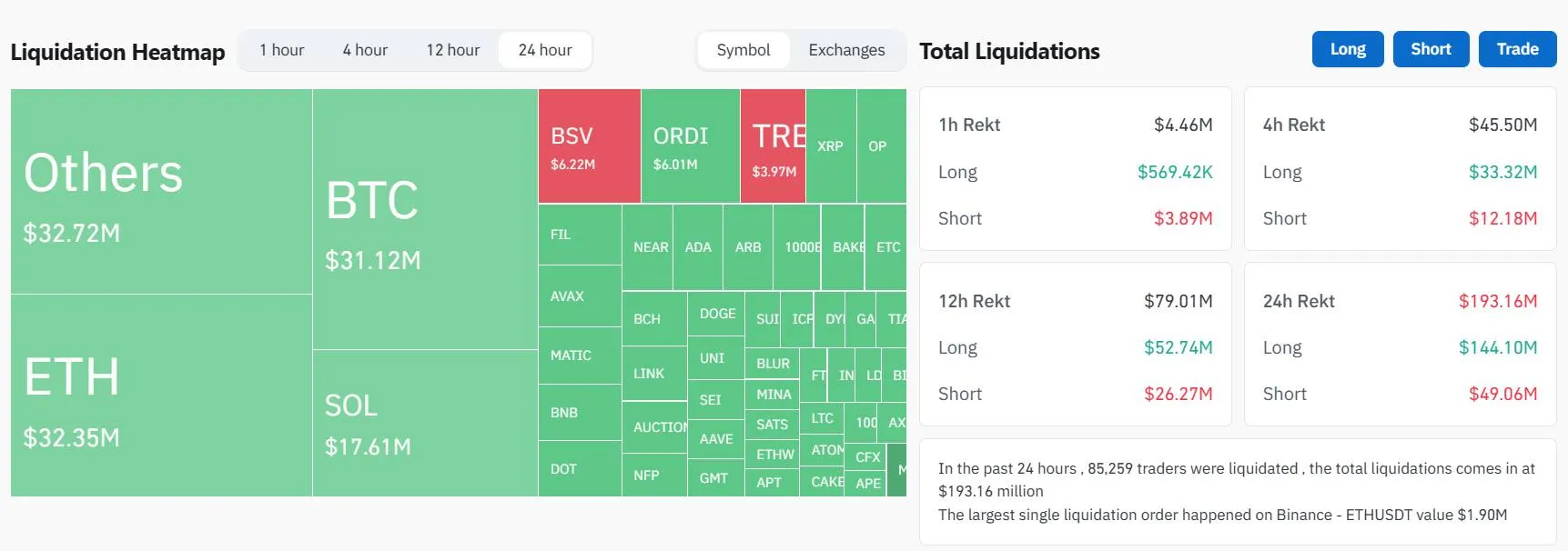

Not only SOL, about 144 million USD of Long positions (short buying) were liquidated during the day, according to data from CoinGlass.

Amount of derivative assets liquidated in the past 24 hours. Source: CoinGlass

Last week, memecoins on Solana such as BONK and WIF were often among the market’s top gainers, but this week they are down more than 50% from their monthly highs. This shows that investors tend to take profits and turn to stablecoins to control the hype of these memecoins.

On the contrary, while SOL was undergoing a sharp correction, rival BNB took the opportunity to demonstrate its strength. Thanks to that, BNB regained the top 4 position. However, SOL still maintained its position in the top 5, a position it achieved from XRP on December 21.

Top 6 based on market capitalization. Photo taken by CoinMarketCap at 08:56 AM on December 29, 2023

Overall, Solana is still one of the best performing cryptocurrencies in 2023. Compared to January this year, SOL has increased by more than 958%, starting from 10 USD, and is one of the “fire phoenixes” quickly recovered after a series of losses in 2022.

Related: Solana Demonstrates Superiority Over Ethereum

A deep adjustment is extremely necessary for SOL at this time, to control the unstable upward momentum, which is being pushed up by excessive leverage in derivatives positions, according to David Shuttleworth, representative by Anagram.

Shuttleworth emphasized that on-chain data shows that traders are tending to withdraw capital from SOL and reduce engagement with this token.