Bitcoin is in the midst of a strong recovery and is expected to soon test the $90,000 mark. However, investors remain cautious, uncertain whether this price level can be sustained in the long run.

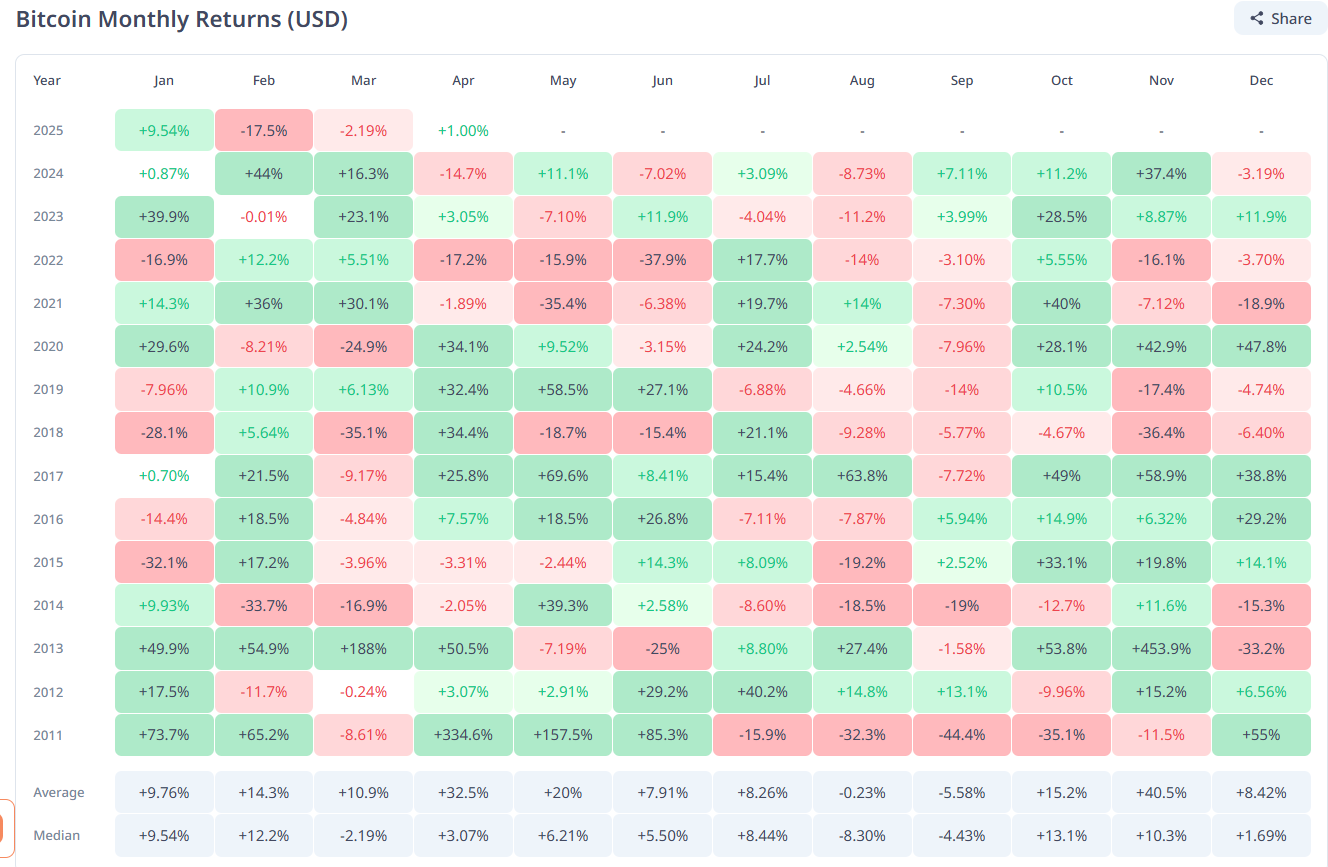

After posting declines of 17.39% in February and 2.3% in March, Bitcoin has started to regain momentum in Q2, recording an impressive 3.77% gain in April alone. Despite previously dipping to a yearly low of $74,500, BTC has now surged close to $90,000—significantly distancing itself from its recent bottom. This development has sparked renewed optimism among investors about the potential for a bullish breakout.

On the macro chart, this could mark Bitcoin’s first major breakout in 2025, fueling hopes of a new bullish cycle. However, several underlying factors could hinder this upward momentum in the short term, making it difficult for BTC to break through the $90,000 threshold on its first attempt.

Real Spot Market Demand Needed — Not Just Leverage

The Bitcoin futures market is currently cooling off, as evidenced by a 50% drop in the BTC-USDT futures leverage ratio. While this is a healthy sign for the long term, the derivatives market still holds dominant influence for now.

According to analyst Axel Adler Jr., net cumulative buying volume surged to $800 million on April 11 — a strong signal that buying activity is gaining traction. In fact, BTC rose from $78,000 to $85,000 within just three days, aligning with historical patterns where high net inflows typically precede price surges.

However, Maartunn, an analyst from CryptoQuant, noted that the current rally is largely driven by leveraged positions — i.e., borrowed capital — rather than genuine spot market demand. This suggests that retail investors have yet to fully re-enter the market.

Chart data also reveals that while demand for Bitcoin is recovering, it has not yet reached a state of sustained net growth. Historically, 30-day accumulation tends to plateau after a short-term bottom, which could result in price consolidation over the coming weeks.

Following a nearly 20% correction, Bitcoin’s chances of breaking above the $90,000 mark in this initial recovery phase appear limited — unless there’s a strong combination of real spot demand and leveraged momentum. Only then could BTC gather enough strength to maintain a sustainable uptrend in the medium term.