According to DappRadar’s April report, user activity in blockchain gaming slightly declined and investment slowed down, yet the overall ecosystem shows signs of recovery and greater maturity.

Specifically, the number of daily Unique Active Wallets in the blockchain gaming sector dropped by 10% in April, hitting a year-low of 4.8 million. Gaming’s dominance in the decentralized application (dApp) industry also declined, now tied with decentralized finance (DeFi) at 21%.

“It’s evident that user attention is temporarily shifting away from gaming,” said Gherghelas. “But beneath the surface, new infrastructure is going live, major publishers are doubling down, and many high-quality titles are nearing launch.”

She emphasized, “The blockchain gaming industry is not dying — it’s evolving. Development teams are quietly building, and capital continues to flow in. What we’re seeing could be a healthier ecosystem — one less driven by speculative play-to-earn models and more by users who genuinely care about gameplay, asset ownership, and community.”

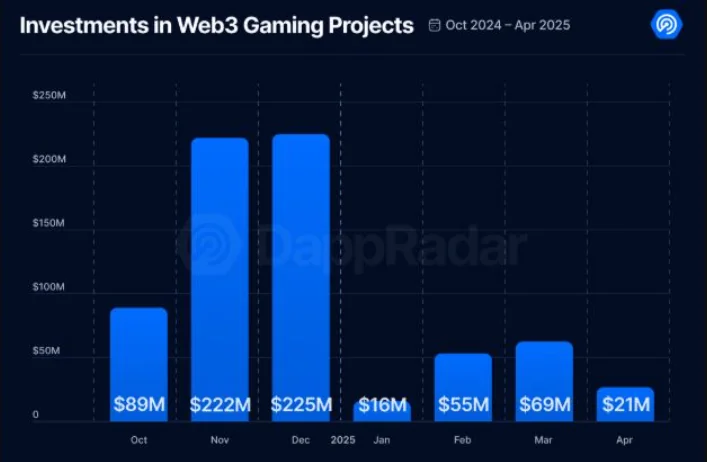

However, investment in blockchain gaming fell sharply in April, dropping 69% from March to just $21 million.

Weaker Projects Fade, Capital Shifts to Real Builders

Gherghelas noted that part of this decline stems from a growing investor and user shift toward sectors like real-world assets and artificial intelligence. Additionally, macroeconomic uncertainty continues to weigh on investor sentiment, making fundraising more challenging for startups.

“Weaker projects are fading away,” she said. “Meanwhile, funding is being redirected to teams that are quietly laying the foundation for the next generation of blockchain games.”

“Investors are now optimizing for sustainable models, player engagement, and actual retention — not just token hype,” she added. “This clearly indicates the market is undergoing a reset.”

Gherghelas also pointed out that 66% of all blockchain game funding in 2025 so far has been allocated to infrastructure development — a sign of a maturing market.

Mainstream gaming companies remain active in blockchain experiments. Gherghelas cited Ubisoft’s partnership with Immutable and Sega’s integration of NFTs and play-to-earn features into KAI: Battle of Three Kingdoms as prime examples.

“April 2025 wasn’t a record-breaking month for blockchain gaming — and that’s perfectly fine,” she concluded. “We’re witnessing a sector that’s recalibrating.”

“The speculative hype may be cooling, but the builders haven’t stopped. New games are launching. Ecosystems are expanding. Infrastructure is maturing.”