Despite a noticeable surge in whale inflows to Binance last week, long-term netflows have turned negative — a sign that large investors aren’t leaving the market but instead are buying the dip as conditions cool.

Whales Step In as Bitcoin Cools Off

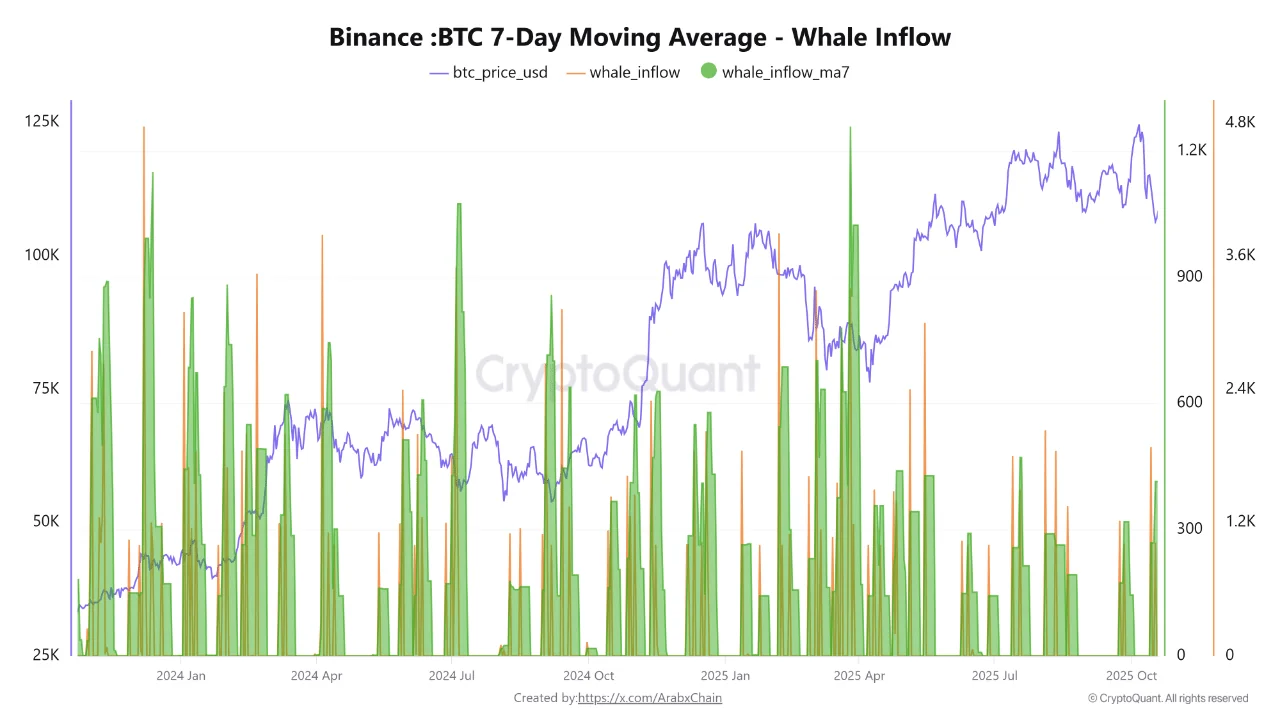

Fresh data from Binance reveals heightened activity among wallets holding 1,000–10,000 BTC. The 7-day average of whale inflows spiked sharply last week, reaching the highest level since July.

This pattern typically occurs when large players move coins onto exchanges, possibly to rebalance portfolios or take partial profits after an uptrend.

Interestingly, this surge in inflows came just as Bitcoin corrected from its $124K peak down to the $104K–$110K range. This suggests that institutions and whales aren’t backing out, but rather preparing for their next strategic move, even as retail traders remain hesitant.

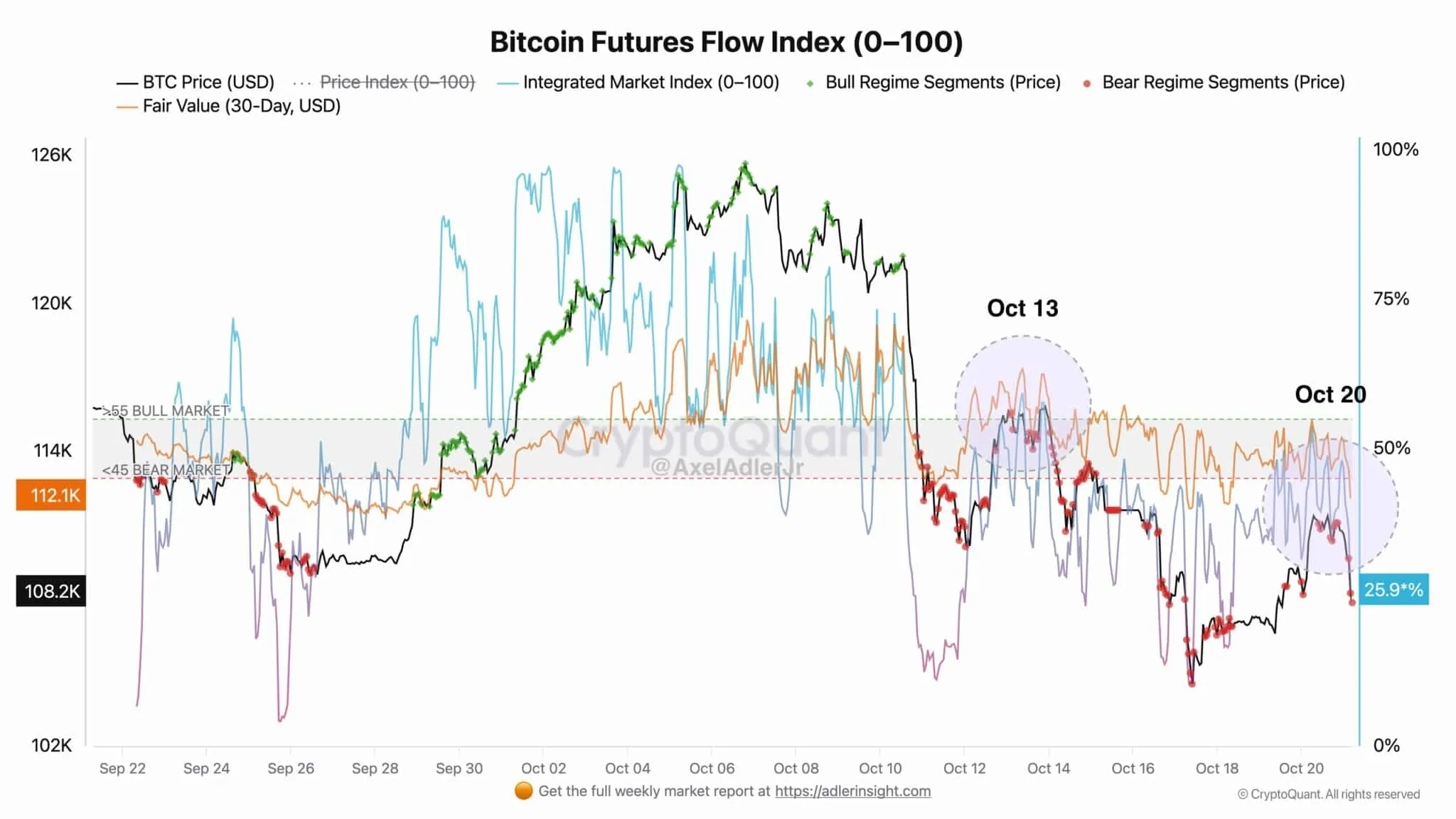

Two Failed Attempts – Bulls Are Losing Steam

The market has now witnessed two failed rallies on October 13 and 20, sparking doubts about Bitcoin’s short-term strength. Market analyst Axel Adler noted on X (formerly Twitter) that the first rebound looked promising but quickly lost momentum, while the second “barely got off the ground.”

The key momentum index remains stuck below 45, deep in bearish territory, while BTC continues to trade below its 30-day Fair Value. This signals buyer exhaustion, suggesting that the market could be taking a breather to rebalance before its next major move.

Selling Pressure Eases – A Glimmer of Hope

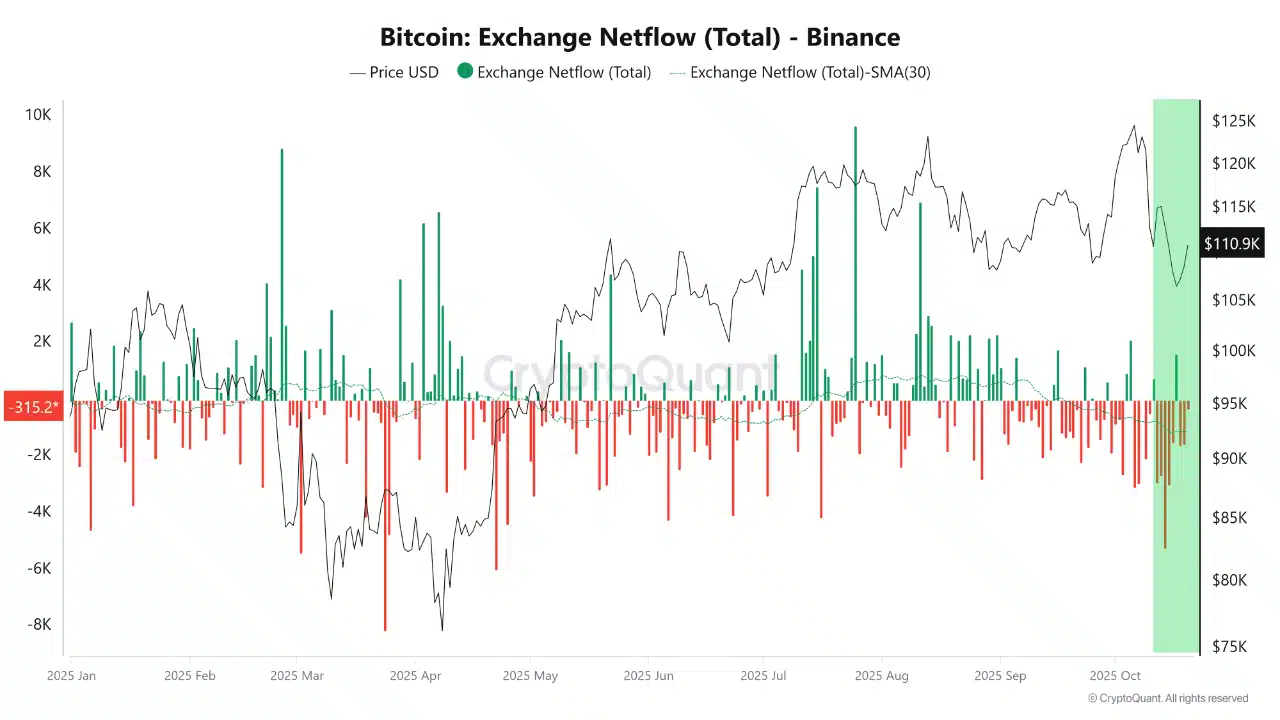

Despite weak bullish momentum, there’s a flicker of optimism emerging. Data from Binance shows that Bitcoin’s netflows have turned sharply negative, meaning more BTC is leaving the exchange than entering.

This trend often reflects growing investor confidence, as coins withdrawn from exchanges are typically moved into long-term storage — effectively reducing sell-side pressure.

In other words, strong hands are accumulating, while short-term traders are stepping aside. If this accumulation trend continues, Bitcoin may be quietly building the foundation for its next powerful rally once the market finds balance between supply and demand.