BlackRock’s Bitcoin Spot ETF Disappears from DTCC

BlackRock’s iShares Bitcoin ETF had a brief vanishing act on the DTCC website, only to reappear, sending shockwaves through the cryptocurrency market. The sudden disappearance and reappearance of the IBTC ticker on the Depository Trust and Clearing Corporation’s (DTCC) platform caused a flurry of excitement.

Shortly after IBTC appeared on the DTCC website, Bitcoin’s price skyrocketed to new yearly highs on October 23, as the market anticipated the potential approval of a spot ETF. However, when the ticker quietly vanished from the site a few hours later, Bitcoin’s price took a sharp 3% dip, revealing that much of the trading activity was closely linked to developments surrounding ETFs.

The drama surrounding the IBTC listing was so intense that it briefly crashed the DTCC website, a rare event according to senior Bloomberg ETF analyst Eric Balchunas. This unusual attention underscored the unique nature of this entire situation.

Looks like the DTCC website has crashed pic.twitter.com/UyrrfAl2Eu

— Eric Balchunas (@EricBalchunas) October 24, 2023

When IBTC reappeared on the DTCC’s list, a keen observer on Twitter noticed a change from “Y” to “N” in the “create/redeem” column. Bloomberg ETF analyst James Seyffart explained that this change signified that BlackRock was preparing for the ETF’s launch, pending SEC approval. The “N” indicated that it wasn’t open for create/redeem because it wasn’t live yet.

One significant change in the DTCC iShares Bitcoin Trust (IBTC) listing I see here. The original listing (on the right) had a “Y” under create/redeem. This one has an “N.” What does that mean @EricBalchunas @JSeyff ? pic.twitter.com/Y89rK2TqlI

— Joe Light (@joelight) October 24, 2023

A DTCC spokesperson clarified that adding securities to the NSCC security eligibility file is a standard practice in preparation for a new ETF’s market launch. However, this doesn’t imply the outcome of any pending regulatory or approval processes.

Despite the turbulence, Bitcoin remained steady following IBTC’s reappearance, showing a 0.15% increase in the last hour according to CoinMarketCap data. It was trading at $33,940, reflecting a 19.1% gain over the past week.

The Recent Bitcoin Rally Puts 81% of Supply into Profit

A significant milestone was reached in the world of Bitcoin (BTC) this week, as the cryptocurrency surged to a new annual high, pushing the vast majority of investors back into a profitable position, according to a recent report from Glassnode.

Following Bitcoin’s remarkable rally, approximately 4.7 million BTC, equivalent to 24% of the circulating supply, turned a profit.

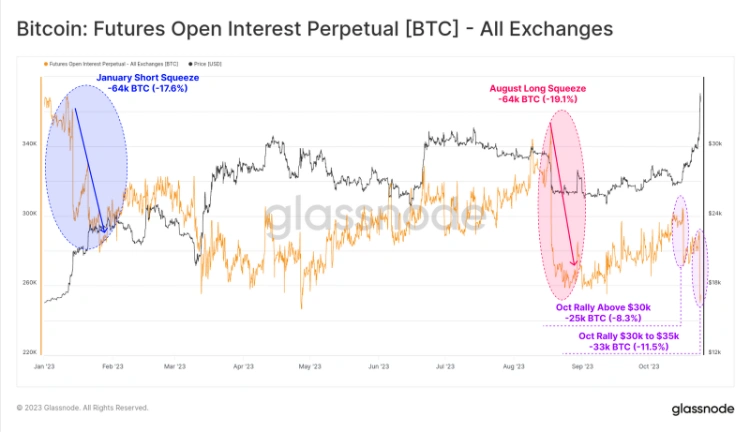

This surge in value was accompanied by a series of short liquidations that wiped out 35,000 BTC in open interest from the perpetual futures market on October 23, adding to a prior 25,000 BTC liquidation on October 17.

Glassnode likened this event to a previous short-squeeze in January, which propelled Bitcoin above the $20,000 mark.

In terms of geographical impact, data from K33 research revealed that perpetual open interest increased by 26,735 BTC on offshore exchanges but rose by 4,380 BTC in CME-regulated venues. Meanwhile, the options market experienced a surge, with open interest in call options increasing by 80% to $4.3 billion. High open interest in call options is often seen as a bullish signal for the market, suggesting a positive sentiment.

CME BTC futures OI has breached 100k BTC for the first time ever.

While offshore perp OI shrank by 26,735 BTC yesterday, CME’s OI grew by 4,380 BTC. pic.twitter.com/kjKBRYCoSX

— Vetle Lunde (@VetleLunde) October 24, 2023

Glassnode pointed out that Bitcoin’s recent rally brought it above two significant “cost-basis” levels, which are estimates of the price at which the typical investor acquired their current BTC.

The True Market Mean Price estimate, currently at $29,780, indicates that the market has historically spent an equal amount of time trading above and below this level. Additionally, Bitcoin’s Short Term-Holder cost basis, surpassed at $28,000, resulted in an average gain of 20% for recent investors.

>>> Bitcoin Surges to $35K USD, Reaching Highest Level in Months

Despite these gains, long-term investors appeared remarkably resilient, with their aggregate holdings reaching a new all-time high of 14.899 million BTC. Notably, around 29.6% of this group still holds Bitcoin at a loss, a pattern resembling previous periods like late 2015, early 2019, and the March 2020 market crash. Glassnode suggested that this cohort might be more “hardened” and resolute compared to previous cycles.

Conclusion

In conclusion, Glassnode emphasized that the market has crossed several key psychological levels, making it crucial to monitor developments in the weeks to come.