Binance Coin (BNB) is exhibiting bullish momentum as it tests a critical support level, hovering near the $491 mark. This support zone has consistently been a notable point for buyers, as evidenced by repeated rebounds from this level. The robustness of this support suggests that BNB could be gearing up for a bullish reversal.

The BNB price chart displays the formation of a bullish pattern, with prices adhering to an upward trendline over time, indicating increasing buying pressure. This suggests that if the trend continues, the token might surpass significant trendline resistance levels as it aims for a target of $555.

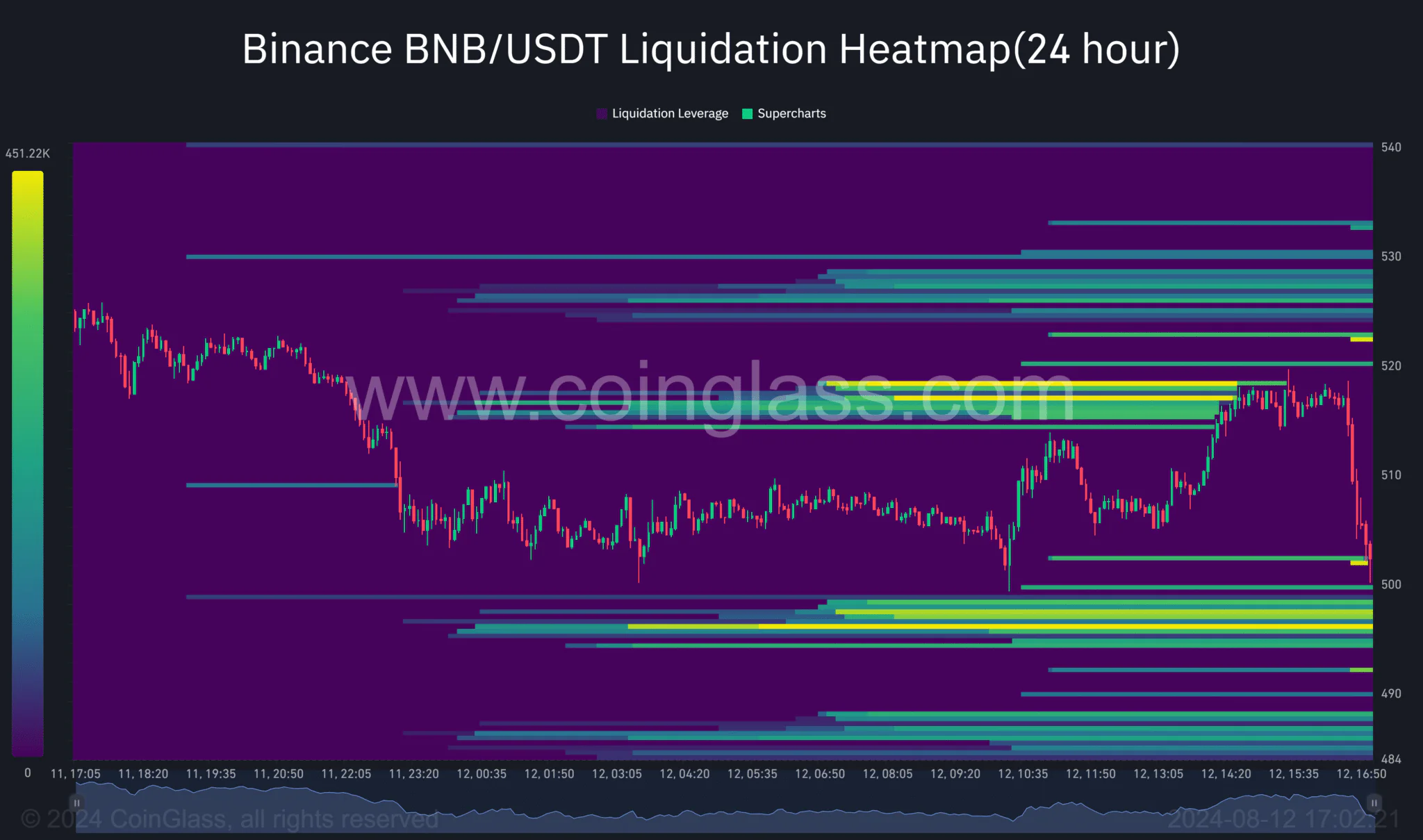

Will the liquidation pool of BNB fuel this bullish momentum? According to Coinglass liquidation data, there is a massive liquidation pool of 37,200 BNB at a price around $522.

Historically, sudden price surges often occur when such concentrated orders are involved during liquidation. As the exchange rate approaches this level, a short squeeze could quickly propel the price toward the $555 target.

Over the past months, it appears there have been no significant changes in the open interest data for the BNB Exchange. Despite some recent price fluctuations, the level of open interest has remained relatively stable.

This stability indicates consistent participation from market players. Such steadiness in open interest might provide ample liquidity for any potential upward moves.

Eyes on $555

Current market prices and on-chain metrics suggest that BNB could be in a bullish state, even though the cryptocurrency market remains highly unpredictable.

The strong support at $491, coupled with a substantial liquidation pool at $522.5, creates an intriguing setup for a potential price rally.