When Bitcoin experienced a sharp correction of around 30%—a familiar pattern in its market cycles—long-term holders (LTH) remained steadfast in their strategy. Their patience is now beginning to pay off.

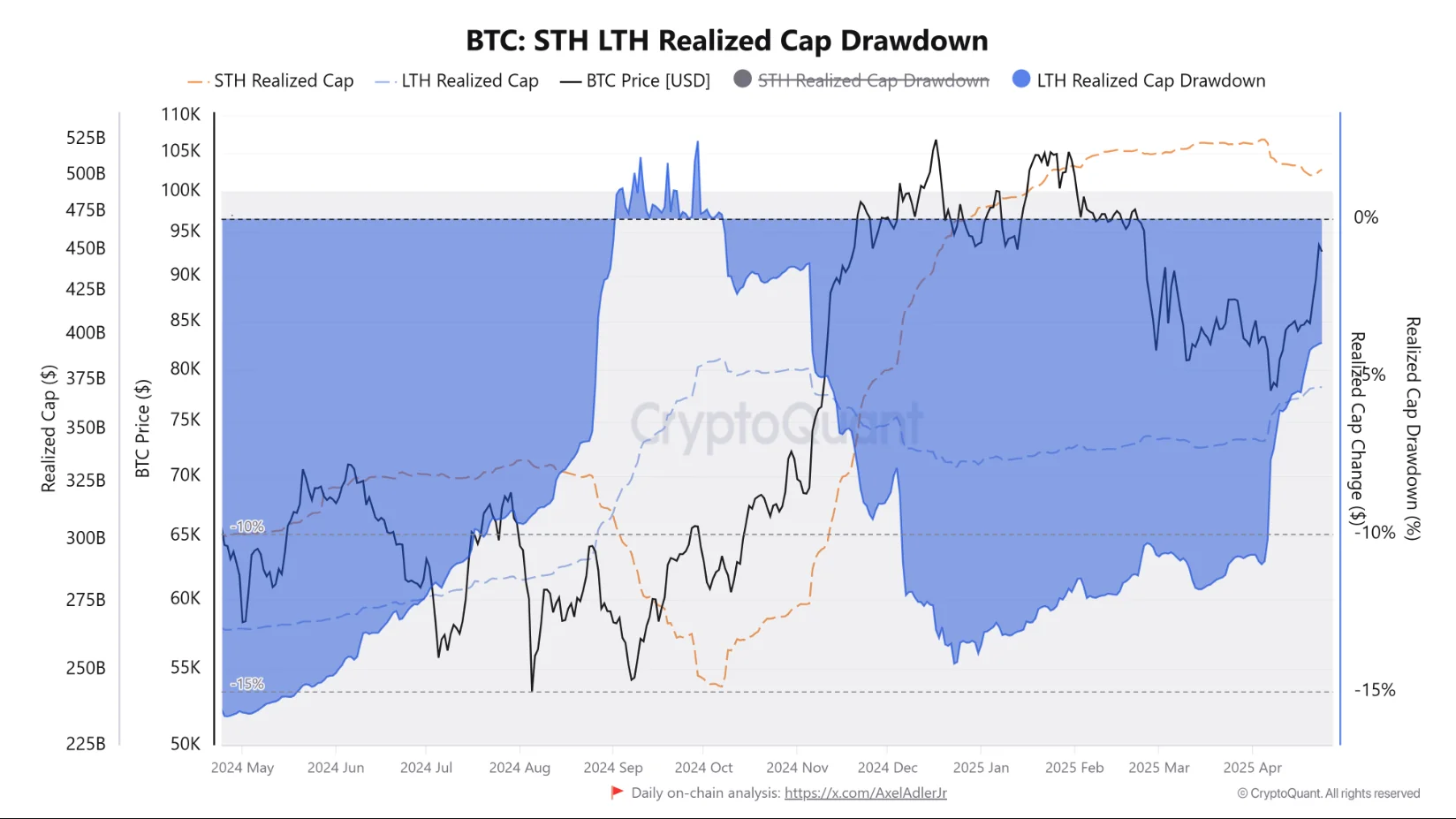

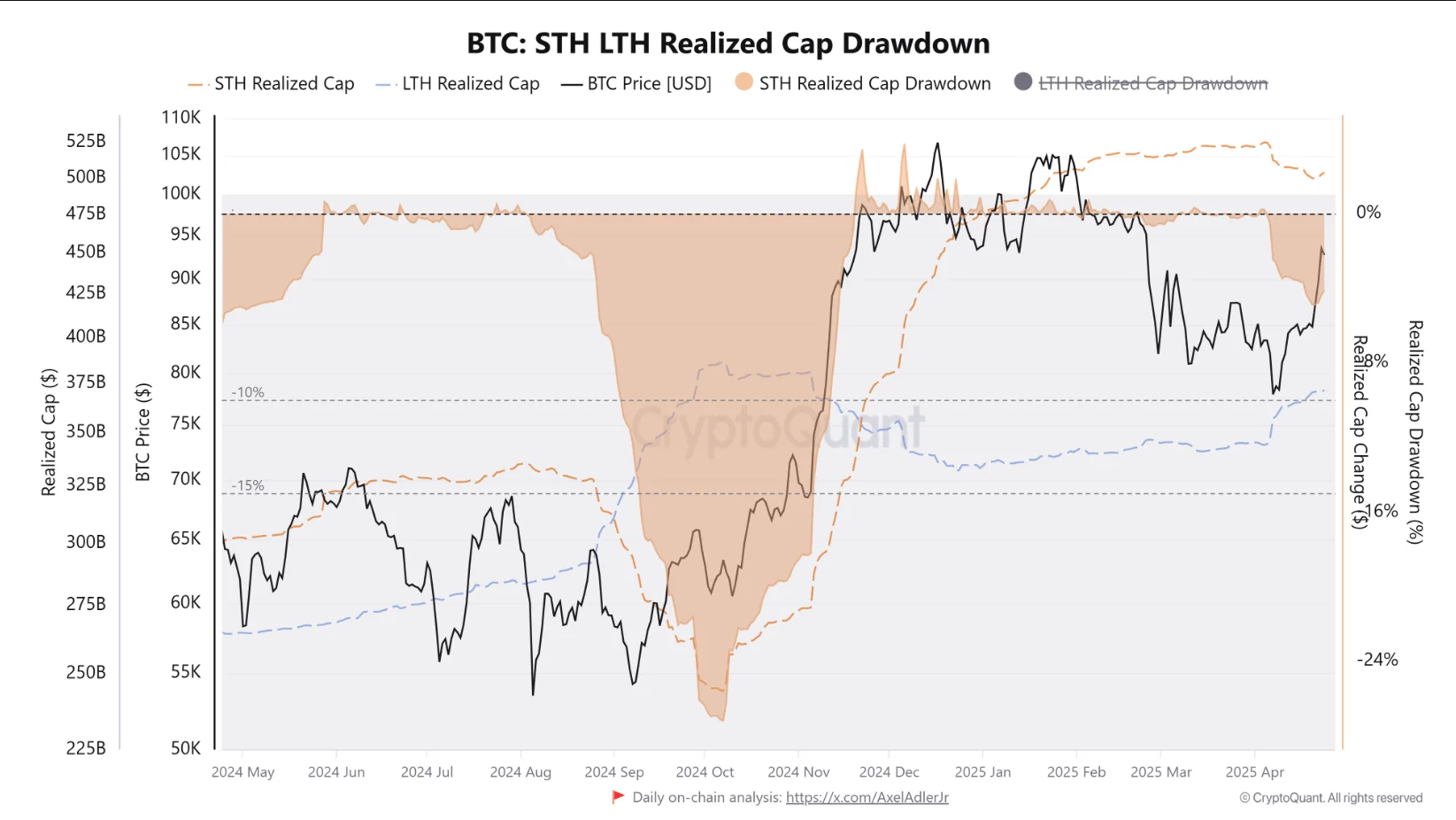

In April, as BTC prices surged from $74,450 to $94,900, the total value of assets held by LTHs grew significantly. According to data from CryptoQuant, their realized capitalization rose from $345 billion to $371 billion between April 1 and April 23—a $26 billion increase.

This is a positive signal indicating a strong rebound after a steep downturn. Earlier in the year, between January and early April, Bitcoin had dropped by over 30%. However, this pattern is not unusual. Historically, such corrections often occur following all-time highs (ATHs) as seen in 2013, 2017, and 2021, serving as a “shakeout” of less resilient investors before the market continues its upward trajectory.

The recent correction has only reinforced the confidence of LTHs, especially as Bitcoin increasingly decouples from traditional financial markets. Amid trade-related pressures on U.S. equities, Bitcoin is becoming more attractive as an alternative asset. At the same time, gold hitting a new high of $3,500 underscores rising demand for non-correlated assets—further strengthening Bitcoin’s position as a “store of value” in the eyes of long-term investors.

In contrast, short-term holders (STH) have only recently returned to profitability. Many had sold at a loss during April’s dip, reflecting the pressure-driven shift in market positions. This mirrors a broader trend seen since early 2024, where STHs often sell during corrections while LTHs accumulate.

Currently, the amount of Bitcoin in profit continues to remain above the “optimistic threshold,” with about 16.7 million BTC in a profitable state. Based on historical data from 2016, 2020, and 2024, when prices hold steady above this range, the market typically experiences strong rallies that push Bitcoin to new highs within months.