Since mid-April, capital flows into Bitcoin have shifted significantly. Whale investments have dropped sharply from $5 billion to $3 billion, while retail investors have increased their capital from $12 billion to $15 billion.

This contrast reflects a change in market sentiment: major players are treading carefully, while smaller investors continue to enter the market—though total inflows have yet to reach historical highs.

Is the Market Turning Bearish?

Data from Binance shows that short positions are currently dominating, with 56.99% of BTC accounts holding sell positions, compared to 43.01% with long positions. This indicates a growing bearish sentiment, as more traders anticipate a price correction.

The dominance of short selling not only highlights market concerns but could also increase volatility—especially if a wave of panic selling occurs.

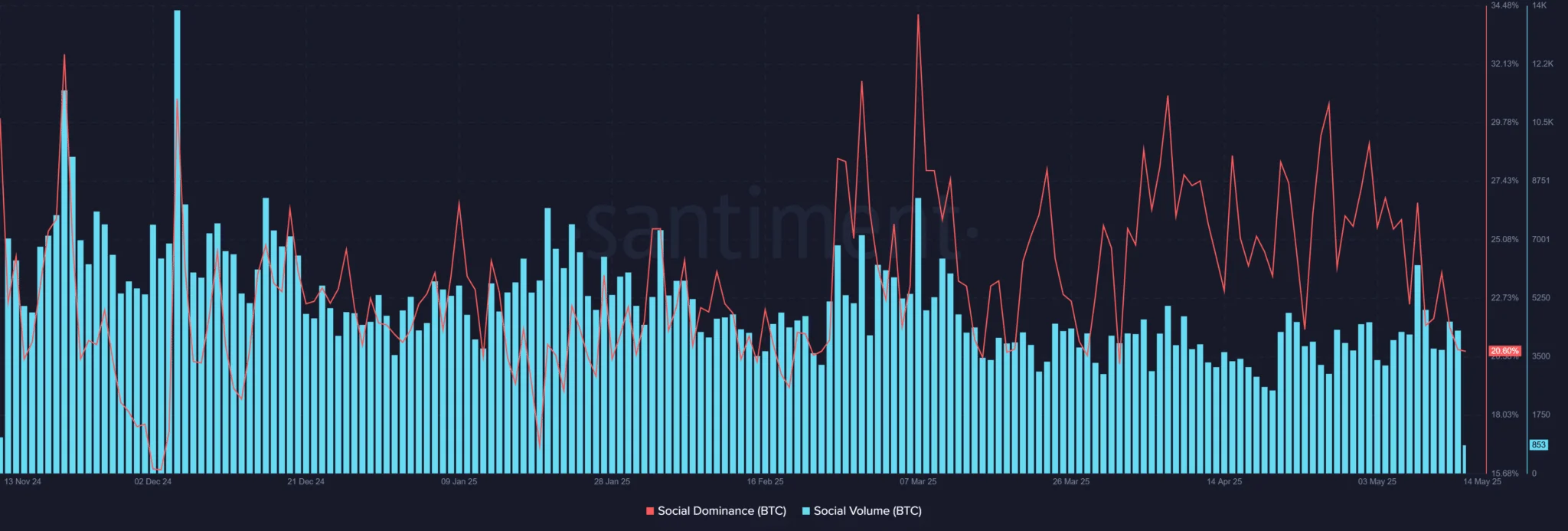

Beyond trading activity, Bitcoin is also seeing a decline in online attention. Its social dominance score has dropped to 20.6%, with only 853 active discussions—a notable decrease compared to previous levels. This points to fading interest from the broader crypto community.

Given the crucial role social media plays in attracting retail investors, this downward trend may pose a challenge to Bitcoin’s ability to sustain growth momentum in the short term.

Institutions Haven’t Backed Out

However, not all signals are negative. Netflow data since late April shows that institutional investors are still quietly accumulating BTC around the $95,000 level. Over the past 30 days, institutional interest has risen by 101.14%—a positive sign. Yet, in the shorter 7-day window, there’s been a sharp drop of -1586.71%, suggesting some short-term capital outflows.

Even so, a positive net inflow throughout the past month indicates that institutions remain confident in Bitcoin’s long-term potential. This serves as a strong foundation for BTC’s longer-term outlook, despite current short-term volatility.