Bitcoin is currently under significant profit-taking pressure around the $106,000 level—an area seen by analysts as a critical threshold before the cryptocurrency can attempt to reach a new all-time high.

Market data indicates that profit-taking activity has become evident at this price zone, stalling Bitcoin’s upward momentum despite continued buying efforts. On May 12, Bitcoin reached an intraday high of $105,800 but later dropped by 3%, falling to $101,400 during the New York trading session. On short-term charts, BTC had been moving within an ascending channel pattern, but eventually broke below the lower boundary—a bearish sign in the short term.

According to data analytics platform Alphractal, Bitcoin’s retest of the $106,000 resistance area is increasing the risk of profit-taking. CEO Joao Wedson noted that BTC is now approaching what he calls the “Alpha Price” zone—a level where long-term investors and crypto whales often seize the opportunity to lock in profits.

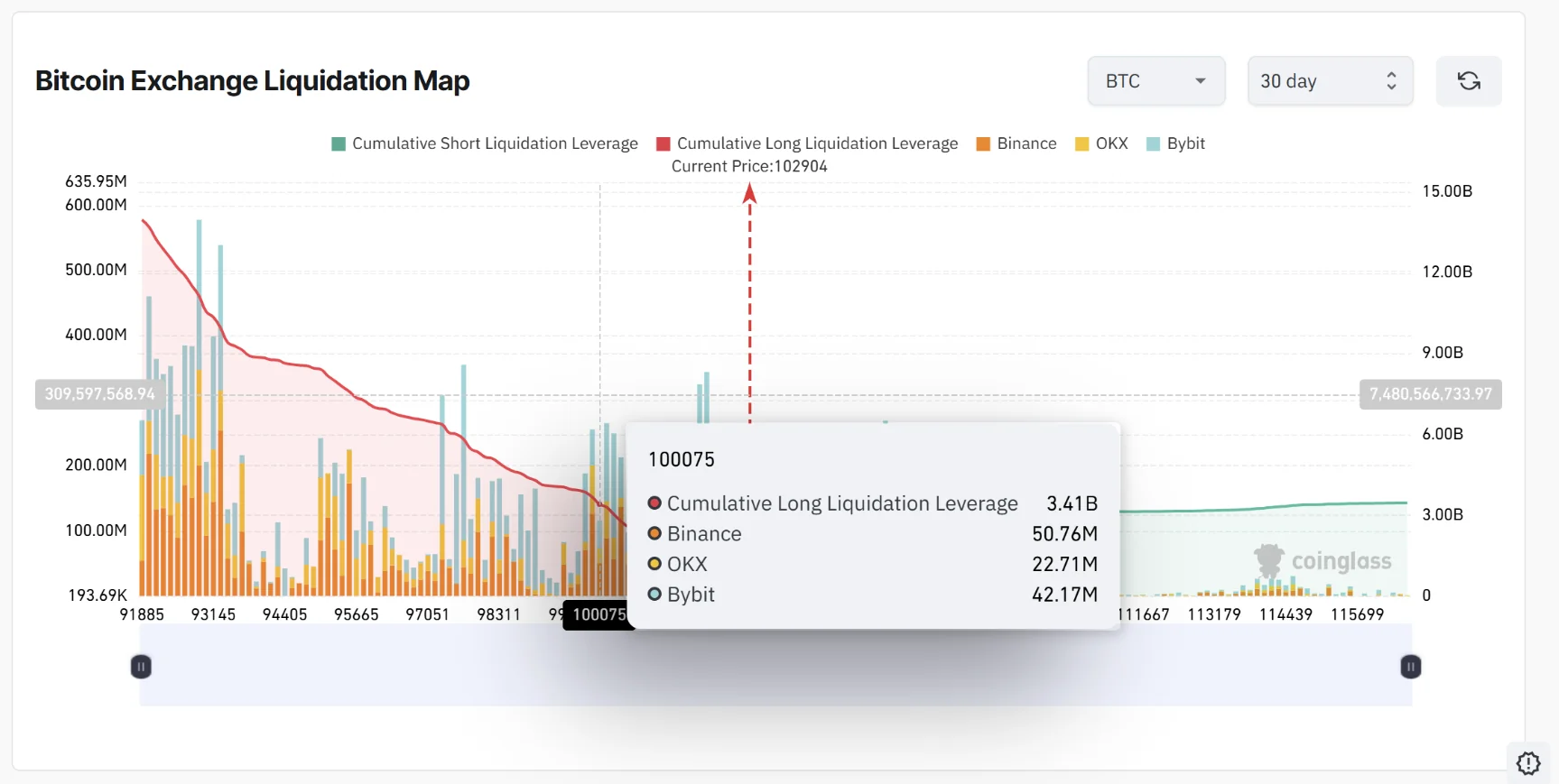

Adding to the bearish pressure, the risk of a “long squeeze” is rising—a scenario where over-leveraged long positions are liquidated as prices fall. If BTC drops to around $100,000, more than $3.4 billion in leveraged long positions could be wiped out. As such, the $100,000 mark is emerging as a “price magnet,” likely to draw the market back to this key psychological level.

Meanwhile, all eyes are on the upcoming Consumer Price Index (CPI) data, as risk-off sentiment spreads among crypto investors. The current pullback in BTC likely reflects market caution ahead of the U.S. CPI report scheduled for release on May 13.

In March, the CPI came in at 2.4%, below expectations of 2.5% and down from February’s 2.8%. Analysts forecast that April’s CPI will remain steady at 2.4%, thanks to stable energy prices amid balanced oil supply and demand, along with a slowdown in wage growth—factors that ease inflationary pressure.

If the upcoming CPI once again comes in lower than expected—as it did in the last two releases—it could provide a bullish catalyst for Bitcoin by strengthening expectations of Federal Reserve interest rate cuts in 2025. This, in turn, would benefit risk assets such as equities and cryptocurrencies. Conversely, if the CPI exceeds forecasts, it could rekindle inflation concerns, drive up the U.S. dollar, and exert downward pressure on BTC.

Should selling pressure persist even after the CPI data is released, key support zones to watch include the $100,500–$99,700 range—considered a Fair Value Gap (FVG) on the 4-hour chart. Another FVG zone worth noting lies between $98,680 and $97,363, representing an approximate 8% correction from the recent high.