Just one day after hitting an all-time high of $124,089 on Thursday, Bitcoin sharply reversed to below $117,500, wiping out $227 million in leveraged long positions. However, derivatives metrics showed little significant change, suggesting the market remained calm — but also lacked the momentum to break decisively above $122,000.

Inflation shock or internal market pressure?

The $6,630 drop barely affected the BTC futures annualized premium, which currently stands at 9% — within the neutral 5%–10% range. This indicates the recent peak was not fueled by excessive leverage, and traders stayed relatively composed despite the slip below $118,000. Still, the data also reflects a lack of conviction in a straight run toward $150,000.

Some attribute the pullback to the 3.3% year-on-year rise in the U.S. Producer Price Index (PPI) for July — hotter than expected — which prompted investors to become more risk-averse and reduced expectations for aggressive rate cuts from the Federal Reserve. While the S&P 500 quickly erased its intraday losses, Bitcoin’s sharp correction appears to have been driven by additional factors.

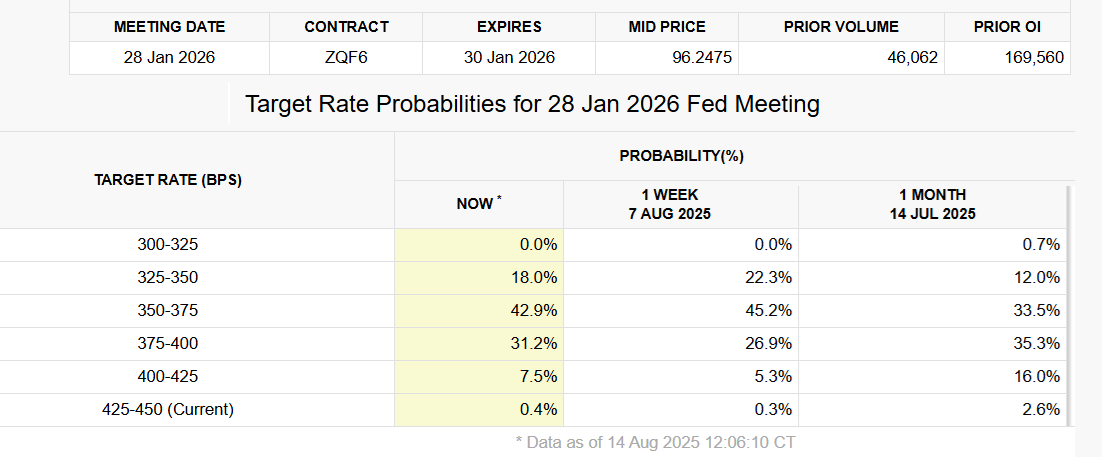

According to the CME FedWatch tool, the probability of the Fed cutting rates to 3.75% or lower by January 2024 now stands at 61%, down from 67% a week earlier. This backdrop is generally unfavorable for risk assets like Bitcoin.

Market sentiment also soured after U.S. Treasury Secretary Scott Bessent stated the government has no plans to expand Bitcoin holdings in its Strategic Reserve. In a Fox Business interview, he also dismissed the idea of using proceeds from a potential revaluation of Treasury gold to purchase more Bitcoin. This stance contradicted earlier market expectations, particularly since an Executive Order signed by President Donald Trump in March explicitly mentioned “budget-neutral strategies for acquiring additional Bitcoin.”

Options market shows resilience

To gauge whether traders expect further downside, analysts look at Bitcoin options delta skew. This indicator typically rises above the 6% threshold when put (sell) options become more expensive, signaling bearish sentiment. Currently, the delta skew stands at just 3%, suggesting a balanced risk outlook and a healthy market.

Although Bitcoin has repeatedly failed to hold above $120,000, options data indicates that traders are not overly concerned about a potential retest of the $110,000 support level. More likely, traders used the move toward record highs as an opportunity to secure profits, with broader concerns stemming from macroeconomic conditions — especially as U.S. national debt has now surpassed the $37 trillion mark.

In the long term, Bitcoin remains well-positioned for significant gains in 2025, supported by central banks expanding their balance sheets to offset fiscal deficits. However, muted activity in derivatives markets clearly shows that enthusiasm for a decisive break above $120,000 remains limited.