iShares by BlackRock has quickly emerged as a frontrunner among the recently approved Bitcoin ETFs, boasting substantial inflows. The question now is whether its latest advertising campaign will further enhance its appeal and attract new investors.

BlackRock Bitcoin ETF Ad Beckons

The newest advertisement from BlackRock’s iShares caught the attention of Bloomberg analyst Eric Balchunas. Noteworthy was the ad’s language, boldly positioning the Bitcoin investment product as synonymous with ‘progress.’ Balchunas observed that the primary target audience for this campaign is likely traditional investors who have never considered incorporating cryptocurrencies like Bitcoin into their portfolios. He commented,

“The advertisement emphasizes how the ETF standardizes BTC, making it akin to traditional stocks and bonds in your portfolio. Its clear focus is on conventional 60/40 investors, as opposed to the Bitcoin faithful who typically eschew traditional securities.”

The term ’60/40-ers’ refers to adherents of a common and conservative investment strategy involving a 60% allocation to stocks and a 40% allocation to bonds. Interestingly, many younger investors involved in cryptocurrencies prefer maintaining custody of their BTC, showing indifference to ETF offerings.

Balchunas also pointed out BlackRock’s dominance in liquidity among its Bitcoin ETF peers. He suggested that this latest advertising campaign could solidify BlackRock’s position as the leading player in the Bitcoin ETF space.

BlackRock’s strategic moves are exuding a strong, advisor-friendly appeal. The firm seems poised to solidify its position as the unrivaled liquidity king in the category, and doubling down with additional advertisements appears to be a calculated and sensible move.”

Competition Heating Up

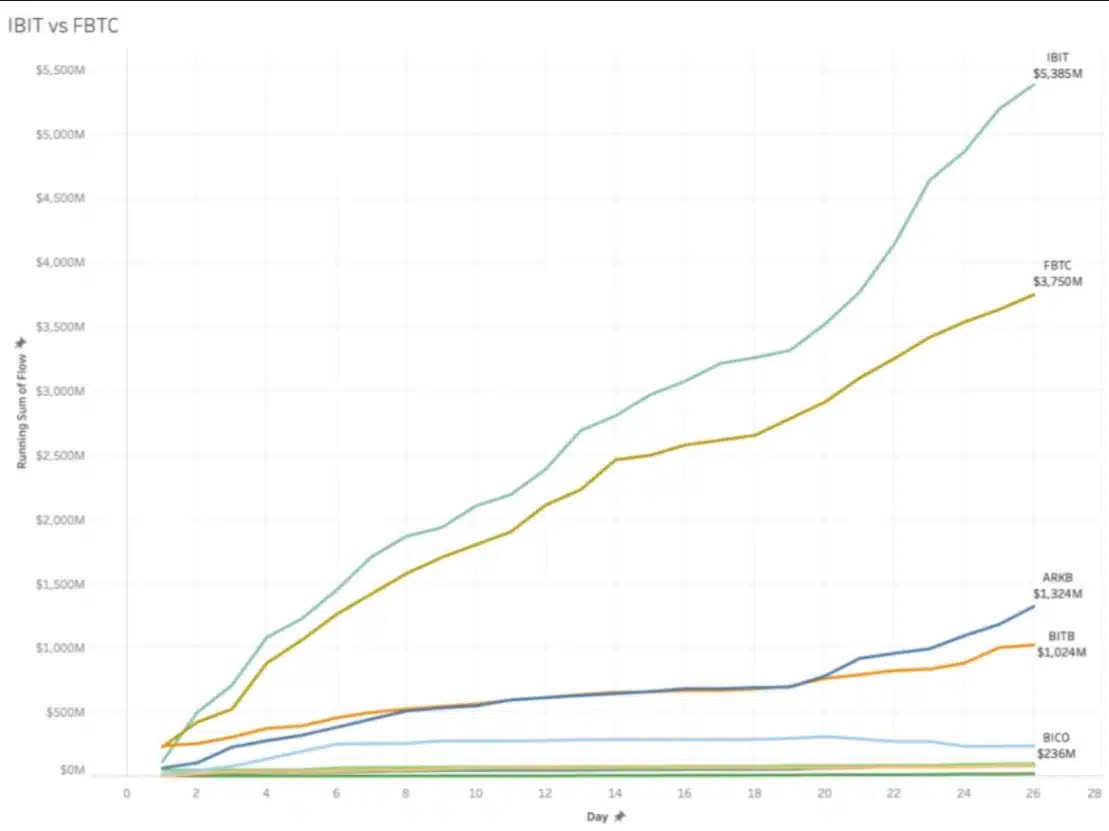

The competition in the realm of Bitcoin ETFs is intensifying, and the impact of BlackRock’s approach is clearly reflected in the numbers. The iShares Bitcoin ETF (IBIT) has demonstrated remarkable growth, surpassing its closest rival, Fidelity’s FBTC, by a considerable margin.

Bitguide data reveals a substantial gap between the two, with IBIT attracting an impressive $5.4 billion in inflows compared to FBTC’s $3.75 billion. The recent trend indicates a widening divide, as IBIT began pulling ahead approximately two weeks ago after a period of neck-and-neck competition.

Related: Record Inflow of Funds into Bitcoin ETF Spot Funds

CoinShares, in its latest weekly digital asset report, also highlighted a surge in crypto inflows, reaching nearly $2.5 billion last week. This marks the highest level of inflows since December 2021 when Bitcoin was readjusting from its previous all-time high above $69,000.

The report coincides with Bitcoin briefly breaching the $52,000 level last week before experiencing a slight pullback. Analysts in the crypto space hold varying opinions, with some anticipating that Bitcoin ETF flows will continue to drive up prices, while others foresee a potential cooling-off period leading up to the next halving.