Arthur Hayes, the visionary behind the well-established crypto platform BitMEX, has orchestrated a significant shift in his investment strategy. In a departure from his previous stance, Hayes has divested his holdings in Solana (SOL) and redirected his financial allegiance towards Ethereum (ETH).

This strategic pivot, as narrated by Hayes, found its genesis in a profound meditation session that compelled him to reevaluate his investment portfolio, ultimately favoring Ethereum over Solana.

Arthur Hayes Predicts Ethereum to Reach $5,000

Hayes, renowned for his insightful perspectives in the crypto domain, has long been an outspoken advocate for Ethereum, particularly applauding its successful transition to a proof-of-stake model. His positive outlook on Ethereum is further fueled by his admiration for Vitalik Buterin, the co-founder of the project, leading him to boldly predict that the price of ETH could ascend to $5,000.

Fam … I have a confession to make.

I received a msg from the Lord while meditating. He said dump that Sam coin POS, and profess your love for Archangel Vitalik.

So I dumped $SOL, and bot more $ETH.$ETH = $5,000

— Arthur Hayes (@CryptoHayes) December 22, 2023

The crux of Hayes’ support for Ethereum lies in his belief that the broader market has yet to fully grasp the magnitude of Ethereum’s seamless transition. In his view, this transformative change positions Ethereum as a stalwart supporter of an emerging ecosystem, fostering innovative businesses and protocols.

Who is ready for a weekend alt szn green doji piss up? Can we send $SOL over $100? Let’s do it fam 🫡🫡🫡🫡🫡🫡

— Arthur Hayes (@CryptoHayes) December 5, 2023

Contrastingly, Hayes had previously entertained speculation regarding Solana (SOL), suggesting a potential price surge nearing $100 during a bullish period for altcoins. However, his recent shift in holdings reflects a recalibration of perspective, acknowledging the capricious nature of the market and the imperative of strategic adaptability.

December Surge: Ethereum’s Impressive Rally

The recent surge in Ethereum’s performance aligns with Hayes’ optimistic forecast. In the initial days of December 2023, ETH witnessed a substantial uptick, surpassing the $2,100 mark. A key catalyst for this surge is the heightened anticipation surrounding the U.S. Securities and Exchange Commission’s (SEC) deliberation on a spot Ethereum Exchange-Traded Fund (ETF).

This regulatory development has infused the Ethereum market with a palpable wave of bullish sentiment, as investors speculate on the potential ramifications of an ETF approval on the cryptocurrency’s value and accessibility.

November showcased Ethereum’s noteworthy performance, outpacing Bitcoin with a 13% surge compared to BTC’s 8% rise during the same period. The impetus for this growth was primarily attributed to BlackRock’s formal filing for a spot Ethereum ETF.

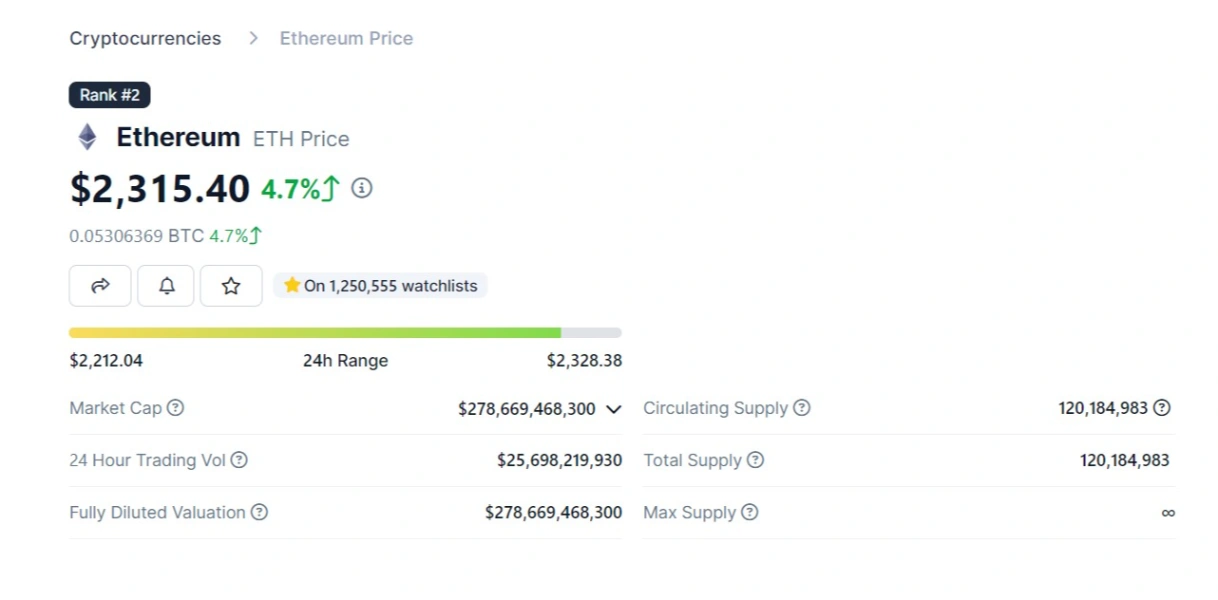

As per the latest data from CoinGecko, Ethereum is presently trading at $2,315.40, accompanied by a 4.7% increase in the last 24 hours and a notable 16.45% rise over the preceding 30 days, signaling a robust trajectory for the cryptocurrency.